Sales of butter and butter blends reached $3.52 billion for the 52-week period ending May 15, according to research provided by Chicago-based IRI. This includes all sales at grocery, drug, mass market, convenience, military, and select club and dollar retailers. The $3.52 billion figure represents a 2.2% decrease compared to the 52-week period ending May 15, 2021.

Unit sales of butter and butter blends declined by 7.6% year-over-year to nearly 932 million. However, the price per unit rose 21 cents during the past year to $3.78.

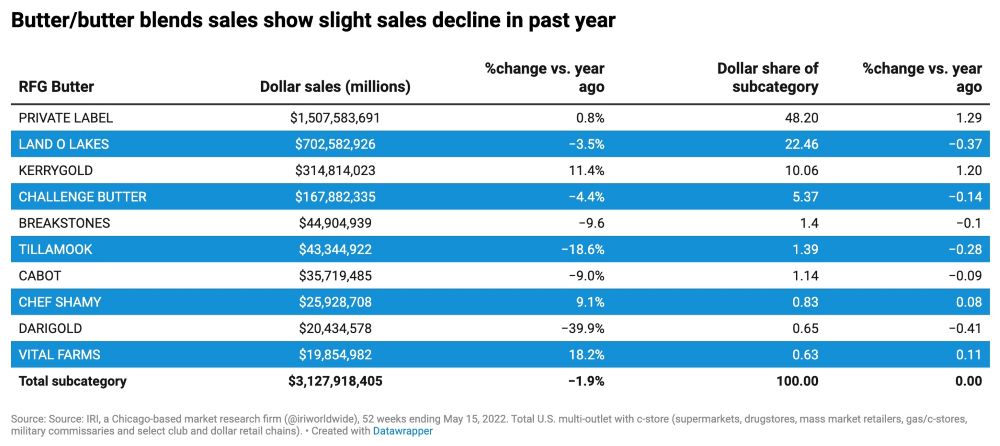

Refrigerated butter sales totaled $3.1 million for the year ending May 15. Under this category, Kerrygold dollar sales and unit sales both had strong year-over-year increases, each rising more than 11%, according to IRI data. Kerrygold now accounts for 10% of sales in the product category.

Chef Samy also enjoyed strong year-over-year growth, with dollar sales and unit sales both rising approximately 9% compared to the prior year period.

Vital Farms is quickly rising through the ranks as well. Its sales of refrigerated butter increased more than 18% to nearly $20 million. Unit sales exceeded 5 million, representing a nearly 23% year-over-year increase.

In the refrigerated butter blends category, total sales declined nearly 5% to $392 million. However, three companies achieved triple-digit sales growth: Kerrygold, Chef Samy and Seagold, IRI data suggests. Kerrygold’s sales topped $12.6 million, an 188% increase. Chef Samy’s sales topped $1.2 million, an increase of 140 percent year over year, while Seagold saw sales of $164,558, an increase of 121%.

Switching gears to creams and creamers, the category generated total sales of more than $5 billion for the 52 weeks ending May 15, a 5% year-over-year increase. Unit sales, however, declined slightly to nearly 1.43 billion, but the price per unit rose 18 cents to $3.57, according to IRI.

Under the regular coffee creamer subcategory, sales climbed to $3.84 billion, exhibiting a robust increase of nearly 8% for the year ending May 15. Several companies had stand-out years in this category. Nestlé, which accounts for nearly 56% of coffee creamer market share, was No. 1, reaching $2.14 billion during the past year, a 7.5% year-over-year increase.

Chobani also had a strong year in the coffee cream subcategory, with dollar sales increasing 86% to $74.6 million. Enjoying triple-digit increases during the 52 weeks ending May 15, according to IRI, were Planet Oat, with sales rising 540% to $34 million, Blue Diamond achieving sales of $13 million, up 455%, and Kitu Super Creamer, coming in at $6.58 million in sales, an increase of 103%.

Regular dairy half-and-half sales were $1.08 billion for the 52 weeks ending May 15, reported IRI, representing a decrease of nearly 3% year over year. Unit sales fell to approximately 375 million, a drop of nearly 7%. The price per unit increased 11 cents to $2.86.

Enjoying double-digit sales growth in this category were Horizon, up more than 13 percent year over year to $64.7 million; Shamrock, up 31.5 percent to $9.45 million; Byrne Dairy, rising 65 percent to $7.4 million; Farmland, increasing 24 percent to $5.3 million; and Borden, whose sales rose 10 percent year over to $4.4 million.

Lastly in the refrigerated dairy cream subcategory, total sales dipped nearly 5 percent to $171 million. Unit sales dropped 9 percent to 46.3 million. The price per unit increased 17 cents to $3.69.

Among the companies with strong years for the period ended May 15 in this category were Farmland, with sales increasing more than 40 percent, La Vaquita, whose sales increased 19 percent, Quesos, enjoying a 16-percent increase, Rosenbergers seeing a 20-percent sales increase, and Verole achieving a 49-percent year-over-year sales jump.