The culprit is the ever-increasing variety of beverage choices in the market. With 30 different kinds of drinks in the cooler in front of him instead of say, three, Mr. Milk Drinker has gotten flighty and chosen beverages other than milk.

There has been, and still is a good deal of truth in that explanation. And just as milk has begun to reinvent itself, and is now at least a major component of say six or seven of those 30 choices, many consumers are coming to the beverage aisle with a brand new set of nutritional concerns.

Welcome to 2004! There's a helluva ride ahead for milk and other dairy beverages.

The dairy industry has made strides in recent years by offering better flavor, more flavors, improved packaging, and even shelf stability-by making milk fun. But when the industry began to take these steps some 10 or 12 years ago, no one could have anticipated that epidemic obesity, and low-carbohydrate diets would one day be getting so much attention.

Most recently, low-carb dairy beverages, which are essentially milk with less lactose and more protein, have joined the other designer milk offerings that include lactose-free and reduced lactose milks, fortified milks, milks formulated for specific demographics, and even a milk with soy protein added.

Some industry experts say a preference for low-carbohydrate food and beverages is already having an impact on milk sales. Others say the hurdles and opportunities that dairy processors are facing have changed little in the last five or 10 years. Either way, the industry has its work cut out for it.

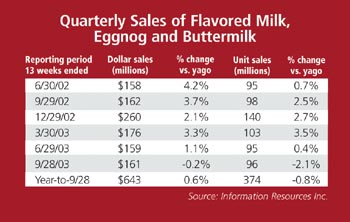

But before we explore these ideas let's look at the most recent sales numbers.

By the numbers

Overall milk sales actually increased by a fraction of a percent in 2002-IDFA' Dairy Facts pegs it at 0.5%, while Beverage Marketing Corp.'s Milk and Dairy Alternative Beverages in the U.S. report goes with 0.3%. But a look at recent figures from Information Resources Inc., show that overall milk sales might have slowed significantly in 2003. IRI showed volume declines for each of the first three quarters of 2003, with a year-to date drop of 1.6%.While overall sales may have showed some growth, per-capita sales continue to dog the industry. That number was down to 22.4 lbs in 2002 from 22.5 lbs in 2001.

But per-capita consumption numbers for teens may give milk marketers hope. In 2001, teen per-capita consumption was up for the first time in six years. It climbed to 22 gals-nearly a 3% increase. In 2002 per-capita consumption among teens was up another 6.8%.

The industry is particularly excited about this, because it may be the result of concerted efforts, says Tom Nagle, v.p. of marketing at the International Dairy Foods Assn.

"Over the last several years we have reduced the number of targets and goals to provide an adequate number of dollars over a smaller number of tasks.," Nagle says of the industry's generic marketing efforts. "We agreed to restrict our efforts to kids, teens and moms and adult women."

In these three areas there have been good results. The biggest increase in consumption right now is for toddlers, and Nagle says that is directly related to the mom focus. In two of the last three years consumption among kids is up, and teens have drunk more milk two years in a row.

"Those targets were selected based on a variety of criteria, and part of it is that these are already strong areas, and they offer long-term value. If we can keep consumption in those groups at higher levels, we really expect some follow-through for a whole life cycle."

- With growth slowing in the past few years, the compound annual growth rate is now at -0.2% for the five years leading up to 2002, according to Beverage Marketing.

- Vending sales actually decreased in 2001 and 2002. Explanation? Antiquated vending machines offering milk in gabletop cartons are being removed more quickly than modern machines are being added.

- Per-capita volume consumption from vending machines has actually increased however, as larger units are now being offered.

- Lactose-free milk grew by a remarkable 17% in 2002 as lactose-reduced and acidophilus milk lost share of this specialty segment.

- Most other beverages categories also performed sluggishly in 2002 and 2003, with bottled water being the exception. Bottled water mustered double-digit dollar sales growth in all but one of six recent quarters according to IRI.

"Overall sales have been coming down the last part of 2002 and the first part of last year," he says. "We feel this is due in part to price changes. We've seen some increases in the last few months and we are seeing that reflected in sales."

Although the industry has put a lot of money into marketing, it is still dwarfed by the efforts of other beverage segments.

"Milk has a limited and declining share of voice. We used to make up about 14% of the advertising dollars spent on marketing beverages, but it has gone down to 8%," Nagle says. "Milk spending hasn't changed, while juice, soft drinks, and bottled water are spending more."

