Food marketers, including dairy processors, must adopt “a strong multichannel relevance, including a strong and seamless digital presence, or they will undoubtedly become obsolete,” said Susan Viamari, editor, Thought Leadership, IRI. Chicago-based IRI analyzes markets and shoppers.

“To ensure growth, marketers must execute well against four key strategies: protect and grow the base; maintain solid availability against existing and evolving channel preferences and behaviors; optimize marketing mix by media and retail channel; and develop channel-specific products and packages,” Viamari said.

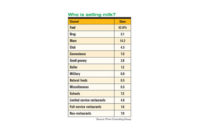

According to IRI, in the past year, grocery and drug channels experienced flat to negative trip frequency and declining basket size, while the Internet saw a modest uptick in both frequency and trip spending. Dollar channel trips also were largely flat; however, the average basket size rose considerably, with an increase of 3 percent. And, club trips slipped slightly, but spending growth outpaced the industry average at 0.9 percent. These shifts underscore the depths of consumers’ willingness to try new channels and banners along their pursuit for value.

Shoppers shop at club stores to stock up

During the past several years, trip mission patterns have changed considerably. The club channel is getting more of its dollars from pantry stock-up missions, and the drug channel is playing more of a fill-in role. These shifts underscore the channel-blurring phenomenon that is taking place.

| More than 80% of shoppers visit three or more channels. Retailers and manufacturers must provide value to each and every shopper through individualized targeting and flawless execution, IRI advises. |

In addition, the grocery channel has lost share in core food and beverage departments, including refrigerated, general foods and beverages. Club is winning in beverages and general food, while also gaining nearly one-half share point in liquor. Mass/super lost ground in a number of departments, including home care and general merchandise, once again to the benefit of club. The dollar channel is holding steady across major departments, with slight up-ticks here and there, such as gains in beauty.

These food categories are growing in these retail channels

The ranks of the fastest-growing CPG categories illustrate the powerful influence that home-based eating trends are having on the industry. But, a look at top-growth categories across channels demonstrates that consumers are turning to varied and sometimes even unexpected channels to fulfill their CPG needs.

The following are the top-growth categories by channel:

- Grocery: Coffee, refrigerated meat, spirits/liquor

- Drug: Cold/allergy/sinus liquids, lip treatment, wine

- Mass/Super: Coffee, refrigerated meat, yogurt

- Dollar: Cigarettes, frozen dinners/entrees, milk

- Club: Refrigerated salad/coleslaw, snack nuts/seeds/corn nuts, yogurt

- Internet (pick up/mail order): Coffee, dog food, weight control

- Internet (delivery): Canned fruit, deli meat, canned beans

IRI is offering a free webinar, entitled “Channel Migration: The Road to Growth Has Many Lanes,” at 11 a.m. CT on Nov. 5.

Download the free report “Channel Migration: The Road to Growth Has Many Lanes”