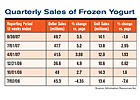

Meanwhile, frozen yogurt’s turnaround continues, although there was a slight downturn in unit sales in the most recent quarter.

First, let’s look at ice cream. The quarterly figures at right are from IRI’s FDMX data, which looks at food, drugstore and mass merchandisers, but does not include Wal-Mart or channels like convenience and foodservice. With the exception of the third quarter 2006, unit sales have slipped in each of the last six quarters. In three of those periods, the losses were little more than 1%, and could potentially be explained away by supply fluctuations.

The pie chart represents the top brands in IRI’s slightly more specific measure of ice cream only-this made up $4.1 billion of the $4.5 billion in sales for the period, from the same FDMX measures. Here dollar sales slipped about 1.8% for the year and units were off by about 4%.

Some brands grew their dollar and unit sales and others lost. Private label is a significant leader in ice cream, and its market share was up 1% for the period. Dreyer’s Slow Churned grabbed an additional .68% market share for the same period, and Ben & Jerry’s was up too, gaining about a half a percentage point more in unit shares.

Better-for-you products continue to do well in general.

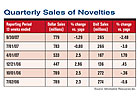

According to IRI data novelties have not done well lately either, but some lower-calorie options leading the way with double digit gains.

According to Nicholas, the launch includes new flavors - Passion Fruit, Orange and Green Apple. An added health bonus? The apple shell provides a “good shot of pectin and fiber.”

Adam Baumgartner, senior marketing mgr., retail brand development for Wells’ Dairy, Le Mars, Iowa, calls health concerns the biggest driver in the ice cream and frozen novelties sector right now.

“One of the biggest impacts is that it has forced manufacturers to continue to raise the bar with what they’re delivering in terms of quality,” he says. “It also has opened the door for products in the frozen category that formerly weren’t accepted, [such as] superfruit novelties with antioxidants and probiotics in frozen yogurt.”

New health-conscious Blue Bunny frozen novelties from Wells’ Dairy include 100-Calorie Bars in Vanilla Fudge, Fudge, Orange & Raspberry Crème, Butter Pecan and English Toffee varieties, Baumgartner says. Other recent launches include The Champ! Strawberry Cone, Strawberry Vanilla Bars and Rocky Road Sandwiches.

Because probiotics-infused products “are trending upward,” Orrville, Ohio-based Smith Dairy Products Co. is researching inclusion of such beneficial bacteria in its Ruggles frozen yogurt, says Penny Baker, the company’s marketing director. The company also continues to monitor the organic trend.

“Our challenge is to develop frozen desserts that both are better for you and deliver a great, taste and texture -we want to take out the guilt factor,” she says. Smith Dairy introduced Ruggles Organic ice cream in four flavors last summer, as well as eight flavors of Ruggles Churned Light Ice Cream last spring. Baker says the company plans to expand the latter line in 2008.

Tom Gleason, president of Oregon Ice Cream Co., Eugene, Ore., agrees that consumers are gravitating toward healthful items - and are reading labels and counting calories.

Speaking of creamy, Oregon Ice Cream perfected an extrusion process that produces a texture that’s better than molded alternatives, says Gleason. Also in line with the super-premium push is a new downsized (2-ounce) ice cream sandwich. It allows consumers to indulge without guilt.

Brian Goldstine, dir. of marketing for Unilever’s Breyers brand, calls Breyers Double Churn Free ice cream a “great example” of a lighter indulgence.

“Its rich and creamy texture would never lead you to believe it’s fat-free,” he says.

For the kids, new Popsicle Natural Colors & Flavors are sure to appease moms wary of artificial ingredients. Also new (and with natural colors and flavors) are Popsicle Slow Melt ice pops, which last longer than regular pops, Goldstine says.

Portion control also is a benefit of the new Choco’s Ice Cream Bon Bons from San Diego-based La Petite Foods. According to Linda Taylor, the company’s owner, the all-natural, bite-sized, chocolate-enrobed ice cream treats - in Peanut Butter, Chocolate, Vanilla, and Mocha/Java varieties - are guiltfree indulgences that appeal to adults.

Moreover, the “smile” faces used in the bright product packaging “evoke a sense of nostalgia” in many consumers, she says.

Going along with portion control is the push toward single-serve and snacking, says Paul Klingensmith, vp of frozen dessert sales for Pennsauken, N.J.-based J&J Snack Foods.

“Frozen novelties aren’t just for dessert anymore,” he stresses. J&J Snack recently acquired Whole Fruit Sorbet and Fruit-a-Freeze frozen fruit bar brands from a subsidiary of CoolBrands International, Klingensmith notes. Among the newest Whole Fruit Sorbet flavors is a Pomegranate, Blueberry & Acai Blend.

Refrigerated & Frozen Foods Retailer contributed to this report.