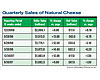

According to Information Resources, Inc., a Chicago-based market research firm, natural cheese sales have risen more than $375 million since mid-2007 and maintained an average of 12% in increased sales since last year.

Market research shows brands like Kraft, Heluva Good, Sargento, Borden and Land O’Lakes closely competing to secure top 10 slots of various types of cheese. Meanwhile, private label leads the way in categories such as chunks, shredded, slices, string, ricotta and refrigerated cheeses, and come in second with cubed and crumbled cheese.

For instance, the natural shredded cheese arena brought in nearly $900 million, with private label at the top followed by Kraft, Sargento, Crystal Farms and Borden, IRI results illustrate.

Processors continue to see great success with new and existing offerings of convenience products like all manners of shreds, slices and cubes, as well as innovative formats designed for home chefs that include other ingredients to deliver meal prep solutions.

Other forms of natural cheese – specialty cheeses and formats that don’t quite fit elsewhere – are displaying a 30% sales growth, the healthiest growth among all of cheese’s subcategories, suggesting consumers view fancy cheese as an affordable indulgence as they tighten their belts elsewhere.

Private label leads here with more than $4 million in sales, followed by Mozzarella Fresca at nearly $2.5 million. This category also includes Crystal Farms’ Cheezoids string cheese; Emmi USA’s Swiss cheese; Gerber Swiss Knight, also produced by Emmi USA; Amish Country Limburger cheese made by the Williams Co.; Anco fine cheese made from whole milk; Swissrose cheeses, including parmigiano, reggiano and taleggio; Sargento; and Cantaré artisan cheese.

However, the natural cheese cube aisle lags behind all the other natural cheeses by only bringing in $21 million. However, Kraft is responsible for 50% of the total cube sales, followed by private label at only $6 million. Kraft also dominates in the grated cheese category, again trailed by private label and 4C Foods.

But while natural cheese sales are brisk, it appears to be at the expense of process cheeses. Processed slices, according to IRI, take in more than $460 million in sales, with private label in first. But Kraft eats up six of the top 10 slots with its Singles, Deli Deluxe, Processed, Process Free, Velveeta and 2% Milk slices.

On the other hand, the processed cheese arena slows down total sales with cheese balls and spreads bringing in only $18 million, imitation cheese eking out $11 million and all other forms just shy of $3 million.

Regardless of how it’s cubed, chunked, sliced or shredded, cheese of all forms are here to stay, even if some categories begin to slumber.