The two San Antonio moms were laying the groundwork to launch a chain of healthful sandwich shops that would free them from their employment at Boeing Aerospace when they had their fateful encounter with ice cream. Working in Tucker's home kitchen, with ingredients from the local GNC and only a laymen's understanding of food science, they were trying to design a nutritional beverage they could sell along with the sandwiches. Something inspired them to pour some of the mixture in ice cube trays and insert Popsicle sticks.

"I don't think we ever talked about the sandwich shop idea again after that," says Tucker who now runs Fussworthy Foods, San Antonio, with Boyett and a third partner.

Instead, they created Worthies, a line of all-natural lowfat stick novelties fortified with whey protein, folate, and a slew of vitamins and minerals. Less than three years later Worthies, which are manufactured for Fussworthy Foods by Perry's Ice Cream, Akron, N.Y., are carried by an increasing number of retailers including HEB, Buy Low, Kroger's and 7-Eleven.

Yes, people told them that ice cream is not supposed to be good for you.

"But we know better," Tucker says. "As moms we know better. As a mom I don't eat yogurt, and I don't eat diet ice cream, so I thought if I can get some ice cream that really tastes good, that's healthy, it would be great."

Taking the bad stuff out of ice cream was nothing new. Lowfat and no-sugar-added products have a long history in the ice cream aisle. Low-calorie, diet specific novelties have been among the most successful frozen dessert products in recent years, and the popularity of the Adkins Diet drove dozens of new product introductions starting in 2003. As Dairy Foods took the temperature of the ice cream market last year the buzz was all about better-for-you ice cream, be it a richer tasting light product from Dreyer's Grand Ice Cream, Oakland, Calif., or a set of four different better for you lines from Ben & Jerry's, South Burlington, Vt. But there wasn't much talk about adding 20% of the Daily Value of A,D,B6,B12,C,E to an ice cream product. In 2005, we may see the dawning of a new trend-fortified ice cream.

Better-for-you is still the buzz. In fact when you look beyond ice cream and even dairy, it's evident that food manufacturers have finally moved to a centrist position of common sense nutrition. New products hitting the shelves and those in the pipeline have a bit less of what's bad for you and a bit more of what's good for you.

For ice cream that means that the heavy hitters are offering products with a bit less fat and bit less sugar and fewer calories. The NSA niche, and the diet products are still there. Some low-carb offerings died very young, many are still in the freezers, and some are being given a more rounded nutritional profile.

The waves of better-for-you ice cream trends are stacked up closer than ever, with low-carb having spread across the flat packed sand at the shore, what we might call better light (including low-temp extrusion, and less fat/less sugar products) forming a high perfect crest, and natural, fortified products just beginning to build out beyond the break. Who knows what lies a mile off shore, might we expect (gasp!) functional ice cream.

Now before we drift off into visions of a 1960s surf movie, we must keep in mind that we are talking about ice cream. So, while better-for-you is all the rage, there is still plenty of plain old indulgence and fun to go around.

Sales trends and business moves

Ice cream is a mature market with household penetration of about 90%, so spectacular sales growth is never expected. Ice cream makers must follow consumer trends to stay in position to get the best possible share of the market. That being said, a brief look at overall numbers is important.When Dairy Foods previewed the 2004 season we noted that ice cream sales in general had gone from a period of steady growth to one of zero growth, and sales began to shrink in mid to late 2003.

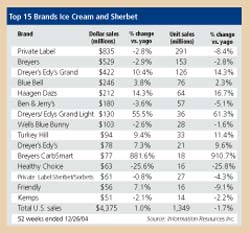

Well, about the best news that can be found in the most recent numbers is the rate of attrition has slowed a bit. Dollar sales actually grew throughout much of 2004, but that may have been the result of price increases. In the first two quarters of the year, unit sales were slipping by more than 2% per quarter compared to the same periods in 2003. But from July through December unit sales shrunk less than 1%. These figures, from Information Resources Inc., represent supermarket, drug store and mass merchandiser sales, but do not include foodservice, convenience stores or Wal-Mart.

Some troubling numbers can be found in the novelties category too. For the past couple of years novelties have performed well, and better-for-you novelties, very well. But according to IRI's figures, novelty sales went flat last summer and shrunk in the last two quarters of 2004.

Did the 2004 rush of low-carb and better for you products turn the tide on shrinking ice cream sales? Well, one could argue that it did slow the bleeding, as many of those better-for-you brands have gained significant market share.

Dreyer's Grand Light was already growing at the end of 2003, but after the Slow Churned technology was implemented and backed with Dreyer's largest-ever marketing campaign, sales really took off. In the 52 weeks leading up to Dec. 26 the brand saw a 61% jump in unit sales, according to IRI, and went from 9th place to 7th in the top 10 overall brands of ice cream.

