Nestl?.A. of Switzerland, the world’s largest food outfit with more than $46 billion in annual sales, and Unilever PLC, of London and Rotterdam, with over $26 billion in annual receipts, now own or are involved with several of the best known brand names in the ice cream aisle—Nestl?H?en-Dazs, Dreyer’s/Edy’s, Good Humor, Breyer’s, Ben & Jerry’s, Godiva and Starbucks.

Both have been buying into the United States for quite awhile, but a planned consummation between Dreyer’s Grand Ice Cream Inc., Oakland, Calif., and Nestl?ould up the stakes of the game. As this article went to press, the multi-million dollar transaction was in doubt. The Federal Trade Commission announced March 4 that it would seek an injunction against the proposed deal. The agency raised concern that the merger would hamper competition and lead to higher ice cream prices.

This came despite the previous day’s news that Dreyer’s and Nestl?ad agreed to sell some assets to Integrated Brands, a unit of CoolBrands International Inc., Markham, Ontario. The deal may or may not be off, but one way or another, the two giants are likely to continue to compete for market share. And what are Nestl?nd Unilever playing for? A look at the most recent product and sales trends shows a category with surprising growth and refreshing innovation.

“Ice cream has a lot of potential,” says Jay Brigham, executive v.p. with a candy and inclusions company in Dallas. “I think if you look at what milk has done with single serve in the c-store market ice cream still has the potential to do something like that.

“It’s a very innovative category, and there’s a lot of opportunity to do things like color changing ingredients, or to try pop-rocks or to develop sugar-free products for instance,” Brigham says.

Ice cream by its very nature is a breeding ground for imaginative flavors and forms. Some of the latest flavor innovations include ethnic flavors, flavors inspired by other desserts, such as crème brulee and root beer floats. Delicate, elaborate inclusions including tiny chocolate shapes filled with flavors are more and more prevalent, and one manufacturer (easy to guess who) has turned the swirl on its head.

Meanwhile, new sweetener options and consumer demand have fueled the introduction of several no-sugar-added products from ice cream makers of all sizes.

Packaging continues to change, too. The move to the squround half-gallon package, and its smaller size continues, and one processor even trumpeted the introduction of the new package with a press release discussing the smaller size.

Ice cream sales are charting a bit differently from a year ago, with the artificially inflated dollar sales coming back closer to reality and a corresponding positive shift in unit sales, even as ingredient prices have remained high.

Have Nestl?nd Unilever launched the Great American Ice Cream Race? Only time will tell. But it’s obvious that the category is sitting pretty.

Rich, indulgent growth?

Two years agoDairy Foods’ description of ice cream sales might have awakened images of the cornfields of Indiana. While perhaps they aren’t completely flat, it’s fair to say that ice cream sales figures are populated by few peaks or valleys.That being said, some interesting sales numbers have emerged in the past couple of years.

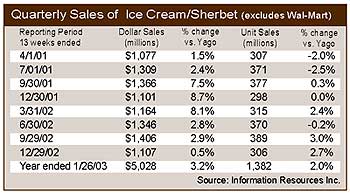

Overall, category sales in 2000 were up 3.5% in terms of dollars and 2.7% by units, compared to 1999, according to Information Resources Inc. A year later, dollar sales were up 4.0% while unit sales dipped 2.1%. That was for the 52-weeks leading up to Dec. 2., 2001, a period that saw a spike in ingredient prices that was ultimately reflected at the grocery checkout.

While these conditions have not completely subsided, dollar sales are climbing at a modest pace and unit sales are once again gaining ground. According to IRI, just over $5 billion worth of ice cream and frozen dairy desserts was sold during the 52 weeks leading up to Jan. 26, 2003. That represents a jump of 3.2%. The 1.4 billion units sold represents a 2% up tick from the previous 52 weeks. Those numbers do not include Wal-Mart sales, and those numbers are strikingly similar to what the category did back in 2000.

A breakdown into category segments shows that novelties continue to perform well—up 7.7% in dollar sales for the year and growing by both measures in each of the last 12 quarters. Surprise, surprise! It seems that the slide in the frozen yogurt category has finally slowed. The double-digit declines of 2000 are a hazy memory, and frozen yogurt actually grew in the third quarter last year before slipping just a bit at the end of the year.

Uhm, that’s good...

Nothing spurs growth like innovation, and for ice cream, that means more than just the never-ending quest for new flavors.This year’s trends represent a continuation of a couple of themes—no sugar added offerings, and ethnic flavors for instance—and the introduction of some new twists like classic desserts from H?en Dazs and simple flavors from Ben & Jerry’s.