Redefining milk

You can't talk about milk sales trends without talking about how milk has been reinvented and redefined for the consumer. And in the last year or two those changes have taken on new dimensions.Exhibit 1: Early in 2003 Dr. Pepper introduced its Raging Cow dairy-based beverage with a press release that claimed the company was bringing some excitement to the "boring" world of milk. A bit presumptuous, yes, but the very idea of a soft drink company taking on flavored milk shows that milk is no longer just a commodity. Even the competition agrees.

Exhibit 2: Also in 2003, two dairies introduced products that are essentially low-carb milk. Sold in milk-ish packaging in the dairy case, everyone but the government will call this stuff milk.

While flavored milk is included in most sales trend reports (including those cited in this article), things like Raging Cow, coffee drinks, and other dairy based beverages are not included.

"I think we might need to re-evaluate how we measure fluid milk sales," says Joe O'Donnell, executive dir. of the California Dairy Research Foundation. "I would imagine that if we are not looking at those sales as milk then we are missing something."

While they aren't considered statistically, they have to at least be considered in an analysis, O'Donnell says, and even in terms of product development.

"If you look at the way any food company operates, they will constantly be looking to cost-reduce the formula," O'Donnell says. "So if you look at these beverages you are going to see an evolution to more dairy by-products like whey protein and buttermilk solids being used. They are going to formulate to get the best results at the lowest price.

"This is an age of ingredients and reformulation, and that whole drive will cause us to rethink what we classify as milk products."

Some of that is already happening, but there is potential for more, says Market Analyst Jerry Dryer.

"I think the opportunity is there in terms of us developing some nice, high-end products using liquid milk protein concentrate for nutritional supplements like the Ensure beverages, and for making traditional milk products better too. In effect you can fortify milk with a liquid milk protein concentrate so that you have higher protein and maybe less lactose."

One company that has been successful at reinventing and repositioning milk is HP Hood, Chelsea, Mass.

One of the oldest and most well-know processors in the industry, HP Hood doesn't rest on its laurels. In 1999 Hood introduced Simply Smart, a line of reduced-fat milks formulated to taste ... well, less like reduced fat milk. Hood also manufactures and distributes the No. 1 national brand of milk, Lactaid, under a license from McNeil Consumer Healthcare. More recently, Hood has introduced a Lactaid branded product that is fortified with Soy Protein. Late last year it rolled out nationally a line of Hood branded products called Carb Countdown that is aimed at low-carb dieters. Carb Countdown competes with the Le Carb drink line introduced last year by SouthWest Foods, Tyler Texas. Both are essentially milk with less lactose and more milk solids.

In these examples, processors are adding value to what has traditionally been the commodity side of the business-that is, white and chocolate milk sold in multi-serve packages for in-home consumption.

John Kaneb, president of HP Hood says he sees the industry putting more focus on making fundamental changes in and adding value to these kinds of products.

"What you are talking about is using raw cows milk in more imaginative ways, " Kaneb says. "I have a very strong feeling that it's going to be a lot more important than it has been. It certainly is very, very much a primary focus of this company."

Dryer says fortifying beverages with the right kinds of dairy ingredients could be a key to helping sell more milk in the form of nutritious dairy beverages. But he also says he's having second thoughts about soft drink companies helping the cause of dairy, even if they invent products that are largely made with milk.

"I think the downside is the soft drink guys getting into the business," he says. "They are selling milk and sugar now instead of water and sugar, and I think some of those products could give us a black eye."

Thinking outside the home

It's been more than a year since the Los Angeles Unified School District voted to ban on-campus sale of carbonate soft drinks during school hours. A number of schools across the country have since taken the same bold step. With the new vending options now available to dairy processors, this is yet another opportunity for processors to expand their business in an arena where milk has not traditionally sold well-out-of-home, immediate consumption sales.Compared to the supermarket dairy case, this is an area where the industry has already introduced a lot of innovations. Going back to the invention of the Chug, new flavors, better labels, and new bottle shapes have flowed continuously for more than a decade. Single-serve milk can now be sold in attractive packaging from eye catching, high tech vending machines. Single serve aseptic packaging options include HDPE bottles, as well as the traditional brick and the flashier Prisma. National brands of chocolate milk are offered in more convenience stores, drug stores and foodservice locations than ever before.

When you talk about single-serve/immediate consumption, much of what you are talking about is flavored milk. Industry groups have worked hard to promote the residual nutritional value in the flavored milk while downplaying concerns about excessive sugar or artificial colors. Of course some processors have introduced products without artificial colors and excessive sugar. Some products targeted to kids are fortified with vitamins and made with less sugar or with other sweeteners. But recently, ordinary flavored milk, sugar and all, received a healthy dose of positive p.r.