It's been two years since the Dreyer's and Nestlé merger took place, and the company has obviously been doing something right. It now has four brands in the top 10 and all four experienced substantial unit growth in 2004.

Hershey's Ice Cream, Harrisburg, Pa., is growing its business in part through independently-owned Hershey's Ice Cream stores. Recently, Hershey's has seen the opening of additional independent stores in the South and Midwest, and the company plans to continue to add stores.

From the rollout of three new flavors to expanding distribution and strong growth, Velvet Ice Cream Company, the fourth-generation family-owned ice cream manufacturer based in central Ohio, has a lot in its bowl for 2005.

Velvet will introduce its new flavors, Bearfoot Brownie, Peaches ‘N Cream, and Mimosa Sherbet, in response to consumer trends. "Varieties full of bite-size treats and sweets, and specialty flavors, will become even more popular in 2005," said Velvet's V.P. of Marketing and Sales Luconda Dager. "The low-carb craze is fading fast, so we'll also return to marketing our Light line as lower-calorie and lower-fat, rather than lower-carb."

Dager also noted that the company will focus on its new foodservice division. "We started manufacturing the Sysco brand in December of 2004, so now we have the opportunity to do business with more than 80 Sysco operating facilities," she said.

Velvet also will undertake several exciting promotions following its Great Ohio Inns Sweepstakes of the last two years. For instance, Velvet will sponsor a recipe contest. "These promotions really help build brand loyalty and increase consumer awareness in a way that traditional advertising can't," said Dager.

Cold Stone Creamery, Tucson, Ariz., has been growing aggressively through franchise operations for a number of years. In 2004 more stores were added in Michigan and in New England, and the 14-year-old company now has more than 1,000 stores nationwide.

The company's CEO recently told a group at a local business function that Cold Stone plans to be the top-selling store-based ice cream brand nationwide within five years. He also revealed that it was working on partnership with Target Stores and planning to intensify take-home offerings from stores.

Oberweis Dairy, North Aurora, Ill., is also getting into the franchise game. In addition to an innovative home delivery system, Oberwies operates 33 company-owned stores that offer both old-fashioned soda-fountain service and take-home of ice cream and dairy products. Late last year it awarded three franchisers the rights to open nine stores in Illinois, Indiana and Wisconsin. It hopes to sell 500 franchises within the next five years. The company is seeking to acquire or build a second manufacturing plant to supply the stores.

Smith Dairy Company, Orrville, Ohio, recently announced the acquisition of the traditional ice cream business from Superior Dairy, Canton, Ohio. Superior has decided to focus its full attention on prepared desserts, ice cream cakes, and a line of new specialty products.

From carb counters to iron women

Dolores O'Rourke Ames, of Newbury, Conn., has long had a similar inclination to that of the two moms at Fussworthy Foods."I wanted to eat a whole pint of ice cream one day, but of course you can't do that," say Ames, who has applied for a patent for a product she plans to develop called Health Wise ice cream. "There is some guilt associated with eating ice cream," she says. "And I've always wanted to eat it without feeling guilty."

Ames, a self-described inventor, envisions packaged ice cream in a squround, that would have a similar nutrition profile to Worthies, with about 20-30% of the Daily Value of up to 20 vitamins and minerals, including iron, zinc, magnesium and potassium.

She hopes to have a patent by June and would like to find a company that could help her to develop and market the product.

It's not just upstart entrepreneurs who have decided that it's OK to bolster the nutrition of frozen dairy desserts. Last year CoolBrands International Inc., Toronto, test marketed Yoplait® Frozen Breakfast Bars™ in the Washington D.C./Baltimore area. This line of frozen yogurt novelties represents a new category of frozen dairy breakfast foods. And what's in them besides Yoplait frozen yogurt? You guessed it, 12 vitamins and minerals including calcium and iron.

CoolBrands' Marketing V.P. Matthew Smith says the line is now available in Florida too, and that the company is working gradually toward a national roll out.

"It's doing very well," Smith says. "But getting it on the shelves outside the ice cream aisles takes a bit more time."

The bars, which were recognized by Dairy Foods as a top new product of 2004, have also been approved by USDA for inclusion in the Child Nutrition Program in U.S. Public Schools.

CoolBrands is rolling out a number of other better-for-you products this year, including NSA Crayola Pops in the Eskimo Pie line, indulgent Sorbets in the Godiva line, and even more healthful Dogsters treats to keep the puppy from getting too chubby.

Good Humor-Breyers, Green Bay, Wis., has tweaked its market-leader low-carb line CarbSmart™ with the addition of Breyers® CarbSmart™ Light Vanilla Fudge Sundae and Breyers CarbSmart Light Chocolate Peanut Butter. Each have half the fat, and 40% percent fewer calories than regular ice cream, and 4g net carbs per half-cup serving.

