But apparently not everyone is buying in, and that’s why numbers from Chicago-based Information Resources Inc. indicate a decline in sales in three of the top milk categories.

According to IRI stats as of Nov. 29, skim and low-fat milk sales are down 16.3%.

For the $6.8 billion skim and low-fat milk category, IRI figures place private label brands in the No. 1 spot, followed by HP Hood’s Lactaid 100% Lactose Free Reduced Fat Milk. Dean Foods claimed the third and fourth slots, with its Horizon Dairy’s Organic Reduced Fat line and Dean’s fat-free milk, respectively. Organic Valley snagged fifth place with its organic fat-free milk options, trailed by Prairie Farms, Garelick Farms, HP Hood’s other low-fat milk choices, Kemp’s Select 1% Milk and Stonyfield Farm’s organic fat-free milk line.

Meanwhile the whole milk category followed suit with a 17.8% decline in sales and a 1.8% drop in unit sales.

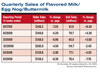

On the other hand, the flavored milk category – now being accused by some being as bad as sugary soft drinks as a school beverage option – only dropped 5.2% in sales but increased 3.4% in unit sales.

For example, standing at No. 5, HP Hood’s chocolate- and coffee-flavored milk helped accrue the company’s 3.1% sales hike, while Dean Foods introduced DHA Omega-3 chocolate milk under the Horizon Organic brand, which helped it claim a 19.7% jump in sales. Hiland Dairy saw a 12.8% increase in sales of its chocolate- and strawberry-flavored milk options. Kemp’s came in at No. 9 with a whopping 138.3% jump in sales due to its Select line of flavored milk, available in Banana, Chocolate, Strawberry and Cookies ‘n Scream varieties.

However, although private label brands absorb $228.7 million of the $714.3 million flavored milk category, it saw a 1.5% drop in sales. Meanwhile, Nestlé Nesquik sales plummeted 17.8% and Dean’s and Prairie Farms saw drops of 11.2% and 7.5%, respectively.

IRI figures also show a 3.5% rise in kefir, milk substitute and soymilk sales, with a 2.9% boost in unit sales.

Silk soy milk, produced by Dean’s WhiteWave Foods, maintained its No. 1 spot by raking in $250 million in sales.

The No. 8 slot goes to Blue Diamond Growers for the launch of its calcium-enriched Almond Breeze milk substitute, available in Original, Chocolate, Vanilla and Unsweetened Vanilla. The Almond Breeze line contains half the calories of 1% milk, thus helping Blue Diamond rake in a 917.7% leap in sales.

Additionally, 8th Continent Soymilk, made by Stremick’s Heritage Foods, eked out a soaring 1,011.8% hurdle in sales with its team of light, fat free and omega-3 DHA-enhanced options.

While some consumers may stray from milk, processors are in position to garner consumer attention and fight the hype with a panel of new products and innovative flavors.