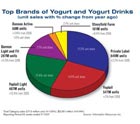

Looking at the top table at the right for yogurt and yogurt drinks, it’s clear that sales growth in the first two quarters of 2007 are not on pace with 2006. This includes unit sales. Having topped a billion units in the first quarter, the unit number is now down a bit. Of course yogurt is traditionally sold as individual cups, but many of the most recent successful new products are sold in multipacks. One explanation for the slowdown is that this measure does not capture alternative channels and is focused primarily on traditional grocery stores where sales might be flattening, as overall business is being lost to competitive channels.

Even assuming that IRI’s measure might still be somewhat reflective of overall trends, it should be noted that one or two slow quarters may simply be a blip, or an adjustment from a period when sales were really taking off at breakneck pace.

Looking at the same F/D/M/X measure but for a full 52 weeks, we see that unit sales were up about 1.6% for the 52 weeks ended July 15. Dollar sales grew by more than 4%.

Looking at the market share of the top brands, we see that private label maintains a slight advantage over the top brands in the market. It should be noted, however, that private label’s dollar sales, units and share by both measure, are all shrinking. And while the established brands including Yoplait Original and Light, and Dannon Light and Fit, are all experiencing sales growth, they are losing market share to other brands. Activia is now the No. 4 brand after private label and sales continue to grow at a brisk pace, with those numbers reflecting the fact that it has been less than two years since its introduction.

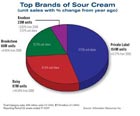

Perhaps the most notable data here is that the Daisy brand continues to gobble up market share from the established leaders and it is now the top brand after private label. The owners of the Daisy brand, the enigmatic Dairy Brand L.P., Dallas, is building a new plant in Arizona.