The company says that although low- carb diets may have peaked, carbohydrate awareness is here to stay. Since their introduction, CarbSmart ice cream products quickly became best-sellers throughout 2004. Indeed CarbSmart was the number 10 ice cream brand (excluding private label) for the year ended Dec. 26, according to IRI. (For more information about this new line see New Product Review.)

GH-B is also adding good stuff to a new product in the Popsicle line. ACE pops are fortified with vitimins A, C and E.

Body vs. Soul

The success of Dreyer's Grand Light has been nothing short of remarkable. At January's Dairy Forum, the company's Chief Operating Officer, Tim Kahn said the low temperature extrusion technology, which maximizes the mouthfeel at any fat level, will help redefine mainstream ice cream. Kahn said Grand Light has been so successful it could well become Dreyer's flagship brand. The company is so pleased, it now plans to do something similar with its market-leader superpremium brand. Häagen Dazs Light will have less fat and less calories than the superpremium line, but all the indulgence the brand has become known for.Meanwhile, another big player in the superpremium category, Ben & Jerry's is refining its better-for-you offerings. In 2004, the folks from Vermont, (part of Unilever's North American ice cream operations that also include Good Humor-Breyers) introduced a foursome of distinct lines of better-for-you products using the slogan "Less Body...More Soul." The line up included NSA ice cream, Light Ice Cream, Carb Karma, low-carb products and Low-Fat Frozen Yogurt.

Carb Karma is gone completely this year, and some of the other lines are being fine-tuned, says Lee Holden, "senior public elations coordinator" with B&J.

"A new line we are introducing this year is Body and Soul," Holden says. These have 25% less fat, sugar, and calories than the regular line."

Body and Soul kicks off with reformulations of four classic flavors: Cherry Garcia, Chocolate Chip Cookie Dough, Chocolate Fudge Brownie, and Half Baked.

Wells' Blue Bunny line will see the addition of Health Smart® Strawberry Crème Bars, a swirl of fat free no sugar added Strawberry and Vanilla ice creams, on a stick.

Wells' will also add some new flavors to its Carb Freedom™ line, including Caramel Toffee and Neapolitan. Pierre's French Ice Cream, Cleveland, is expanding its Slender® line of No Sugar Added, Reduced Fat products to include novelties. Ice Cream Sundae Cones, and Sandwiches are among the offerings. Pierre's will also introduce a new premium round top Sundae Cone.

Blue Bell Creameries, Brenham, Texas, is characteristically cautious with its better-for-you offerings, adding two SKUs of NSA products to its novelty line this year. Carl Breed, Blue Bell's director of marketing, says the flavors, 12-packs of Fudge Bar and Moo Bar will duplicate existing regular line flavors. "We're using the same pictures with a vibrant NSA banner and a slightly different color scheme."

Blue Bell will continue with a small line of low-carb offerings but does not plan any other expansion in the arena of more health related products.

One of the biggest stories in the dairy industry in 2004 was the acquisition of Crowley and Kemps by HP Hood, Chelsea Mass., and one of the outcomes of that acquisition, is that Kemps, which has always been an important player in the ice cream market is now operating on an even larger scale. Kemps has become the frozen dessert division of the new Hood LLC, so the timing could not have been better for a co-branding partnership that has blossomed between Kemps and General Mill's Pillsbury division (see related story p. 30).

The end result is a 2005 rollout of a seven-SKU line of Kemps branded Pillsbury Doughboy® ice cream. The flavors are largely focused on, but not limited to, baked good flavors and inclusions, and include Turtle Fudge Brownie, Peanut Butter Fudge Chunk, and Cake and Ice Cream. They are premium level products making no better-for-you or all natural claim.

Manufacturers have a number of products on deck for this season that will have nothing to do with watching your waistline.

Ben & Jerry's original line will get three new flavors including Dave Matthews Band Magic Brownies, which is vanilla ice cream, fudge brownies and raspberry swirls.

Marsha, Marsha, Marshmallow, is a play on the nostalgic popularity of the 1970s Brady Bunch sitcom.

"It's almost like a s'more concoction with chocolate ice cream, with fudge chunks, toasted marshmallow and a graham cracker swirl," Holden says. "Our guys perfected that graham cracker swirl last year with the Primary Berry Graham." That election-season flavor now joins the year-round lineup as Strawberry Cheesecake.

Fossil Fuel, is sweet cream ice cream with chocolate cookie pieces, fudge dinosaurs, and a fudge swirl.

Holden says a new indulgence-focused line called Mood Magic is being launched with two flavors: Chocolate Therapy, and In the Crunch.

