HOUSTON—In 2005, H.E. Butt Grocery Co. (H-E-B), based here on the Texas Gulf Coast introduced MooTopia, milk that features 60% less sugar, 35% more calcium, 75% more protein and 4g carbohydrates, per serving.

MooTopia is also lactose free, and it is substantially creamier and more flavorful than traditional milk, according to H-E-B. The company says taste tests show that MooTopia skim milk is creamier than traditional 2% milk, while MooTopia 2% is creamier than traditional whole milk.

H-E-B, along with partner Select Milk Producers Inc., Artesia, N.M., patented the process.

This not the first time that a company has found a way to concentrate the desirable components in milk while removing or reducing the less desirable. H.P. Hood introduced Simply Smart more than five years ago, and SouthWest Foods rolled out Le Carb Dairy Drinks in 2003, and Hood followed with Carb Countdown. But H.E.B.'s product may have something those products did not-company.

In Southern California an entrepreneurial company with some partners in the dairy industry is test marketing a product called Sun Milk that replaces milk fat with sunflower oil, a polyunsaturated fat that may have some health benefits. Around the world, dairies and other beverage marketers are selling milk enhanced with things like Omega 3, a beneficial fatty acid.

Could the arrival of these products represent the beginning of a trend-this idea of making milk itself even better? Well, perhaps. We'll explore that notion and some other trends in packaging, marketing, and distribution, and try to determine where milk is headed after taking a look at some unpasteurized sales figures.

By the numbers

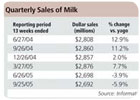

Looking first at retail numbers from Information Resources Inc., 2005 was not a very good year for milk sales. For the overall category, unit sales were down in each of the last six quarters through Sept. 25. IRI numbers (F/D/MX) are only for food, drugstores, and mass merchandisers excluding Wal-Mart. But looking at the more comprehensive USDA numbers doesn't offer any more comfort. The recently published Dairy Facts 2005 from the International Dairy Foods Association (IDFA), includes USDA numbers through 2004. Total milk sales, expressed there in pounds of product sold, was down to just below 53 billion lbs. Since 2000 that number has increased only once and that was in 2002 when it reached 54.34 billion.Tom Nagle, IDFA's v.p. of marketing says the 2005 numbers won't be much better than 2004, but he does see a few bright spots, while noting that IRI numbers are perhaps becoming less of an indicative measure.

"Looking at USDA and retail it looks like total milk sales will probably be more or less flat for 2005," Nagle says. "For a long time there has been a migration of milk sales out of the supermarket and into other channels. The two biggest winners (last year) in terms of channel development have been dollar stores and restaurants. Another major change is schools and vending, and then how do you measure those."

Certainly there are sales that are not being measured, but there are also some figures that are hard to ignore, like per-capita consumption. In 2004 that number dropped again as it has for each of the last six years. The per-capita figure is now down to 180.3 lbs a year from what might be called a modern-day high of 237.8 in 1980.

There are lots of theories on why milk sales numbers won't budge, and we'll get to that later, but first let's look at what's going on in the larger beverage arena.

Plop, fizz, boom

Milk isn't the only beverage category where sales were less than sparkling in 2005. Carbonated soft drinks, the traditional rival of milk, experienced volume and dollar sales losses in each of the last six quarters through Sept. 25, according to IRI. Refrigerated juices and juice drinks, a category in which many dairy processors participate, actually had a better go in 2005 than in 2004. Dollar sales and unit sales were both up a bit in the first three quarters of 2005, where they had been slipping in 2004. No surprise at what the big winner is for the beverage category-it's bottled water. This subcategory grew even faster in 2005 than in 2004, with a whopping 20.7% dollar sales jump in the quarter ended Sept. 25. If the fizz is gone from the carbonated drink business, bottled water is the boom beverage of the new millennium. The success may be even more remarkable when you think that these IRI figures don't include cafeterias, fast food restaurants, vending machines, or convenience stores. Refrigerated iced tea and refrigerated lemonade also did well last year, and both of those are categories that dairy processors can do and do participate in successfully. Dairies should be thrilled that cream sales are taking off, thanks in part to the reinvention of coffee, and all those pitchers of cream products made available to coffee stand customers.One milk subcategory that has been very successful for dairies in recent years is flavored milk, and while flavored milk sales growth has slowed, it still offers opportunity for growth, which is why companies from outside the dairy industry continue to pursue it in one way or another.

Bravo's CEO Roy Warren says the deal and other developments in the industry will help Bravo and others take flavored milk sales to the next level.

