Juices, teas and coffees challenge milk for that all important “share of stomach.”

eeping an eye on nondairy beverage trends is important for dairy processors because many dairies also bottle juices, teas and coffee-based drinks. According to the Dairy Foods 2014 Beverage Study, 43% of survey respondents process juices, 34% coffee drinks, 27% smoothies, 23% sports drinks, 20% tea and 16% punches. Other dairy processors, like makers of yogurt or ice cream, can use beverage flavor trends to direct the development of new products. Nondairy beverages are competitive products to fluid white and flavored milks. Sales in the juice and drink categories (including refrigerated, frozen and shelf-stable products) totaled about $16.6 billion in the 52 weeks ended Jan. 26, 2014, nearly as large as the $17 billion fluid milk category, according to the market research firm Information Resources Inc., Chicago The total refrigerated juices and drinks category increased 1.7% to $6.6 billion in the period, with unit sales up by 2.5%. While the increase in the juices/drinks category looks slight, keep in mind that orange juice makes up 51% of the category and OJ sales dropped 2.5% to $3.4 billion. Other beverages showing declines include cranberry juice and blends (down 38%), grapefruit juice/cocktail (down 31%) and grape juice (down 25%). On the other hand, juice varieties making sales gains include cranberry cocktail/drink (29%), vegetable juice/cocktail (29%),

eeping an eye on nondairy beverage trends is important for dairy processors because many dairies also bottle juices, teas and coffee-based drinks. According to the Dairy Foods 2014 Beverage Study, 43% of survey respondents process juices, 34% coffee drinks, 27% smoothies, 23% sports drinks, 20% tea and 16% punches. Other dairy processors, like makers of yogurt or ice cream, can use beverage flavor trends to direct the development of new products. Nondairy beverages are competitive products to fluid white and flavored milks. Sales in the juice and drink categories (including refrigerated, frozen and shelf-stable products) totaled about $16.6 billion in the 52 weeks ended Jan. 26, 2014, nearly as large as the $17 billion fluid milk category, according to the market research firm Information Resources Inc., Chicago The total refrigerated juices and drinks category increased 1.7% to $6.6 billion in the period, with unit sales up by 2.5%. While the increase in the juices/drinks category looks slight, keep in mind that orange juice makes up 51% of the category and OJ sales dropped 2.5% to $3.4 billion. Other beverages showing declines include cranberry juice and blends (down 38%), grapefruit juice/cocktail (down 31%) and grape juice (down 25%). On the other hand, juice varieties making sales gains include cranberry cocktail/drink (29%), vegetable juice/cocktail (29%),

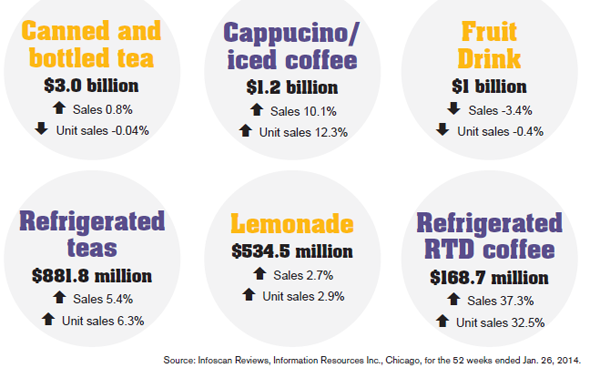

drink smoothies (23%) and blended fruit juice (up 17%). Lemonade showed sales gains of 3% to $534.5 million. Sales of refrigerated teas and ready-to-drink coffee registered impressive gains. Cappuccino/iced coffee sales increased 10% to $1.2 billion and RTD refrigerated coffee sales rose 37% to $168 million. Refrigerated tea sales rose 5.4% to $881 million. Although sales of canned and bottles tea rose just 0.8%, these formats are a $3 billion market.

Brisk, a brand managed by a joint venture between PepsiCo Inc. and Unilever USA, Purchase, N.Y., launched a new half-tea/ half-other product line. The new flavors are iced tea and lemonade, iced tea and cherry limeade, and iced tea and tropical lemonade flavors. The beverages are available in 24-ounce cans and 1-liter bottles for $0.99 and $1.19, respectively.

Brisk, a brand managed by a joint venture between PepsiCo Inc. and Unilever USA, Purchase, N.Y., launched a new half-tea/ half-other product line. The new flavors are iced tea and lemonade, iced tea and cherry limeade, and iced tea and tropical lemonade flavors. The beverages are available in 24-ounce cans and 1-liter bottles for $0.99 and $1.19, respectively.

|

|

|

Get our new eMagazine delivered to your inbox every month.

Stay in the know on the latest dairy industry trends.

SUBSCRIBE TODAYCopyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing