Flavored milk consumption will grow at more than double the rate of white milk globally between 2012 and 2015. Consumers are increasingly turning to

|

|

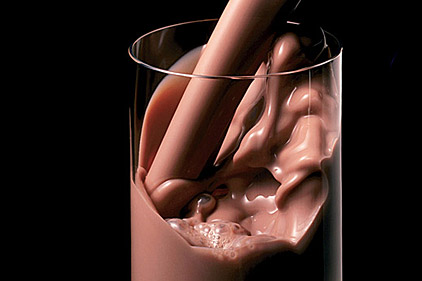

The growth rate for flavored milk consumption in the United States is expected to trip from 2012 to 2015, according to an analysis by a packaging firm. Photo courtsey of Wisconsin Milk Marketing Board |

tasty,nutritious and conveniently packaged flavored milk as an alternative to other beverages, creating opportunities for dairies to improve profitability. Those are the findings from Tetra Pak, a food processing and packaging company based in Vernon Hills, Ill.

Flavored milk, the second most widely consumed Liquid Dairy Product (LDP) after white milk, is forecast to increase globally by a compound annual rate of 4.1% between 2012 and 2015, rising from 17 billion liters to 19.2 billion liters (about 5 billion gallons).

Developing countries will drive demand amidst a growing number of new flavors and products focused on health. White milk is forecast to grow by 1.7% (CAGR) during the same period — from 208.5 billion liters in 2012 to 219.5 billion liters in 2015. Total LDP demand is set to grow by 2.4% from 280.3 billion liters to 301.3 billion liters during this period, according to Tetra Pak research.

“With white milk increasingly commoditized, flavored milk offers dairies the opportunity to provide value not only to consumers but to their bottom line,” said Dennis Jonsson, president and CEO of Tetra Pak Group. “With the right flavors, portion sizing and formulation, flavored milk can meet a huge range of health, nutritional and lifestyle needs.”

In the United States, the volume of total liquid dairy is declining. This is driven largely by changing consumer habits and the falling per capita consumption of white milk which is forecast to decline by 6.5% between 2011 and 2015. Comparatively, flavored milk is growing and expected to increase to 9.5% by 2015.

Tetra Pak identified the following four drivers fuelling the rise in flavored milk consumption:

- A desire for nutritious and healthy food, which is prompting consumers, particularly in developing countries, to turn to nutrient-rich milk products.

- The urbanization, rising prosperity and the pace of modern life, which has increased “on-the-go” consumption of ready-to-drink (RTD) flavored milk in convenient portion packs.

- Consumers’ eagerness to try new food and drinks, with flavored milk well-poised to meet that need.

- Consumers seeking “indulgent” eating and drinking experiences as a way of escaping the daily grind during times of economic uncertainty.

“People don’t mind spending a bit more for small indulgences when times are tough and they are making bigger sacrifices,” said Libby Costin, Global Portfolio marketing director.

Americans move to higher-value milks

In the United States, consumers are used to getting the largest volumes of milk for low prices. However, consumers are moving towards higher-value products. In fact, the best-performing segments within white milk have been enhanced, value-added and organic milk. In addition, flavored milk consumption is growing due to taste, convenience and nutrition preferences. Widespread acceptance as a post-workout drink have spurred Americans to seek healthier products, fueling flavored milk and reformulated milk growth.

The millennial generation represents a significant opportunity, with a significant purchasing power representing 25% of the U.S. population. Potential growth in flavored milk and other dairy-based products present an opportunity to offer convenient, yet sophisticated, options for this up-and-coming consumer.

Though worldwide consumption of flavored milk is still low compared to other beverages, such as carbonated soft drinks, positive consumer perceptions about the health benefits of milk are creating opportunities to significantly increase flavored milk consumption, according to Tetra Pak. The growth rate for flavored milk consumption is expected to be more than triple that of carbonated soft drinks in 2012-2015. During that period, carbonated soft drinks are forecast to grow by 1.3% compared with an estimated 4.1% for flavored milk.

“For consumers unwilling to compromise on taste, health or convenience, flavored milk is proving an increasingly popular alternative to other beverages,” said Jonsson. While demand for flavored milk is forecast to rise globally, demand in developing countries, particularly across Asia and Latin America, is set to outpace that of developed countries in North America and Europe, highlighting emerging economies as the growth engines of the dairy industry.

Demand in China, India, Brazil

In fact, seven of the world’s top 10 flavored milk markets are developing countries, Tetra Pak research shows. China is the world’s largest, followed by the United States and India. Increased demand for flavored milk from 2009 to 2012 was mainly driven by four emerging countries: Brazil, China, India and Indonesia.

The trend is set to continue from 2012 to 2015. While developing countries accounted for 66% of flavored milk consumption in 2012, this is forecast to rise to 69% by 2015. China, South Asia and Southeast Asia drink more than half the world’s flavored milk. In fact, just six Asian countries — China, India, Indonesia, Malaysia, the Philippines and Thailand – consume 47% of the world’s flavored milk, Tetra Pak research shows.

Cartons have become the established packaging format for flavored milk, according to Tetra Pak. They accounted for 62% of RTD flavored milk packaging in 2012, up from 57% in 2009, and are expected to rise to above 64% in 2015, with portion packs expected to reach 81% of RTD flavored milk consumption. n

—Based on a press release from Tetra Pak.