Home » Keywords: » cheese sales data

Items Tagged with 'cheese sales data'

ARTICLES

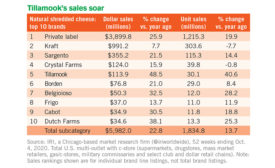

Cheese sales explode in retail channels

Both the natural and processed cheese categories saw double-digit dollar sales gains.

November 16, 2020

Convenient cheese formats rule

Cheese processors also will find growth opportunity in snackable options and adventurous flavors.

May 11, 2020

Natural cheese continue to climb

In the ongoing battle for sales, natural cheese continues to outshine processed cheese

December 5, 2019

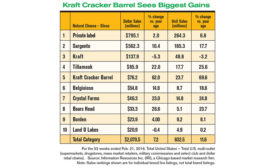

Sales of cheese slices, strings outpace other forms

Consumer preference for natural cheeses in slices and strings/sticks rise, but shredded cheese is the overall category leader.

April 11, 2016

Get our new eMagazine delivered to your inbox every month.

Stay in the know on the latest dairy industry trends.

SUBSCRIBE TODAYCopyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing