Of course some of the best recent success stories have to do with adding value with convenience forms like shreds and slices, added functional ingredients, or an origin of organic and no-rBST milk.

We’ll look at these trends and others, such as lowfat and probiotic cheeses after we run through some numbers.

Cheese sales

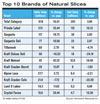

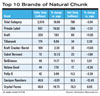

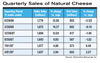

Natural shredded cheese is now the largest cheese natural cheese segment, having surpassed natural chunks. Natural sliced cheese has also been among the fastest growing cheese products in the last couple years. That trend is continuing in 2008.The cheese slice is still the biggest selling form for natural and process cheese combined, but sales of natural slices are growing while sale of processed slices are shrinking.

More than 880 million units of natural shreds were sold in the 52 weeks ended Sept. 7. While that constitutes a slight downturn from the year prior, the natural chunks category has seen more significant slippage, (-3.54%). Shreds and slices are a bit more resilient.

These numbers are according to data from Information Resources Inc., a Chicago-based market research firm through its FDMX measure of food, drugstore, and mass merchandiser retailers. They do not account for Wal-Mart and most club stores, nor do they include convenience channels.

String cheese also continues to grow, at least in terms or dollars, while unit sales of string have flattened.

The Frigo brand from Saputo is the top brand after private label and continues to show strong growth.

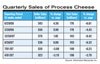

Taking a longer and broader look at cheese, Mintel Research Group, Chicago, completed a study of the cheese category in the spring of 2007. One of the first things Mintel noticed was that natural cheese had surpassed process cheese in the U.S. and the trajectory was expected to continue.

During 2001-06, sales of processed cheese exhibited the steepest sales decline - 9.1% - among all segments. Against the backdrop of increased sales of natural cheese, there has been a shift away from processed cheese and related consumer wariness toward the segment’s reliance on chemical emulsifiers, coupled with limited flavor and texture availability.

The study also noted that Kraft is the clear market leader with over 36% of market share in 2006. Private-label manufacturers accounted for over a third of the total sales in 2006.

Meanwhile, warehouse clubs and supercenters experienced a strong growth of 9%, contributing $146 million to the total sales growth during 2004-06, and reaching a 13.7% market share. In addition to the convenience of one-stop shopping, the mass channel has also benefited from value pricing, especially during the sharp increase of cheese prices in 2004.

Specialty stores, which primarily include the sales from natural grocery stores, exhibited impressive growth of nearly 20% during 2004-06. The natural grocery channel benefited from American consumers’ growing appreciation of organic and natural food.

Squeaky trends

Wisconsin Milk Marketing Board (WMMB), a nonprofit farmer-funded organization, closely monitors food news and trends as part of its cheese marketing efforts, conducting an annual year-end analysis of food trends and their impact on cheese. Americans now consume more than 32.5 lbs of cheese per person and this is projected to grow to 36 lbs by 2016, according to government predictions.“While projected growth in cheese consumption is great news, just as exciting are predictions for a future full of extraordinary original and traditional artisanal cheeses,” says Marilyn Wilkinson, director of product communications for WMMB.

“In many ways, our cheesemakers are rediscovering the past when farmstead operations, pasture grazing and the artistry of aging cheeses were the norm.” In Wisconsin, specialty cheeses continue to claim a larger share of total production each year, now at about 16% of all cheeses made in the state.

American chefs continue to initiate trends with their ever-imaginative quest for new ideas and uses that eventually impact supermarket shoppers and home cooks, WMMB says. Having established cheese courses as a mainstay menu offering in white tablecloth establishments, upscale chefs are now pushing the limits with new cheese accompaniments. Watch for nut and seed brittles, chutneys spiced with other au courant flavors such as cardamom, pomegranate and quince and beverages that deviate from the standard wine and beer offerings. Sparkling cider, tea and coffee-all are great cheese accompaniments. And so are spirits.

