Natural High

by Julie Cook Ramirez

Riding the coattails of the low-carb craze, makers of

natural cheese enjoy increased consumption.

The phrase “diet

food” typically conjures up visions of oatmeal, rice cakes and green

leafy salads — hold the dressing, of course. And while many a pound

has been shed by sticking to such healthful (albeit bland) menus, dieting

no longer has to mean giving up flavor — or a sense of indulgence,

for that matter. In fact, today’s dieters may very well not get the

sense they are sacrificing anything at all in order to slim down.

After years of feeling they had to give up favorite

foods in order to lose weight, subscribers to the most recent widespread

diet crazes have found themselves not only allowed, but encouraged to

partake of such previously forbidden fare as steak, eggs and cheese. Under

the popular South Beach and Atkins plans, dieting became all about cutting

carbs and upping the protein. Despite concerns expressed by some in the

health care industry, who warned that such a diet could result in a

heightened risk of high blood pressure and cholesterol, consumers in droves

took to the reduced-carbohydrate craze — for a while anyway.

As with just about every other fad, diet or otherwise,

the low-carb craze had its moment in the sun. As it turns out, consumers

loved the effect such diets had on their waistlines, but found that they

just couldn’t eliminate such favorites as bread and potatoes from

their diet permanently. In due time, low-carb’s days were numbered,

as consumers began taking a more balanced approach to weight loss once

again.

That’s not to say the whole low-carb craze was

merely an exercise in futility. On the contrary, it opened consumers’

eyes to the effect that carbs have on their bodies and helped them adopt a

new approach to making smart food choices. In times past, for example, the

vast majority of consumers wouldn’t have even considered cheese when

seeking a healthy snack. Under the Atkins and South Beach plans, however,

cheese was branded a good choice due to its high-protein, low-carb

properties. Fortunately, such eating habits linger on, despite the fact

that the overall low-carb lifestyle has gone by the wayside for most

consumers.

“Even though people aren’t talking about

the low-carb diets as much anymore, you’ve still got a pretty

constant group of people that have woven that type of weight management

diet into their lifestyle on a regular basis,” says Steve Ostrander,

vice president of marketing for Lake Mills, Wis.-based Crystal Farms, a

subsidiary of Minnetonka, Minn.-based Michael Foods Inc.

| TOP 10 NATURAL CHEESE BRANDS* | ||||

| $ Sales (In Millions) | % Change vs. Year Ago | Unit Sales (In Millions) | % Change vs. Year Ago | |

| Total Category | $5,961.1 | 6.1% | 2,171.6 | 1.4% |

| Private Label | 2,136.9 | 4.3 | 880.1 | 1.3 |

| Kraft | 1,342.0 | 7.8 | 514.2 | 3.0 |

| Sargento | 414.1 | 11.1 | 151.5 | 5.9 |

| Tillamook | 201.1 | 8.0 | 44.5 | 3.3 |

| Crystal Farms | 138.1 | 9.8 | 61.9 | 7.1 |

| Precious | 105.3 | 6.7 | 27.3 | -10.6 |

| Polly O | 101.0 | 17.3 | 28.4 | 12.7 |

| Sorrento | 99.5 | -1.7 | 29.8 | -5.8 |

| Frigo | 96.5 | -6.5 | 29.8 | -10.2 |

| Borden | 79.7 | -3.3 | 38.2 | -10.5 |

| * Total sales in supermarkets, drug stores and mass merchandisers, excluding Wal-Mart, for the52-week period ending August 7, 2005. SOURCE: Information Resources Inc. | ||||

| TOP 10 NATURAL SHREDDED CHEESE BRANDS* | ||||

| $ Sales (In Millions) | % Change vs. Year Ago | Unit Sales (In Millions) | % Change vs. Year Ago | |

| Total Category | $2,019.2 | 5.7% | 809.1 | 2.9% |

| Private Label | 868.5 | 6.4 | 365.1 | 5.7 |

| Kraft | 567.0 | 8.7 | 222.4 | 2.8 |

| Sargento | 222.5 | -0.3 | 85.4 | -2.7 |

| Crystal Farms | 80.6 | 8.9 | 30.8 | 6.0 |

| Borden | 57.0 | -6.5 | 26.7 | -14.2 |

| Kraft Free | 31.1 | 7.0 | 11.2 | 3.5 |

| Kraft Classic Melts | 29.0 | -12.8 | 12.0 | -15.5 |

| DiGiorno | 22.9 | -8.6 | 6.5 | -13.1 |

| Stella | 13.1 | 8.5 | 4.0 | 2.9 |

| Sargento Bistro | 11.6 | 340,659.2 | 5.0 | 425,605.0 |

| * Total sales in supermarkets, drug stores and mass merchandisers, excluding Wal-Mart, for the52-week period ending August 7, 2005. SOURCE: Information Resources Inc. | ||||

With more consumers picking up cheese due to its

positive nutritional attributes, natural cheese, in particular, has

experienced growth. According to Jay Allison, national sales manager for

Tillamook County Creamery Association, Tillamook, Ore., it’s all

about trust. People generally know that natural cheese is made from

natural, wholesome ingredients. They’re not so sure, however, exactly

what goes into making “pasteurized processed cheese.” Thus,

they’ve embraced natural cheese in larger numbers than ever before,

particularly when it comes to areas that were previously dominated by

processed, such as slices.

