Consumers’ desire for convenient snacks and fast, high-quality protein is helping to shine the light on the benefits of drinkable yogurts and kefirs. As we reported in our cultured dairy outlook in the April issue, the popularity of yogurt beverages and on-the-go yogurt smoothies is increasing. It’s not just a drink for children anymore and the sales numbers show it. Alongside that, other cultured dairy categories (see cottage cheese and sour cream) are seeing some renewal, thanks to innovative products and flavors.

Drinkable options on the rise

In the overall yogurt category, dollar sales increased 3% to $7.6 billion, and units were up 1.2% to 5.1 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Feb. 21, 2016.

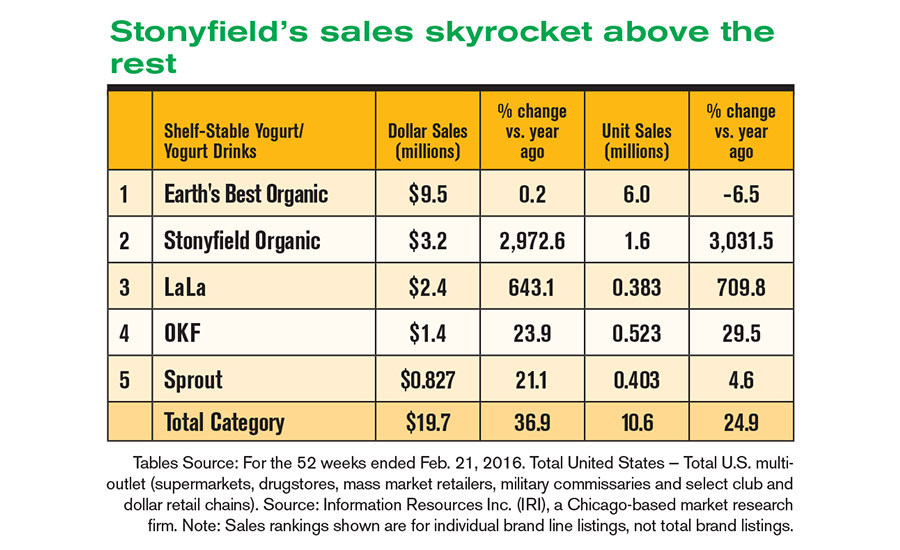

Meanwhile, the shelf-stable yogurt/yogurt drinks segment saw a huge jump — dollar sales rose 36.9% to $19.7 million and unit sales jumped 24.9% to 10.6 million. Among the top 10, Earth’s Best (The Hain Celestial Group) led the segment with $9.5 million — but dollar sales barely moved (up 0.2%) while units dropped 6.5%. But several brands saw significant sales increases. Stonyfield Organic’s dollar and unit sales skyrocketed 2,972.6% and 3,031.5%, respectively. LaLa (Borden Dairy Co.) showed dollar sales up 643.1% and unit sales increasing 709.8%. All Dairy Innovations’ dollar sales jumped 1,836.3% and unit sales rose 2,158%. Sprout Foods’ dollar and unit sales rose 21.1% and 4.6%, respectively. Hormel Foods struggled in the segment — dollar sales decreased 65.7% and unit sales fell 62.2%.

In the refrigerated kefir segment dollar sales rose 10.3% to $104.5 million and unit sales jumped 11.8% to 32.3 million. Lifeway Foods dominated the segment with $86.3 million sales — dollar sales were up 5.7% and units increased 8%. Also among the top 10, three brands saw huge sales increases. The Greek Gods (The Hain Celestial Group) showed dollar and unit sales jumping 41.4% and 45.8%, respectively. Clover Stornetta Farms’ dollar and unit sales increased 127.6% and 129.5%, respectively. All Fresh Made saw numbers skyrocket — dollar sales rose 245.5% and unit sales jumped 327.2%.

Cottage cheese gets a boost

The cottage cheese category’s dollar sales increased 1.2% to $1.1 billion, and units improved 7.2% to 432.6 million. Since unit sales grew faster than dollar sales, it suggests that dairy processors cut prices to achieve volume. In the top 10, Hiland Dairy saw the biggest increases — dollar sales were up 13.4%, while unit sales jumped 32.5%. At Prairie Farms, dollar sales rose 12.2% and unit sales increased 23.9%. Breakstones (Kraft Heinz) showed an increase of 10.4% for dollar sales, while unit sales jumped 18.8%. Knudsen (another Kraft Heinz brand) improved dollar sales by 9.9% and unit sales rose 12.8%.

Sour cream, cream cheese trying to compete

Numbers showed some promise for the sour cream category — dollar sales increased 3.2% to $1.1 billion, with unit sales up 2.7% to 613.6 million. Daisy Brand led the segment, with dollar sales up 9.4% to $551.1 million and unit sales rising 9.2%. Dollar and unit sales increased 5.1% and 18.5%, respectively, for Kraft (Kraft Heinz).

Cream cheese was the only category to see unit sales decrease. While dollar sales were up 1.4% to $1.5 billion, unit sales dropped 0.1% to 663.2 million. Among the five cream cheese segments that make up the category, only two saw sales numbers ticking up. The cream cheese-brick segment’s dollar sales improved 3.7% to $713.3 million, and unit sales increased 1.3% to 331.4 million. The cream cheese-whipped segment showed dollar sales up 1.9% and unit sales improved 2.5%.