What's new in the case

Home cooks will note cheese-worthy happenings at their foodshopping retailers as well. Hispanic cheeses, reflecting growth in the general population and a broad desire for Mexican/Latin cuisines, continue to surge, increasing 25% in dollar volume in the first quarter of 2007 compared to 2006, according to a report from the International Dairy Foods Association.Adding to the sales is an expanded selection. In addition to Queso Blanco and Fresco, Wisconsin makes Asadero, Cotija, Queso Quesadilla and Queso Oaxaca, everything from crumbly accent varieties to sumptuous melting and filling cheeses.

Elegant, upscale cheese shops are opening around the country and to be competitive, supermarkets are going more upscale, too, developing in-store cheese centers that feature more specialty and artisanal selections, more cheese sampling, more cut-to-order options and better trained staff who can provide tips on serving, entertaining, pairing and storing. Cheese centers will be stocked with compatible foods and beverages, making them akin to a cheese boutique within the store.

Weight Watchers and Schreiber Food are working together to change the perception of reduced-fat cheese through a new partnership. The two companies now offer six natural and process cheese products under the Weight Watchers label.

The line includes a first of its kind to the U.S. market: Reduced Fat Shredded Cheddar Cheese in single-serve packets. This 33% less fat Cheddar retails as a package containing six 1-oz individual packets. The unique packaging of New York-based Soignon’s new Crumbled Goat Cheese just won the gold medal at the 2008 World Championship Cheese Contest. The resealable pouch sits upright on shelves, and the bright, attractive label stands out from the crowd in the dairy aisle. Weighing only 5g, the pouch uses just a tiny fraction of the petroleum consumed in manufacturing and shipping most other cheese tubs, which weigh an average of 28g. The fresh crumbles of unripened goat cheese have a light, refreshing goat milk flavor and a soft texture that melts in the mouth.

Tillamook has revved up its shredded cheese line with five new flavors: Classic Cheddar; Mexican ; two new Italian blends, (one with mozzarella and Parmesan, and another with smoked Provolone added to the mix of mozzarella and Parmesan); and last, but not less flavorful, shredded Colby Jack.

Sartori Foods Corp., Plymouth, Wis., recently rolled out Sartori Reserve premium brand SarVecchio Parmesan, SarVecchio Asiago, Dolcina Gorgonzola and Bellavitano.

These four sophisticated cheeses have been praised for their balance, texture and complex flavors.

Bellavitano was named the Best Uniquely American Cheese earlier this year in the American Cheesemaker Awards competition. In fact, each cheese in this new Sartori Reserve premium cheese line has been recognized with numerous awards and accolades in cheese competitions.

New from Lactalis

Sorrento Lactalis, Buffalo, N.Y., recently introduced Fresh Moz-zarella Cheese varieties in convenient sizes and packaging. Sold under the Precious and Sorrento brand names in West and East coast markets, respectively, the new Fresh Mozzarella Cheese varieties are available in a 12-ounce vacuum-sealed log and 8-ounce Ciliengini in water. The company also introduces Omega-3 +Plus snack string cheese. The new snacking cheese is made with milk containing docosahexaenoic acid (DHA) plus eicosapentaenoic acid (EPA) omega-3 fatty acids.Fast Facts

- Nearly one in two consumers report using chunk and pre-shredded cheese.

- Among forms of cheese, one of the biggest stories is string cheese, which is benefiting from its position as a snack food, propelled by single-serve packaging and its popularity among children.

- Individually wrapped slices are the most popular form for American cheese, as around 74% of respondents report using it. Among respondents from all ethnicities, Hispanics exhibit the lowest incidence of using individually wrapped slices but the highest incidence of using chunk/loaf/block/wedge form.

- Over half of consumers are likely to use only one brand of American/processed cheese.

- Black and Hispanic consumers are heavier consumers of American/processed cheese, than white consumers.

Links

- State of the Industry 2008: Ice Cream--Sweet Success

- State of the Industry 2008: Yogurt Still the Bright Spot

- State of the Industry 2008: Butter--Spreading What's New

- State of the Industry 2008: Changes in the Big Beverage Market

- State of the Industry 2008: Ingredients--Pricey Necessities

- State of the Industry 2008: Introduction

- State of the Industry 2008: Milk--Ups and Dows

- Tetra Pak