North American consumers seem to be eating a bit less ice cream and other frozen desserts and, they might be a bit more particular about what kind of product they select.

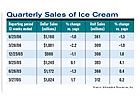

The latest sales numbers in the ice cream category show that sales have been down for the last two quarters available. It should be noted that these quarterly figures, from Information Resources Inc., do not capture the third quarter, which is usually the largest quarter for ice cream sales, and which in recent years has been the only quarter where the entire ice cream category has experienced any significant growth.

While overall sales appear to be trending down, several brands are undergoing decent to outstanding growth, while private label sales continue to shrink in 2006 as they did in 2005. For the 52 weeks ended Sept. 10, private label dollar sales were down 4.9% while unit sales were down just about a point.

Dollar sales of Dreyer's/Edy's Slow Churned have jumped astronomically, in part because it's a relatively new brand. Still it is quite remarkable that Slow Churned is now the No.4 brand after private label, and it is less than three years old. Dollar share for the low-fat brand were up by 4.7%.

Dreyer's Grand Ice Cream Inc.'s Häagen Dazs brand is also doing quite well, as the company has turned its focus from mergers to sales. Häagen Dazs also has a new light line that has been heavily promoted.

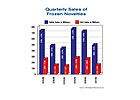

The numbers in the top table are for the broadest category of ice cream, including sherbet, sorbet and frozen yogurt. The third table is for all novelties, including ice cream novelties and water ice.

Dollar sales of novelties trended up a bit in Quarter 2, but the last significant jump also came in the third period last year.

While it is not broken out in the tables we offer here, IRI's data does show that frozen ice cream/ice milk desserts (primarily ice cream cakes) are heating up. The subcategory makes up less than 10% of the ice cream market, but it has shown consistent growth, and most recently sales jumped 9.4% by dollar and 10.4% by unit.