A study published last month in the Journal of Adolescent Health, and funded by the Northeast Dairy Foods Research Center concluded that consumption of sweetened dairy foods and beverages and presweetened cereals has a positive impact on the diet quality of U.S. children and adolescents, whereas sugar-sweetened beverages, sugars and sweets, and sweetened grains had a negative impact on their diet quality. At the same time, the American Academy of Pediatrics published a policy statement recommending that pediatricians work to eliminate sweetened drinks in schools and encourage alternatives offerings including low-fat white or flavored milk.

If all the efforts of the industry and individual processors in the flavored milk/single-serve/out of home arena have not yet paid full dividends it's pretty likely that it will in the near future. IDFA's Nagle says flavored single-serve milk will continue to grow from these efforts.

"With all the different approaches that are being taken, if each one adds just a little it will eventually result in a 1% increase in the (compound annual growth rate), and for milk, that would be pretty substantial," he says.

Most sources say flavored milk now accounts for 7.4% of all milk sold. Throw in value-added milk, specialty dairy products, and dairy based beverages and that number could be close to 10%. And it may be higher than that in a couple of years.

So, that question arises: will value-added products ever become big enough to float the entire milk beverage category into positive sales growth?

"We certainly believe the answer is yes," Nagle says. "For several years in a row, flavored milk has been disproportionately responsible for milk's growth. For the two years prior to 2003, the flavored milk was 30-40% of the total category growth."

But because ordinary white milk still makes up more than 92% of milk sold, some are skeptical about how large a role value-added products can ultimately play.

"The move over the past five to 10 years to single-serve certainly has been a big boost to the industry perhaps more in terms of profits than in terms of total gallons," says Stanley Bennett, president of Oakhurst Dairy, Portland, Maine. "Certainly it helps, but, it will not float the whole category."

Good products and good service

On a fundamental level, what makes any company successful in any industry is good product and good service. The dairy industry has evolved into an industry that can provide both of these from vastly different types of organizations to vastly different types of customers.Hood, and a couple other national companies, have built national sales and distribution networks that allows them to sell milk to huge national retailers. Oakhurst, on the other hand, has grown its milk business by serving a local customer base in Maine, by being local.

"Out of necessity we emphasize those things where we can distinguish ourselves. We are in fact a local family-run business and our milk comes from local dairy farmers," Bennett says. "We also have given 10% of all pre-tax profits to organizations protecting the environment throughout northern New England."

Bennett says the company also lives up to its often used slogan: "Oakhurst is preferred because there is a difference in milk."

Oakhurst was in the spotlight last year when it was sued by Monsanto over its no-rBGH label claim. It settled the suit by agreeing to adjust its claim. But quality goes beyond the hormone issue, Bennett says.

"We've never looked at milk as a commodity. Our milk tastes better, has a longer shelf life and has fewer off flavors, than most."

Back to the large end of the spectrum, Dean Foods, Dallas, recently increased its investment in the organic milk market by completing a full acquisition of Horizon Organic, a company it has owned a stake in for several years.

Meanwhile generic marketing efforts continue to promote milk across the board. There's no doubt that programs like gotMilk? and Milk Moustache have helped improve milk's image, but some have said the programs need to evolve into something that talks more specifically about milk's virtues.

Anecdotes of processors offering home delivery, organic milk, stronger brands, more marketing, and better packaging show that milk has come a long way and has a lot of potential. And most in the industry say all the efforts to increase milk sales will eventually show a result. Beverage Marketing predicts very slow growth over the next five years.

"Just as milk's decline has been slow over a long period,

its rejuvenation may be similar" says Clay Boatright v.p.,

of trade marketing with the Dean's Dairy Group. "I think flavored and value-added items will continue to grow. Meanwhile, helping consumers remember that milk is one of nature's healthiest building blocks should help revitalize traditional white milk."

Sidebar: New Milk-type Beverages A-Plenty

By Donna Berry, Product Development EditorInnovative beverages based on milk-fluid or dry-are hitting dairy cases and beverage aisles at full force. Consumers know drinking milk is healthful, but with the great new flavors, energy formulations and convenient packaging on the market today, it is also cool. Indeed, more and more people are turning to single-serve milk-based beverages to quench their thirst, and meet their daily requirement for essential nutrients.