“Ice cream flavors are very cyclical,” says Brigham. “Coffee, for instance, seems to be down a little bit right now. I think things geared to kids is a hot trend, co-branding obviously is still hot, and Hispanic and international flavors. And chocolate and caramel are as popular as ever.”

H?en Dazs has introduced a line of Classic Dessert flavors, and an exciting new Hispanic flavor. Desserts Extraordinaire is a line of seven ice cream flavors inspired by the world’s most indulgent desserts. Flavors include: Chocolate Mousse, French Vanilla Mousse, Strawberry Cheesecake, Chocolate Raspberry Torte, Bananas Foster, Cafe Mocha Frappe and Creme Brulee. Desserts Extraordinaire began shipping nationally in January.

Inspired by Latin America’s classic 3-milk soaked Tres Leches Cake, H?en-Dazs has transformed the complex flavors and textures of the dessert into a creamy superpremium ice cream. Bits of lightly rum-soaked sponge cake are combined into rich milk and cream ice cream, then swirled with a delicate ribbon of caramel and a touch of coconut flavor. Tres Leches also began shipping in January.

Marigold Foods, Minneapolis, will run a special rotating line of flavors under the Kemps brand this year.

Flavors from Around the World is a promotional tie-in with Northwestern International Airlines featuring flavors that evoke international vacation destinations. Moon over Maui was rolled out in February, and will be followed by Cancun Caramel and Eiffel Tower Truffle. Each half-gallon package includes a $20 coupon, which customers can collect to receive up to $100 off the price of an international flight.

Ben & Jerry’s, South Burlington, Vt., continues to redefine the boundaries and flavor and form, and has even done something with its recent flavor offerings that seems out of character.

Last year Ben & Jerry’s introduced its Core Concoctions series, which takes the swirl and turns it into a quarter-sized core of rich gooey stuff in the center of the pint.

In December Ben & Jerry’s introduced a line of smooth flavors that help further the company’s social mission.

The For a Change line is made up of Chocolate, Vanilla and Coffee, with no chunky stuff. But these are not ordinary products.

To make their best chocolate, coffee and vanilla ice creams ever, Ben & Jerry’s looked for ingredients that deliver great quality and flavor, and also help return benefits to the farmers who supply them.

Dippin’ Dots, the flash frozen ice cream line made in Paducah, Ky., has recently been expanded to include five new flavors—Mocha Cappuccino, Chocolate Covered Cherry, Tropical Tie Dye, Orange and Vanilla and Blue Bubble Gum.

Wells’ Dairy Inc., Le Mars, Iowa, has teamed up with Blue, the loveable star of the popular Nick Jr.® Blue’s Clues television program. Blue now has her very own ice cream flavor—a yummy blue vanilla ice cream dotted with Blue’s Clues paw print sugar cookies. Packaged in square half-gallon containers, Blue Bunny Blue’s Clues ice cream is available wherever Blue Bunny brand products are sold.

Perry’s Ice Cream, Akron, N.Y. is rolling out Indiscretion Luscious Ice Cream™ with flavors like Spellbound, Hidden Riches, After Dark and Sweet Revenge. The line is geared to grown ups, and particulary to women.

Another flavor trend that has been simmering below the surface (let’s see if it emerges in 2003), is peanut butter.

Mayfield Dairy Farms, Athens, Ga. recently launched its highly anticipated P.B. & Chocolate Crunch Ice Cream. The flavor, part of the Mayfield Select line, features rich chocolate ice cream with swirls of peanut butter and pieces of chocolate-covered waffle cone. Another flavor in Mayfield’s select line is the Hispanic offering Ensalada de Fruta.

Smith Dairy Products, Orville, Ohio plans to roll out a Peanut Butter Cup flavor in the Candy Bar Classic’s™ family of its premium Ruggles® line. The dozen new flavors slated for 2003 will also include Mint Brownie, Chocolate Moose Tracks® and Apple Pie.

HP Hood of Chelsea, Mass., features two peanut butter flavors in its premium Peak Treasures line—Peanut Butter N’ Chip Trails and Chocolate Peanut Butter Avalanche.

...and good for you!

Dairy Foods’ 2002 Ice Cream Outlook pegged no sugar added as an emerging trend, and sure enough, thanks to the availability and acceptance of high-intensity sweeteners like aspartame and sucralose, there are more sugar-free options than ever. That trend has continued into 2003. Most recently Pierre’s French Ice Cream, Cleveland, rolled out Slender, with a name and logo that bring to mind the branded sucralose product Splenda®, which not surprisingly is the sweetener used in Slender.

