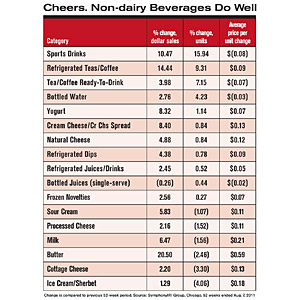

increased 345%, unit sales increased 178% and the average unit price increased $1.16 to $3.09. Clearly, the purple beverage is a superstar, according to 52-week data provided by Chicago-based market researcher SymphonyIRI Group.

increased 345%, unit sales increased 178% and the average unit price increased $1.16 to $3.09. Clearly, the purple beverage is a superstar, according to 52-week data provided by Chicago-based market researcher SymphonyIRI Group.To prepare our State of the Industry report (which begins on page 27), executive editor Marina Mayer and I extracted information about the market leaders in all the major categories of dairy foods and non-dairy beverages.

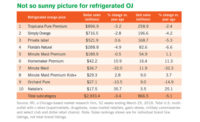

I then looked at the data in the aggregate to compare categories. I wanted to find other potential sales opportunities for dairy processors among the 900-plus entries in the SymphonyIRI tables. The results were disappointing. Although many categories registered price increases (which helped dollar sales rise), unit sales dropped. Dairy processors need to sell more units (at a profit) to ensure their long-term viability.

I kept digging into the numbers, looking to uncover some shiny gems. I found some in the cultured dairy category. Yogurt sales increased (as measured in dollars and units) and prices were up 7 cents. Cream cheese and refrigerated dips also showed gains in dollars, units and prices. Frozen novelties did all right, too.

How do you act on this information? Fluid milk processors can look into bottling juices and teas, or promoting their brands of these beverages more heavily. Ice cream processors can ramp up frozen novelties production. Yogurt makers can ride the current wave of popularity and innovate with flavors and inclusions.

Reformulate for a better bottom line

There’s something else dairy processors can do: make more better-for-you (BFY) products. They will bring you greater sales, greater operating profits and higher returns to shareholders, according to the new report, “Better-for-You Foods: It’s Just Good Business.” Author Hank Cardello told me that he analyzed 15 major food and beverage companies that have a high percentage of BFY products. Cardello is a director of the Obesity Solutions Initiative at the Hudson Institute, Washington, D.C. He called Dannon a “poster child” among processors of healthy foods. Read the report atwww.obesity-solutions.org.