by Julie Cook

Makers of superpremium ice creams ride the low-carb wave

while staying true to their core constituencies.

| Top 10 Ice Cream Brands* | |||||

| Total Category | $ Sales (In Millions) |

% Change vs. Year Ago |

Dollar Share |

Unit Sales (In Millions) |

% Change vs. Year Ago |

| $4,474.0 | -2.1% | 100.0% | 1,227.9 | -0.8% | |

| Private Label | 1,000.4 | -3.6 | 22.4 | 153.7 | 2.6 |

| Breyers | 651.3 | 0.1 | 14.6 | 112.3 | 2.3 |

| Dreyer’s/Edy’s Grand | 474.1 | 0.4 | 10.6 | 70.5 | 2.6 |

| Blue Bell | 241.6 | 1.4 | 5.4 | 61.2 | 4.7 |

| Häagen-Dazs | 217.3 | 7.4 | 4.9 | 60.0 | 7.1 |

| Ben & Jerry’s | 198.8 | -0.4 | 4.4 | 28.4 | -0.2 |

| Wells Blue Bunny | 108.0 | -0.8 | 2.4 | 29.7 | -0.1 |

| Turkey Hill | 107.7 | -4.6 | 2.4 | 29.7 | -1.5 |

| Dreyer’s/Edy’s Grand Light | 99.9 | 5.8 | 2.2 | 22.3 | 6.1 |

| Healthy Choice | 90.5 | -15.9 | 2.0 | 20.5 | -17.4 |

| * Total sales in supermarkets,

drug stores and mass merchandisers, excluding Wal-Mart, for the 52-week period ending January 25, 2004. SOURCE: Information Resources Inc. |

|||||

During times of economic strife, consumers typically embrace two behaviors.

They turn to the comforts of hearth and home, seeking to soothe the sting of

job uncertainty or unemployment, not to mention plummeting savings and retirement

accounts. Additionally, they force themselves to give up little indulgences,

like new cars, family vacations and other extravagances.

On the one hand, this trend bodes well for ice cream,

as it most certainly counts as a comfort food, a taste that harkens back to

happier times. But few could honestly claim it as a necessity, making it

one of the easier things to give up when times get tough.

Apparently, that’s just what some consumers have

done. According to data from Chicago-based Information Resources Inc., ice

cream sales in U.S. supermarkets, drug stores and mass merchandisers,

excluding Wal-Mart, fell 2.1 percent in dollars and 0.8 percent in units

during the 52-week period ending January 25, 2004. The case could be made

that other factors, such as rising butterfat prices and encroachment from

other dessert categories, could be partly to blame. For example, butter

prices soared by almost a dollar a pound between January and the end of

March, when the average weekly price reached a level more than double that

of a year earlier.

But many processors heap the bulk of the blame squarely

on the struggling economy. “There’s no question in my mind that

the ice cream category has paid the price of a down economy,” says

Walt Friese, chief marketing officer, Ben & Jerry’s Homemade

Inc., South Burlington, Vt. “In addition, there’s been a shift

in consumer eating habits toward healthier options and innovation,

category-wide, has just not kept pace.”

That’s not to suggest the entire ice cream

category is in the doldrums. On the contrary, one area in particular

— superpremium — has been experiencing significant growth,

according to Rick Brown, senior vice president and general sales manager,

Lee’s Ice Cream, Owings Mills, Md.

As about why superpremium ice cream has been able to

prosper while the rest of the category has struggled, it’s no great

mystery to Lee’s owner Steven Rubin. “When you want ice cream,

you want the best ice cream, so you turn to superpremium,” he

explains. “That means something high fat, creamy and

delicious.”

Carb Conscious

Increasingly, as consumers have lost their fear of fat

and instead turned their attention to counting carbohydrates with diet

programs like Atkins and South Beach, they have given high-fat products

like superpremium ice cream a second look. Many have determined they can

fit such treats into their diet after all — as long as they

don’t contain too many carbs, that is. Not surprisingly, a number of

ice cream manufacturers have focused their R&D efforts on producing

low-carb superpremium ice creams, most replacing the sugar with Splenda® brand

sucralose.