Pierre’s points out that Slender can be a part of reduced calorie & reduced fat diets and Weight Watchers® programs, and that it is ideal for those concerned about artificial sweeteners, and those who just want to eat healthier. These are the kinds of selling points that are driving the introduction of no sugar added lines as well as other good-for-you products in the frozen dessert category.

- Healthy Choice™, a brand of ConAgra Foods, Omaha, Neb., is introducing a new line of Premium Low Fat Frozen Novelties in select markets featuring five great tasting varieties.

- Unilever N.A. has introduced a new no-sugar-added Slim-a-Bear line of Klondike® brand sandwiches with half the fat, and 25% less calories than the regular products.

- SouthWest Foods, Tyler, Texas has turned heads with its LeCarb line of low-carbohydrate frozen desserts, which have just 6g to 7g of total carbohydrates.

- Wells’ Dairy recently introduced Blue Bunny Sweet Freedom Low Fat/No Sugar Added Ice Cream.

Inside and Out

A typical package of ice cream today is much different from what it was a few years ago, and it’s not just the product, but the package that has changed. The standard quadrilateral package hasn’t gone away, but it’s losing share (as is the round) while the squround and pails and tubs are gaining.Smith Dairy alludes to the these trends in a recent announcement to customers regarding the conversion of its Ruggles line to squrounds.

It also points out that the package represents a new 1.75-quart size rather than a half-gallon.

“Yes we’re taking 8 ounces of product out, but we’re also giving the consumer the type of the container they want,” Bill McCabe v.p. of marketing says in an accompanying press release. McCabe goes on to outline the package’s attractive features including tamper evidence, and higher degree of protection from freezer burn. Smith will also put a greater amount of inclusions and variegates in the ice cream that goes into those new packages.

Smith Dairy is not alone in feeling that it should justify the smaller size of the containers.

“Instead of raising our price, we have chosen to reduce the package size by 8 ounces,” says Scottie Mayfield, pres.

Mayfield pointed to companies like Breyer’s and Dreyer’s Grand Ice Cream who have changed the size of their higher end lines, whether with the squround or with other packaging.

“Breyer’s has chosen to keep their basic line in the traditional size package, and we believe that makes sense,” Mayfield says. “We will follow that same strategy and keep our Classic line in a half gallon.

Sweet Business

The proposed Nestlé buyout of Dreyer's has caused quite a stir on Wall Street, not only because of its impact on the race between Unilever and Nestlé, but also due to the ripple effect it will have on the industry.Until this month, analysts looking at the deal were focused on the distribution of Ben & Jerry’s products. Before the announcement of the Nestlé deal, Ben & Jerry’s was distributed in much of the country through a partnership with Dreyer’s which operates an enviable direct-store-distribution network. But with Nestlé hoping to take a larger interest in Dreyer’s, (Nestlé currently owns a 23%) it appeared Ben & Jerry’s might be off the truck and scrambling to find alternative distribution solutions. (...or perhaps not, see Newsline story p. 11.)

The June announcement of the multi-stage buyout of Dreyer’s included the news that Dreyer’s shareholders would receive the right to sell their stock to the company for $83 per share, beginning in January of 2006, and that there might be a call for redemption for $88 in 2007.

Dreyer’s stock, which had been selling for around $40 a share, immediately jumped to about $70 and kept inching up until the FTC’s announcement which sent it back below $60.

Dreyer’s announced last month that it’s consolidated net sales for 2002 increased 11% to $1.35 billion.

Whether or not it’s related to the competition with Nestlé is hard to say, but Unilever has also made a number of strategic moves in the past year.

In October it was announced that Good Humor-Breyers Ice Cream, Green Bay, Wis., and Ben & Jerry’s had formed a unified out-of-home sales division, named Unilever Ice Cream. The new organization brings together both companies and will represent the five Unilever North American Ice Cream brands, which include Ben & Jerry’s, Breyers, Good Humor, Popsicle and Klondike. The new sales team will focus exclusively on the out-of-home ice cream business and therefore excludes grocery channels.

Last spring Ben & Jerry’s announced plans to shutter its manufacturing facility in Springfield, Vt., and a distribution center in Bellows Falls, Vt., and move those functions to an existing plant at St. Albans, Vt.

Those changes resulted in the net loss of about 75 operations jobs. A couple months later the company announced that it was trimming about 50 jobs at its headquarters in Montpelier, Vt.

On the international front, Nestlé signed an agreement in January with the M¿venpick Group to acquire the M¿venpick brand for ice cream products and related ice cream businesses worldwide with the exception of the New Zealand manufacturing operations.