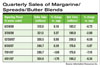

Mintel estimates the market for butter, margarine and table spreads reached $5.2 billion in 2007, a 31% increase from 2002, when the market was estimated at nearly $4 billion. However, sales increased primarily because of rising dairy prices, not because of increased consumer usage. As milk prices rise, so do butter prices, driving up dollar sales while volume sales remain flat.

The market’s other major obstacle is Americans’ general move towards healthier, lower-fat eating. More people are grilling or baking instead of frying, and those who cook with fats are tending towards better-for-you oils like olive oil. Mintel reports that olive oil sales grew 79% from 2002 to 2007.

Butter (and other) eaters

Though the butter, margarine and spread market is faced by numerous challenges, four in five Americans (80%) still reach for these products regularly, according to Mintel. Mintel’s exclusive consumer survey revealed that consumers use stick butter and tub margarine most frequently. Because these products are complementary – butter can be used for cooking and baking, while tub margarine is used as a spread – it seems logical that many consumers use both.

“Healthier-for-you” has been the rule of thumb for new butter and margarine products, as companies try to mold their image to today’s health-conscious mindset.

However, not all healthy product launches in the butter, margarine and spread market have been successful. Price is still very important to American consumers, especially as food prices rise and the economy tends toward recession.

Baking – which relies on butter for taste and texture – has been a challenge with many new nutrition-enhanced spreads, until recently. In January 2008, Smart Balance Butter Blend Sticks launched in certain regions of the United States to improve healthier spreads’ cooking and baking performance. The sticks contain both healthier ingredients and butter to perform better in baking recipes.

Better butter packaging

Beyond better-for-you ingredients, butter, margarine and spread manufacturers are trying to find other ways to make their products appeal to today’s consumer. Recognizing that a traditional 4-ounce stick of butter could be too large for a health-conscious or smaller household, Land O’Lakes introduced 2-ounce sticks in February 2008.The new sticks don’t change the overall product size; purchasers still get a full pound of salted butter. But they do wisely target Americans who only need a small amount of butter for a recipe, allowing them to use what they need and store the rest for later.

Fast Facts

- 51 new butter and spread products were launched between January and September of this year, more than double the number launched in 2003.

- Kosher led the top 10 claims among new U.S. butter and spread products launched between September 2007 and September 2008, followed by trans fat and cholesterol claims.

- Total U.S. sales of butter and spreads are expected to increase by nearly $1.2 billion through 2012.

- 80% of American consumers regularly purchase butter and spreads.

Source: Mintel

Links

- State of the Industry 2008: Cheese is Convenient, Naturally

- State of the Industry 2008: Ice Cream--Sweet Success

- State of the Industry 2008: Yogurt Still the Bright Spot

- State of the Industry 2008: Changes in the Big Beverage Market

- State of the Industry 2008: Ingredients--Pricey Necessities

- State of the Industry 2008: Introduction

- State of the Industry 2008: Milk--Ups and Dows

- Power Engineers