There’s good news to be found in the most recent sales data for yogurt, ice cream, and natural cheese. For milk, however, the glass is still half empty.

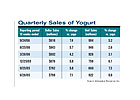

Beginning with yogurt, quarterly sales numbers from Information Resources Inc., indicate that sales in the category have picked up steam again. While overall sales of yogurt (all forms) have been strong for years, there were some signs that the category might be ready to plateau. Quarterly sales growth dropped below 5% in the early part of the year. But in the quarter ended September 24, yogurt’s dollar sales grew more than 7%, and unit sales were up more than 5%. Dollar sales have quickened in each of the last three quarters. Interestingly, yogurt drink sales were actually down ever so slightly in the third quarter. These numbers are for food, drugstore and mass merchandiser sales excluding Wal-Mart.

Overall, natural cheese sales have been strong in the last two quarters, after showing some weakness in the second half of 2005 and in the first period this year.

Looking at the various forms, crumbled cheese is growing swiftly, although it’s still relatively small. Natural slices have been moving nicely-double digits in the last two quarters.

Finally, looking at dairy’s largest segment, unit sales of milk have been down anywhere from 2% to 5% in most of the last six quarters. If there is any good news to be found, it might be that unit sales slipped less than 1% in the most recent period. It’s important to keep in mind too, that some of the most active channels for milk sales are not represented in the IRI numbers.

USDA numbers show that overall milk sales were up 1.2% in the first half of 2006 compared to the first half of 2005. Also, USDA now reports sales numbers of organic whole and reduced fat milk. Comparable figures should be available in 2007.