Press release

ARLINGTON, Va. -- Despite a sustained downturn in global dairy markets, a new U.S. Dairy Export Council analysis forecasts that the fundamentals driving long-range global dairy trade demand remain positive through 2020.

The report says demand will grow, but with less strength than the past decade, and with increased international competition, especially from the European Union. Even with those challenges, U.S. dairy exporters are positioned to compete for increased export volumes and global market share in key product sectors, particularly cheese.

“We are encouraged to see that, despite the recent prolonged soft export market, long-term global dairy demand fundamentals are still in place that will again pressure available milk supplies,” said USDEC President and Dairy Foods columnist Tom Suber. “This should bring both higher prices and a resumed export upside for U.S. suppliers. Yet with a resurgent EU industry, U.S. exporters will need to up their game.”

The analysis is part of USDEC’s ongoing strategic planning that it conducts with Dairy Management, Inc., its primary funder through the dairy check-off. It’s also a useful supplement to its continual assessments of current market conditions. In its January Global Dairy Market Outlook, USDEC forecast it may take until 2017 for global dairy markets to fully recover from the current soft dairy cycle.

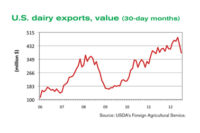

Positive upward trends in U.S. dairy exports

The new report takes a longer-range view, to 2020, to determine how U.S. dairy exports can take advantage of the positive upward trends existing since 2003 when growth in global dairy demand started pinching global supply growth.

“There will be growth,” said Ross Christieson, senior vice president of market research and analysis, who oversaw the report. “The United States is still well-positioned to take advantage of this growth but our competitors are also well-positioned. We need to continue to improve what we do with product, customer service, marketing, and supply chain efficiencies.”

In 2009, the Innovation Center for U.S. Dairy released its “Globalization Report,” an influential strategic analysis by the management consulting firm, Bain & Co. The report, updated in a 2011 “refresh,” said global demand for dairy would exceed the ability of traditional suppliers to meet the need. It concluded that the U.S. dairy industry was well-positioned during the early years of the upcoming decade to meet a larger-than-historical portion of a supply/demand gap.

Part of the new USDEC report compares what was forecast in the previous two reports with what actually happened. It concludes dairy exports grew more than forecast in the original reports, with total global exports actually increasing 30% more than forecast through 2013, with U.S. dairy exports growing 50% more than forecast.

Prospects of U.S. dairy exports are positive for global growth

Looking ahead, the new USDEC report identifies several multi-year market trends:

• Despite the currently tough market, prospects are positive for global growth.

• Growth will be driven by economic and population dynamics in developing countries.

• The U.S. dairy industry remains positioned to build share in global dairy markets.

• The U.S. dairy industry will be particularly well-positioned to capture growth in cheese, SMP and whey, with EU suppliers providing the toughest competition.

• Cheese presents the most significant growth opportunity for the U.S. dairy industry.

Like the 2011 Innovation Center for U.S. Dairy report, the new USDEC report is organized as a collection of charts and bulleted assertions in PowerPoint format. Download it here.

Noteworthy data points include:

• On a liquid milk equivalent (LME) basis, total global dairy trade grew 5.4% annually from 2007-2014.

• From 2014-2020, total global dairy trade is forecast to grow 3.7% annually.

• From 2007-2014, global cheese exports grew 6.2% annually.

• From 2014-2020, global cheese exports are forecast to grow 3.2% annually.

• Developing countries imported more cheese than developed countries in 2014, a trend likely to continue.