Yogurt and dips appear to be the strongest categories for the latest reporting period, while sour cream was basically flat overall and cottage cheese slumped, its brush with greatness during the low-carb craze long behind it.

According to Chicago-based SymphonyIRI Group (formerly known as Information Resources Inc.), yogurt dollar sales rose 3.5% for the year ending Feb. 21. Although private label snagged the No. 1 spot, other brands such as Chobani Greek Yogurt and Fage Total Greek Yogurt snagged spots within the Top 10 – with 316.2% and 36.5% jumps in sales, respectively – thanks to the current popularity of Greek-style yogurt. Meanwhile, Dannon continues to gain steam against rival category leader Yoplait with three top 10 products (four, if you count Danone-owned Stonyfield Farm). Dannon Light & Fit experienced a 26% uptick in sales, along with Dannon Activia Light up 4.9% and Dannon Activia up 3.1%.

Refrigerated dips also saw an overall 2.9% climb in sales, with mixed results among individual brands.

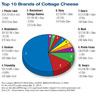

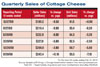

While certain cultured products were claiming victory in the aisles, others seem to have lost their whey … er, way. The rarely hot cottage cheese category, for instance, dropped 8.5% thanks to a wide array of weakened sales.

Dean’s cottage cheese took an 18.1% hit in sales, while sales for Kraft’s Breakstone’s and Breakstone’s Cottage Doubles dropped 10.5% and 17.8% respectively, SymphonyIRI data says. Additionally, Knudsen sales slacked off by 9.6%; private label fell by 9.2% and HP Hood by 9.1%, SymphonyIRI figures state.

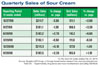

Although data for sour cream shows an overall 1.4% bump in sales, this category experienced a lineup of slumping results, according to SymphonyIRI charts.

For example, Cacique sour cream saw a 12.9% drop in sales, while sales for other brands such as Knudsen and Knudsen Hampshire dipped by around 10%. Meanwhile, Darigold brand sales rose 9%, SymphonyIRI numbers show.

Consumers may be shopping with a fatter pocketbook, but quarterly sales figures show that they’re still a bit selective as to how they’re spending their spare change.