Blue Bell will roll out several new flavors on both the novelty and packaged ice cream side, including more Southwest flavors which are based on traditional Hispanic desserts. May of the company's flavors are limited seasonal offerings, which began in January.

"The first is Carmel Almond Crunch, Breed says. "It has praline coated almonds and an Amaretto fudge swirl."

Sundaes Best, introduced this month is a Vanilla ice cream with three soft swirls: Chocolate fudge, strawberry and pineapple. The Southwest line gets the addition of Plantenos y Freses, or Bananas and Strawberry.

Blue Bell will also migrate into the novelty line a popular ice cream flavor introduced last year.

"The Great Divide is just chocolate on one side and Vanilla on the other, but it has been a real big hit," Breed says. "The new novelty is half vanilla half chocolate on the stick and the entire bar is coated in vanilla and half in chocolate coating."

Cold Stone recently introduced Red Hot ice cream! made with real spicy Red Hot candy infused in sweet ice cream.

New premium flavors from Wells' will include White Fudge Almond Divinity, Orange Dream Original Ice Cream, and the company adds a Mini Bomb Pop® Dream novelty featuring vanilla ice cream coated with orange, cherry or blue raspberry sherbet.

Sidebar: Kemps Tickles the Doughboy

Pillsbury line, licenses with General Mills part of strategic initiatives for HP Hood's Kemps divisionThe 2005 ice cream season will offer some sure-fire hits, but perhaps none with more blockbuster potential than a new line that is "in production" in Minnesota.

Kemps Foods is introducing a line of Pillsbury Doughboy Ice Cream. The heavily researched, highly promoted roll out is the result of a pleasant coincidence of interests, says Raquel Melo, marketing dir., innovation/new products at Kemps.

"Kemps has wonderful brand equity in the upper Midwest, but the further away you are from that bull's-eye of the Minneapolis/St. Paul area, the more the brand equity erodes and it drops off pretty quickly" Melo says. "For instance Kemps doesn't mean a thing to people in Atlanta, but Pillsbury obviously does.

"So we are looking to form co-branding partnerships with brands that are recognized across a broader geography. At the same time, General Mills (also based in Minnesota) has a wonderful business in licensing products, but as far as licensing food products in other categories they had not jumped in."

Until now, that is. General Mills contacted Kemps in January 2004 with the idea of a Pillsbury co-brand, just as Kemps was committing to a strategy of co-branding and licensing, a formula that has been very successful for Kemp's Parent company HP Hood. The partnership was formed, and production team went to work on filling the roles.

"We did utilize a lot of market research-qualitative focus groups and internet testing," Melo says. "On the Internet testing we put dozens of flavors in front of people. First we explained that it's Pillsbury ice cream and then ‘what if, what if, what if.'"

The result is a line that, not surprisingly, draws heavily from the bakery/ice cream flavor arena but also includes a comfort food classic:

Chocolate Chip Cookie Dough is made with chunks of real chocolate chip cookie dough and rich chocolate chunks in vanilla flavored ice cream.

Turtle Fudge Brownie, has chewy brownies, thick caramel ribbons and chunky pecans swirled in chocolate ice cream.

Peanut Butter Fudge Chunk, offers peanut butter and chocolate hearts and fudge ribbons swirled in vanilla -flavored ice cream.

Lovin' Caramel Swirl, includes caramel-filled milk chocolate hearts and caramel ribbons swirled in caramel ice cream.

Brownies ‘N Cream, features rich brownies and fudge ribbons swirled in vanilla flavored ice cream.

Cake & Ice Cream is a new flavor inspired by the delicious memories of warm family birthday celebrations.

Homemade Vanilla is rich and creamy vanilla, the perfect complement to apple pie, fruit cobblers or other desserts.

It's a premium, indulgent product, Melo says, with top quality ingredients and inclusions. "The inclusion level is higher than just about any other premium ice cream, and the quality of those ingredients was also important. It couldn't be just a thick fudge. It had better be the best darn thick fudge you could get. Two of the products have chocolate hearts, and again those chocolate hearts are fantastic."

Limited roll-out began in January, and was accompanied by a marketing push linked to the results of a consumer survey on attitudes about ice cream and consumption practices.

The press release included facts about how women are more likely than men to console themselves with ice cream and how 50% of those surveyed claim they've put unusual items ranging from anchovies and garlic to Wasabi and ranch dressing on their ice cream.

The initial introduction will be in Kemps' and Hood's core ice cream markets including the Midwest and the entire east coast, with the ultimate goal of coast-to-coast distribution. Line extensions and additional flavors are a possibility, Melo says, and plans are already in the works to test market novelties.

Kemps will forge other co-brand alliances wherever the opportunities are found, she adds, including, with other General Mills brands.