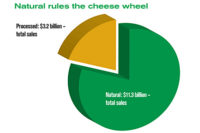

As we wrote about in our State of the Industry report last month, consumers love their cheese and are eating more of it, but prefer all-natural varieties. And convenience and portion control are driving innovation. Sales numbers are up almost across the board in the natural cheese category, while processed cheese sees promise in the cheese spreads segment, where sales have ticked up.

In the natural cheese category, dollar sales rose 0.7% to $12.8 billion and unit sales increased 4.5% to 3.8 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Oct. 2, 2016. In the processed cheese category, dollar sales dropped 4.9% to $2.9 billion and unit sales were down 6.1% to 782.6 million.

The natural cheese category includes these segments:

- Shredded cheese ($4.7 billion, units up 6%)

- Chunks ($3.6 billion, units up 1% )

- Slices ($2.1 billion, units up 9.1%)

- String/Stick ($1.2 billion, units up 2.3% )

The processed cheese category includes these segments:

- Imitation cheese-slices ($1.7 billion, units down 7% )

- Cheese spreads/balls ($503.9 million, units up 3.1%)

- Imitation cheese-loaf ($423.3 million, units up 0.3%)

- Imitation cheese-shredded ($40.2 million, units down 57.5%)

Natural cheese wins

The natural cheese shredded segment leads the category with $4.7 billion sales. Dollar sales were up 0.3%, while unit sales increased 6% to 1.5 billion. Among the top 10 brands, private label dominated with $2.7 billion sales. Dollar sales were up 0.9% and unit sales increased 7.1%. Kraft (Kraft Heinz) came in second with $858.6 million. Dollar sales dropped 0.9%, but unit sales were up 4.2%. Crystal Farms and Kraft’s Philadelphia brand both struggled — dollar sales fell 6.6% and 13.2%, respectively, and units dropped 1.9% and 4.8%, respectively. On the flip side, Kraft’s Velveeta shreds saw impressive numbers — dollar sales jumped 350.2% and unit sales skyrocketed 468.5%. Tillamook and Belgioioso both saw increases, with dollar sales up 8.8% and 21.4%, respectively, and unit sales improving 10.4% and 25.8%, respectively.

In the natural cheese slices segment, dollar sales improved 4.2% to $2.1 billion and unit sales jumped 9.1% to 666.4 million. The numbers looked good for most brands in the top 10, including Sargento, which saw dollar sales climb 3.7% to $568 million and unit sales rise 6.3%. Kraft struggled with dollar sales down 9.1% and units dropping 8.9%. Meanwhile Kraft’s Cracker Barrel brand saw increases — dollar sales jumped 32.6% and units increased 26.5%. Tillamook’s dollar and unit sales improved 3% and 4.4%, respectively. Also showing promise was Belgioioso; dollar sales jumped 30% and unit sales rose 33.6%. Crystal Farms saw its dollar sales improve 12.8% and its unit sales increase 14.2%. Boars Heads’ dollar and unit sales jumped 24.6% and 25.2%, respectively.

In the natural cheese string/stick segment, dollar sales rose 2.7% to $1.2 billion and unit sales were up 2.3% to 415.3 million. Among the top 10, some brands soared and other struggled. Frigo Cheese Heads (Saputo Cheese USA) saw dollar sales go up 4.3%, but unit sales fell 0.4%. Dollar sales for Sargento increased 4.5%, while unit sales jumped 14.5%. Kraft’s dollar sales were up 13.8% and unit sales increased 42.2%. Galbani (Lactalis American Group) showed skyrocketing dollar and unit sales, up 239.4% and 254%, respectively. Dollar sales fell 27.4% for Polly-O (Kraft Heinz), and units decreased 69.7%.

Processed cheese hangs on

Most of the segments in the processed cheese category struggled, but there was one beacon of light. The cheese spreads/balls segment showed dollar sales improving 4.7% to $503.9 million, and unit sales ticking up 3.1% to 125.5 million. The Laughing Cow (Bel Brands USA) dominated the segment with $111.3 million. Dollar sales were up 7% and unit sales got a 5.4% boost. Coming up behind that was Kaukauna (another brand of Bel) — dollar sales fell 0.1%, but units increased 1.2%. Dollar sales for Palmetto Cheese (Get Carried Away) climbed 41.2%, while unit sales jumped 37.1%.