"I like to think that it's all about branding, and while that is key, I think the real gate keeper is technology," Warren says. "We really didn't have the technology until recently.

"It's great to have the target demo in mind, but once you have that done and you've got the product, if you don't have the technology, you can't really treat it like beverage no matter how hard you try, because you can't get it to the immediate consumption channel."

For Bravo that technology is aseptically packaged plastic bottles, a technology it has access to through contract manufacturer Jasper Products, Joplin, Mo.

Knowing that the distribution deal with Coca-Cola will lead to significantly higher sales volume, Bravo more recently signed a long term agreement with Jasper, allowing Jasper to add capacity to its facility. With these agreements in place, Warren is anticipating incremental sales increases, and even looking down the road to more opportunities.

"When you have a beverage DSD delivery guy putting your product into the schools, just like he does with Coca-Cola that's going to change the dynamics of the industry," he says.

Quaker Milk Chillers are sweetened with a blend of natural and no-calorie sweeteners including sucrose, sucralose and acesulfame potassium. They have a similar nutritional profile to plain 2% reduced-fat milk and qualify for PepsiCo's Smart Spot™ symbol because they contain 45% to 50% less sugar than the leading flavored milks and are an excellent source of calcium. The beverages are packaged in aseptic plastic bottles, have a shelflife of six months and do not require refrigeration until after they are opened. Pepsi is using its ambient-temperature distribution system to get the product out into every retail and foodservice sales venue possible.

More vending

Vending machine milk sales have been tested, prodded and documented by the industry and by Dairy Foods, and vending remains an important part of the picture when discussing where milk sales are at and where they could be headed."In their annual survey, VMC (Vending Management Consulting) found that milk sales have been very strong," IDFA's Nagle says. "Milk is one of the star performers in vending right now."

This is another area where Bravo's Warren sees plenty of opportunity too. He says that as the soft drink industry has moved toward the 20 oz. plastic bottle as the preferred vending package, there is a surplus of machines designed for a 12 oz can.

"Coca-Cola Enterprises has tons of these machines," he says. "We have developed a 10-ounce plastic bottle for our Slammers products that has the same dimensions as the 12 ounce can. We are going to stick that in the schools."

Vending, packaging, branding, marketing and distribution are all issues related to how milk is presented to the consumer. And they are puzzle pieces that have been given loads of attention in the last 10 or 15 years after having been neglected for so long. But products like MooTopia go beyond this consideration to focus on the essential product itself.

Another example of this is milk containing Omega-3. In 2004, Nielson Dairy, Ontario, introduced an Omega-3-rich milk which was produced at the farm level through the use of a specially-fortified feed.

The MEG-3 brand was designed to tell consumers the food or supplement brand they are purchasing contains the trusted source of fish oil. MEG-3, with its fish-shaped logo, is featured prominently on OMU milk packaging and throughout its consumer advertising. The ad campaign for the rollout features a digitally animated MEG-3 fish in a video commercial playing in cinemas across Hong Kong.

As was noted at the outset, the notion of reformulating milk is not brand new, and the very idea carries with it some negative connotations for much of the dairy industry establishment, which has for years contended that the product is as close as you get to a perfect food. But that hasn't kept some players from trying to improve what's in the bottle.

"MooTopia is real milk, only better," says Bob McCullough, H-E-B's group v.p. of manufacturing, reiterating a slogan that's on the label.

Much like the way organic milk is viewed as a threat to milk's overall image, reformulated milk seems to be eliciting the same reaction in some quadrants. Certainly, no one is saying that these products alone will solve milk's conundrum. Those intimately involved with the multi-fronted effort to promote milk sales, like Nagle, say there are a number of things that can, (and given more time will), stem the tide of declining consumption. He points to the two-year-old weight loss campaigns.

"We have a lot of numbers now on the impact of the weight loss program," Nagle says. "If you take a look at all the products with lower fat levels and compare that to the whole milk products you see a dramatic trend. All the lower fat levels are tracing upward and whole is tracing down.

"We think this is in part a response to those consumers who have concerns about obesity, and now know that they can have some success in weight control without giving up dairy products," he said.

In 2006 those efforts will continue with an emphasis on real-life success stories, he says.

The overwhelming success of food service initiatives will continue as well in 2006, says Tom Gallagher CEO of Dairy Management, Inc. And Gallagher thinks continued growth in the fast food channel and in schools can and will lead to overall milk sales growth.

"I am a strong proponent of the position that fluid milk sales will not only stop shrinking, but will have an increase in per-capita consumption in a few years," he says.

