No such concerns for makers of natural cheese-that is, if they can get the milk.

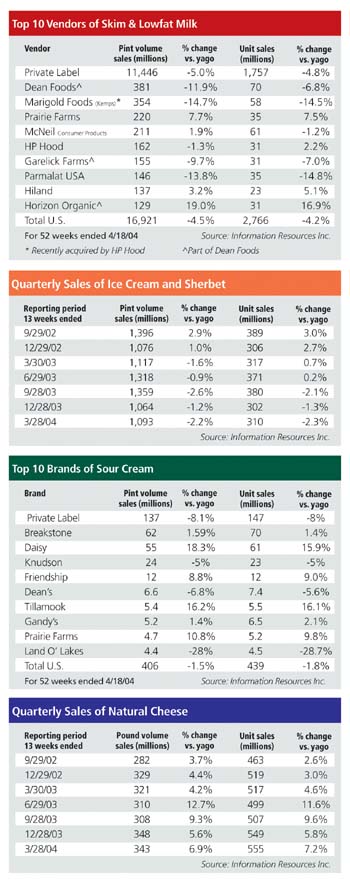

Measured by volume or by unit, natural cheese sales have grown by more than 5% in each of the past four quarters. More than a billion pounds were sold in those same three periods.

IRI's figures represent food, drug, and warehouse club stores but do not include Wal-Mart or convenience stores.

But while cheese sales are on cruise control, milk sales continue to slip. A look at the top 10 vendors of skim and lowfat milk indicates that most of the top companies have lost some volume again from last year. Total U.S. sales were off by more than 4% for the 52 weeks leading up to April 18. The exceptions are in the organic offerings, and in some of the cooperatives. Hard to say, but that might be an early indication of a predicted consumer pattern-as the average price of milk goes up, many consumers turn to lower-priced brands. But private label milk is off just as much as the big brands. It's worth noting that the Marigold business will soon be part of HP Hood's growing portfolio.

Finally, we look at the top 10 brands of sour cream, and, well, go figure! Some brands are taking off like gangbusters and some are sinking out of the picture. Overall sales were down, but by less than 2%.

Daisy, Tillamook, and Prairie Farms enjoyed double-digit growth for the period.