“Consumers are gravitating much more toward

sliced natural cheese, as opposed to processed,” says Barbara Gannon,

vice president of corporate and marketing communications, Sargento Foods,

Plymouth, Wis. “We think that’s a trend that’s going to

continue.”

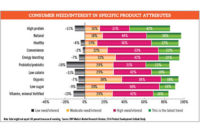

The growing popularity of natural cheese is evident in

the latest data from Chicago-based Information Resources Inc. (IRI), which

shows natural cheese sales rising 6.1 percent in dollars and 1.4 percent in

units during the 52-week period ending August 7, 2005, in supermarkets,

drug stores and mass merchandisers, excluding Wal-Mart. Sales of natural

shredded cheese rose 5.7 percent and 2.9 percent, respectively.

“People are looking for a more simplistic way of

getting their nourishment,” says David Leonardi, director of cheese

education and events, Wisconsin Milk Marketing Board, Madison, Wis.

“When it comes to natural cheese, they just feel that it’s a

cleaner product, a better product. It’s more real.”

Answering the Call

Recognizing the growing interest in sliced natural

cheeses, Kansas City-based Dairy Farmers of America (DFA) recently added a

Colby/Monterey Jack variety to its line of Borden Natural Slices, which

previously included only Swiss and Cheddar varieties. Building on the

popularity of its Borden String Cheese, introduced three years ago, DFA

recently rolled out Borden Kid Builder Natural Mozzarella String Cheese,

fortified with six essential vitamins and minerals — vitamins C, A,

E, B6,

calcium and zinc.

The company has also introduced Borden Snack Bars, a

line of 2-ounce cheese bars designed to compete with candy bars. Boasting

easy-opening, bilingual packaging, Borden Snack Bars are available in four

flavors — Sharp Cheddar, Mild Cheddar, Colby/Monterey Jack and Pepper

Jack.

According to Mark Korsmeyer, president of DFA’s

American Dairy Brands and Dairy Products Groups, it’s all about

building on the momentum currently being enjoyed by natural cheese.

“Our mindset was to parlay upon [the success of] string cheese, so we

asked ourselves what other portable snack-size items we could develop

within the natural cheese category,” he explains. “The

resulting product takes the growth of natural cheese to a higher awareness

level and hopefully, to a higher consumption base.”

If U.S. cheese processors ever hope to approach the

astronomical 40 to 50 pounds per person consumption rates seen in Europe,

Leonardi says they must first tackle two main stumbling blocks. First, they

need to find ways of making cheese more of a stand-alone food, rather than

merely one that is used on and in other foods.

“In the United States, cheese is consumed more as

an ingredient than anything else,” he says. “We have a passion

to put cheese into or onto something, as opposed to Europe, where cheese

stands alone more often than not. We’ve got a long way we can grow in

that respect.”

To Your Health

In addition, Leonardi says, cheesemakers need to

address the misconception that lactose intolerant people cannot eat cheese.

This can best be accomplished by educating consumers that the lactose

content in cheese is practically non-existent, because it “goes down

the drain in whey during the cheese-making process,” he notes.

Therefore, those individuals with lactose intolerance need not avoid cheese

out of fear of stomach upset.

The very popularity of cheese itself presents a

challenge in further growing consumption, according to Ostrander, who

claims that Americans purchase cheese at a rate of 30 to 40 times per year.

Add that to the fact that cheese is purchased by 98 percent of all

households and per capita consumption is rapidly approaching 31 pounds per

person, and the question emerges as to where future opportunities can be

found.

“Anytime you have close to 100 percent household

penetration and you have a high purchase rate like you do with cheese,

everyone is waiting to see if there’s going to be some new technology

that makes it better, more convenient, more flavorful, more healthy,”

he says. “Unless you get a real technological breakthrough or you

have a situation like we had last year with the low-carb craze, you

don’t see big jumps in mature categories like this.”

If Carl Brothersen has his way, some of those future

jumps in consumption may come in the form of vitamin-enriched natural

cheese. As associate director of the Western Dairy Center at Utah State

University in Logan, Utah, Brothersen has developed a method for enhancing

the nutritional profile of natural cheese by injecting vitamins.

Utilizing a proprietary high-pressure injection

technology, Brothersen injected liquid vitamin D, B6 and folic acid into

mozzarella and cheddar cheese. Then, under the sponsorship of Rosemont,

Ill.-based Dairy Management Inc. (DMI), he set out to determine whether the

addition of the vitamins has any effect on the flavor or the ripening

process of the cheeses. Fortunately, they do not. Ultimately, Brothersen

hopes this process will result in commercially-available vitamin-enriched

cheeses, specially fortified for people with particular health concerns.

“Someday, you will be able to buy

vitamin-enriched cheeses, just like now you can buy other vitamin-enriched

foods, such as breakfast cereals and fluid milk,” says Brothersen.

“I wouldn’t expect it to become standard that all cheeses would

have this, but it could become a niche market for people with certain

nutritional needs.”

Julie Cook Ramirez is a freelance journalist based in

the Chicago area.

$OMN_arttitle="Natural High";?>