To that end, Cleveland-based Pierre’s French Ice

Cream Co. recently unveiled Carb Success™ No Sugar Added Ice Cream in Chocolate and Vanilla

varieties. Sweetened with Splenda, the product contains 3 grams of net

carbohydrates per half-cup serving. Developing a low-carb option without

losing the taste and texture of superpremium ice cream didn’t pose

too great of a challenge, according to John Pimpo, Pierre’s assistant

marketing manager. Rather, the challenge lies in determining which flavors

to add to the line next, he says.

When it came to snagging the official Atkins license

for low-carb superpremium ice cream, that accomplishment goes to two

companies. First, Mister Cookie Face, Lakewood, N.J., launched Atkins® Endulge™ ice cream

in portion-controlled cups. Then Ronkonkoma, N.Y.-based CoolBrands

International Inc. rolled out Endulge pint flavors and frozen novelties to

further meet consumer demand for something both indulgent and diet.

“It really is the best of both worlds,”

boasts Matt Smith, CoolBrands vice president of marketing. “It takes

down the sugar, but it is a superpremium-quality ice cream, meaning 16

percent butterfat. It fits the low-carb lifestyle, but it still has the

great taste that people are looking for.”

Smith says securing the Atkins license for pints and

novelties helped CoolBrands round out its superpremium ice cream offerings.

In recent years, the company acquired the Dreamery brand from

Dreyer’s Grand Ice Cream, as well as the license for Godiva® brand ice

cream products.

“When it comes to superpremium, we feel we are

incredibly well-positioned,” says Smith. “People are looking

for a great indulgent flavor experience, and we’ve got three brands

that deliver on that — Godiva with the signature chocolate, whether

in the ice cream or the inclusions; Dreamery with an array of innovative

flavor combinations; and now, we’ve got Atkins.”

To help consumers easily identify the wide variety of

superpremium offerings presented by just one company, CoolBrands plans to

bundle all its superpremium brands into one in-store display. According to

Smith, the idea is to give consumers the “breadth of variety they are

looking for” at the point-of-sale, while creating more critical mass

for CoolBrands in-store.

“That’s something that’s not lost on

the trade accounts,” he explains. “They are obviously looking

to maximize their business, and when we are able to pool all those brands

together, they see that we’ve got the variety that consumers are

looking for, and they support us for that.”

But not everyone is anxious to jump on the low-carb

bandwagon. While management at Lee’s is certainly keeping an eye on

the trend, their impression seems to be that the whole Atkins diet is a

passing fad.

“The product will get out there, it will get a

lot of shelf space and have a lot of sales, but then it will disappear

within a couple of years,” predicts Brown. “We’re more

interested in long-range growth than short-term fads.”

Instead of investing lots of money and effort into

developing low-carb products, Lee’s has focused on growing

distribution for pints of its “fresh-baked” superpremium ice

cream, which features chunks of Claudia’s Kitchen desserts, such as

gourmet cookies, cakes and pies. Numerous co-branded varieties currently

are available, including Peanut Butter Chocolate Chip Cookie, Fudgie,

Coffee Chocolate Pecan Cookie, Mint Brownie and Cookie Dough. Other

Lee’s varieties are Strawberry, Chocolate, Banana Chocolate Chip,

Butter Pecan, Cherry Vanilla, Carmel Truffle Swirl, Old Fashioned Chocolate

Chip and Death by Chocolate.

The company makes no bones about the fact that

convenience stores are its channel of choice. “You have the potential

for greater visibility, you have a smaller group of products in the stores,

and it’s grab and go — real impulse buy,” says Brown.

Also not falling into the low-carb landslide is

Oakland, Calif.-based Dreyer’s. Instead,

the processor is introducing a new version of its

Dreyer’s/Edy’s Grand Light made with a new slow-churning

process designed to make lowfat frozen products that taste like

superpremium. Gary Rogers, Dreyer’s chief executive officer,

describes the process as high pressure/low temperature freezing technology.

The new Grand Light is touted as having half the fat

and a third of the calories of regular Dreyer’s/Edy’s

offerings. So far, early indicators are positive. The company reports that

nearly eight out of 10 consumers participating in blind national taste

tests believed the product was either a full-fat premium or superpremium

ice cream.

Juggling Act

Meanwhile, Scottsdale, Ariz.-based Cold Stone Creamery

remains committed to its franchise concept, considering retail as a

long-term goal rather than an immediate one.