Gallagher believes getting single serve resealable bottles in both schools and food service is key to keeping the attention of milk's younger consumers as they become adults.

At times Gallagher clearly expresses frustration with the processing industry's cautious approach to converting school milk from paperboard to plastic bottles, an action which he sees as the obvious next step in the effort to halt declines in consumption.

"In the last 10 years you have seen about $2 billon worth of TV advertising through Got Milk and it was great stuff, but it is not the answer. Yes, white gallons and half gallons are the core and probably will be forever, but you keep young consumers longer and ultimately that will translate into adult growth."

Formulating Beneficial Beverages

When it comes to formulating beverages for today's consumers, it can all be summed up with one word: benefit. Cola, uncola™, juice, milk and even water are so yesterday. Formulators need to view these beverages as today's beverage base. It's the value-added ingredients going into these bases that render them current and futuristic. Chocolate, coffee, pomegranate and whey are likely the four most popular value-added beverage ingredients. You may be saying that coffee is already a beverage. And you are correct. However, coffee extract and concentrate are ingredients, and they are being used quite innovatively these days.As reported in U.S. News & World Report (Dec. 18, 2005), coffee is "the next great health food." The headline reads: Enjoy! You thought coffee was bad for you? Actually, it seems to protect against all sorts of ills, from diabetes to liver cancer. Another excerpt reads: It turns out that a cup of Joe-or carafe-may chase away the blues; turn you into a better athlete; and protect against diabetes, Parkinson's disease, gallstones and some cancers.

The antioxidants in coffee were given the recognition they deserve, too. "Coffee is rich in antioxidants-substances in vegetables and fruits that deactivate disease-causing byproducts of the body's metabolism." The piece goes on to cite the work of Joe Vinson of the University of Scranton, who recently determined that coffee is the leading source of antioxidants in the U.S. diet-accounting for 60% of the antioxidants Americans typically take in each day. The article notes that it's not just because Americans drink a lot of coffee, but that Vinson's tests found that coffee led the list of foods in antioxidant density, with only chocolate, dried fruits and dried beans ranking higher.

It was likely foresight into coffee becoming the next Fountain of Youth that had scientists at Caffe Del Mar, Solana Beach, Calif., in the lab for almost two years. The resulting coffee drink is in step with today's consumer trends: energy, health and wellness.

"Frappio™ is the most technologically advanced energy beverage to date," says Irene Adams, marketing director. "In addition to increased physical and mental performance, it may be the best-tasting canned or bottled coffee beverage on the market."

High energy, clear thinking, appetite suppression and stress reduction are some of the benefits that consumers will experience with this next generation espresso latte energy beverage. According to the company, Frappio bridges the gap between Starbucks™ coffee products and the extensive field of energy drinks dominated by Red Bull™. With the introduction of Frappio, the company believes it will be initiating the genesis of a coffee/energy category that could grow to 50% of the combined energy and coffee segments.

Atlanta-based Coca-Cola Co., is planning to launch two separate coffee drinks in a bid to extend its portfolio in areas away from carbonated drinks. The first, Coca-Cola Blak, has already entered the French marketplace. Coffee is its value-added ingredient. In addition, the company is working with chocolate maker Godiva Chocolatier Inc., New York, on a ready-to-drink coffee to be launched in the spring.

In 2006 there will likely be a surge of beverages made with pomegranate juice. With an extremely high level of polyphenol antioxidants, pomegranate juice can benefit the heart, as it has been shown to prevent the formation of plaque-forming, oxidized, low-density lipoprotein in the arteries. Research further indicates that the high level of antioxidants found in pomegranate juice is effective in combating free radicals that may cause a number of afflictions, including heart disease, stroke, hypertension, premature aging, Alzheimer's disease and even cancer.

Pomegranate juice has become so trendy, it is used as a mixer at bars and nightclubs. Recently, Lifeway Foods Inc., Morton Grove, Ill., added Lowfat Pomegranate Kefir to its cultured dairy beverage line.

Then there is whey. Whey protein contains all of the essential amino acids in the proportions that the body requires for good health. It also provides about 26g per 100g of protein of the branched-chain amino acids (BCAAs) leucine, isoleucine and valine. BCAAs are unique among amino acids in their ability to provide glucose and a readily available energy source during endurance exercise. In addition, preliminary studies show that a certain form of hydrolyzed whey protein may offer advantages in lowering high blood pressure. There are even some suggestions of protection against infections and viruses.

Remember, consumers want benefits. D.B.