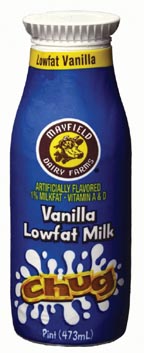

More traditional flavored milk innovations include Mayfield Vanilla Lowfat Milk, a 1% milk beverage available in pint-sized Chugs, which are handy carry-along containers, and in half-pint cartons that are ideal for schools.

"Vanilla milk is the fastest-growing flavored milk in the United States, and a close second to chocolate milk in popularity," says Scottie Mayfield, president of Athens, Tenn.-based Mayfield Dairy Farms, a Dean Foods Co., Dallas. "The dairy industry is doing everything we can to help children and adults get the calcium they need-including introducing appealing new beverages like vanilla milk."

Other flavor innovations include Hershey's York Mint Chocolate Milkshake from Dean Foods and Nesquik Ready-to-Drink Milkshakes in chocolate and strawberry flavors from Nestlé USA, Glendale, Calif.

To compete with the increasingly popular energy drinks in today's marketplace, a favorite among teens and college students, Hyper Cow Inc., St. Paul, Minn., debuted a three-flavor line of 1% milk enhanced with caffeine. The drinks have as much caffeine as a can of cola.

Finally, it's just a matter of time before a dairy-based beverage is formulated to contain phytosterols, which, when part of a diet low in saturated fat and cholesterol, may help reduce the risk of heart disease by lowering cholesterol levels. For now, the closest thing to a cows milk-based beverage is Rice Dream Heart Wise drink from The Hain Celestial Group, Melville, N.Y. Rice Dream Heart Wise drink is a lactose-free and dairy-free beverage that contains the same amount of calcium as whole milk along with phytosterols. It is the first rice beverage to carry the FDA's approved heart health claim for phytosterols on its label.

response, Tropicana Products Inc., Bradenton, Fla., a PepsiCo Inc., Purchase, N.Y., recently debuted Healthy Heart Orange Juice, which contains vitamins B6, B12, C and E, along with potassium and folate, vitamins and minerals also proven to positively effect risk factors for cardiovascular disease.

How are you going to respond to these innovations? Get busy!

Sidebar: Reaching Kids Creatively

By Donna Berry, Product Development EditorWhen it comes to feeding school children, the greatest problem is getting kids to make the most nutritious choices. When it comes to beverage offerings, some schools are finally making moves to get soda out. Unfortunately, the replacement drinks are often not much better, as sports drinks and flavored beverages are taking their place. These beverages may sound healthier, but when you compare Nutrition Facts labels, there is little difference.

ESE Dairies, a subsidiary of East Side Entrees, Woodbury, N.Y., is helping schools help kids make healthier beverage purchases. Since the beginning of the current school year, the company has been marketing a range of aseptic milks and milkshakes that sport Nickelodeon® characters such as SpongeBob SquarePants®, Jimmy Neutron® and The Wild Thornberrys®.

East Side Entrees specializes in marketing and distributing nutritious, student-friendly food products to more than 3,000 school districts nationwide. Through a contract with USDA to use surplus nonfat dry milk, the company is able to make its products affordable for school lunch programs, according to East Side Entrees' CEO Gary Davis.

The 1% milk line includes plain, chocolate, strawberry and vanilla flavors, with one serving containing 25% more calcium and protein than regular low-fat milk. "The milkshakes are made with 2% milk and contain even more added milk solids," says Davis. "The milk solids result in a milkshake with 50% more calcium and protein than regular 2% milk, without extra fat. The solids also create a milkshake-like froth when shaken." All products are made with Grade A milk and sport the Real Seal®.

"We ask the local dairy that provide refrigerated milk to the schools to be our distributor," says Davis. "See, we are not trying to come in and replace refrigerated milk, we simply want to increase consumption at times when refrigerated milk is not always available, like on fieldtrips and after school programs."

The beverages can be stored up to six months without refrigeration. For schools, this translates into improved food safety due to less spoilage, and convenience.

The milks and milkshakes are also being sold through a specially designed vending machine by The Vendo Co., Fresno, Calif., which can vend aseptic boxes and Tetra Pak Prisma® cartons.

"The initial reason for developing the machine was because so many healthful beverages are available in aseptic cartons," says Susan Freuler, marketing mgr., at Vendo. "The machine debuted just in time for the current school year and has been well received, particularly in California schools, which have been the most active in removing soda machines."

Davis adds, "Currently we are selling about 3% of our milk through Vendo's machines, and expect this to grow as more schools catch on."