Boasting product that’s custom-made daily on a

frozen granite stone, the company sells a variety of superpremium ice

creams along with mix-ins like fruits, candies, nuts and traditional

toppings. Cold Stone’s decadent creations sport monikers like Cherry

Cake Double Take, Mud Pie Mojo, Nights in White Chocolate, Cookie

Doughn’t You Want Some and At the Cocoa Banana Cabana. According to

communications manager Kevin Donnellan, Cold Stone was the first processor

to introduce Cake Batter ice cream early last year, a flavor that some in

the industry have predicted to be “the next cookie dough.”

“It tastes like you’re licking the

bowl,” Donnellan says of the flavor. “It’s a unique and

indulgent flavor with a very smooth and creamy consistency.”

Like most other processors, Cold Stone has been

monitoring the Atkins craze and plans to unveil its own low-carb ice cream

during the latter part of the summer. Currently in the final testing stage,

the low-carb incarnation of the company’s Sweet Cream ice cream

boasts a “tremendous flavor,” says Donnellan.

Not about to let its fervent consumer base down, Ben

& Jerry’s has also unveiled a line of low-carb superpremium ice

cream pints. Each Carb Karma flavor features 2 to 5 grams of net carbs per

serving. Guaranteed to “stimulate your mind, satisfy your belly and

soothe your soul,” Carb Karma is available in Half Baked, Chocolate

and Vanilla Swiss Almond varieties. (See New Products in this issue.)

“It tested our creativity, as well as our food

science expertise, but we have come up with some products that really

deliver on the Ben & Jerry’s promise,” says Friese.

“We really feel that our R&D team and flavor developers did a

fabulous job bringing Ben & Jerry’s quality and innovation to a

new segment.”

Of course, even though Ben & Jerry’s has

decided to invest in low-carb and other better-for-you ice creams,

it’s not about to neglect its core line. In recent months, the

company has rolled out three new classic flavors — Primary Berry

Graham, Oatmeal Cookie Chunk and Vanilla Swiss Almond.

“There are a lot of consumers who still come to

Ben & Jerry’s for over-the-top indulgence in the core pint line,

so we will continue to exercise focus in terms of product development

there,” says Friese. “We remain committed to Ben &

Jerry’s core ice cream pint business, as well as to bringing new and

innovative flavors to the line.”

Meanwhile, the past year has seen a small, upstart

company launch a superpremium line that it positions as a political

alternative to Ben & Jerry’s, a company that has become known for

its commitment to causes often labeled as “liberal.”

Baltimore-based Star Spangled Ice Cream Co. makes right-wing-themed

flavors, including Smaller Govern-mint, Nutty Environmentalist, Iraqi Road

and the new Gun Nut, a coconut ice cream with roasted almonds and chocolate

chips. Star Spangled donates a percentage of its

profits to conservative-leaning causes. The idea, according to company vice

president Richard Lesser, is to offer consumers an alternative to Ben &

Jerry’s causes.

Friese dismisses the jabs. “They’ve been out there a while now,”

he says, “and the consumers have already voted.”

Julie Cook is a freelance journalist based in the Chicago

area.

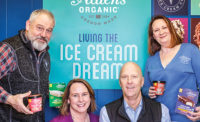

Sampling Superpremiums

What a short break from better-for-yous can bring.

With the nation in the grips

of the low-carbohydrate juggernaut, the market is being flooded by a steady

stream of “better-for-you” ice creams and frozen novelties,

mostly of the no-sugar-added variety to satisfy the demand of Atkins and

South Beach dieters.

Dairy Field applauds

this flurry of innovation and the monumental effort of processors to meet

the growing demands of the public in a timely and efficient manner. But

after reading about, writing about and tasting a bewildering array of

healthier indulgences, we got to wondering what we might be missing in the

traditional superpremium channel — full fat, real sugar, sumptuous

variegates and chunky inclusions.

So we rounded up a few of the newest pint flavors we

could find at a major grocery retailer near the Stagnito Communications

corporate headquarters, including one of the new low-carb offerings —

sweetened with sucralose but possessing a fat content that qualifies it as

a superpremium. We also sampled a boutique brand provided to us by the

maker who’s planning to eventually take the line national.

Here are the results of a recent afternoon Dairy Field staff members

spent eating some ice cream. Participating were publisher Matt

O’Shea, R&D editor Kathie Canning and managing editor James

Dudlicek. The numbered overall scores, on a 1-10 scale (10 being the best),

are an average of scores offered for criteria including taste, texture and

richness.

$OMN_arttitle="Indulgence for Everyone";?>