The U.S. organic and natural foods industry likely started with granola and homemade yogurt produced by a bunch of “groovy” California hippies back in the ’60s. It has come a long way. Mainstream retailers are on board with organic, and more and more dairies are producing organic and all-natural options.

Supermarket and mass merchandisers are aggressively competing for share of organic and natural dollar sales, putting the pressure on Whole Foods Market to expand product offerings and lower prices. Many of these offerings are coming from large corporations that are now in the organic and natural foods business … and not surprisingly, it’s more for the money than from the heart. After all, it is possible to create an organic Twinkie as well as organic Velveeta, but that’s not what the organic consumer is all about.

“I have no illusions about this. I don’t believe that Wal-Mart has come here because they’ve suddenly had a moral enlightenment. It’s because of economics,” says Hirshberg. “I can debate with my radical friends all day long but nobody can challenge the fact that a sale of another million dollars to Wal-Mart helps to save the world.

“Individual consumers changed the biggest company on Earth and in so doing, probably put the last nail in the coffin for synthetic growth hormone,” he says.

Indeed, though times are tough, sales of dairy foods labeled as organic and natural continue to thrive. While it is true that the term natural is not federally regulated, FDA does provide guidance to qualify a food as natural. The term organic is federally regulated, and for many consumers, knowing a food is certified organic provides some comfort in terms of how the food was raised, processed and even packaged.

“The food industry has succeeded in keeping some very important information about their products hidden from consumers. It’s outrageous that genetically modified foods don’t need to be labeled. Today more than 70% of processed foods in the supermarket are genetically modified and we have absolutely no way of knowing,” according to Elise Pearlstein, “Food Inc.” producer. “Whatever your position, you should have the right to make informed choices, and we don’t. Now the FDA is contemplating whether or not to label meat and milk from cloned cows. It seems very basic that consumers should have the right to know if they’re eating a cloned steak.”

“This ruling is a major setback for the consumer’s right to know. It also completely conflicts with public sentiment,” says Hirshberg. “The labeling regulation prevents companies from using truthful and accurate information about practices used to produce dairy products - and thus represents a huge infringement on free speech.

“With this regulation in place, where will these labeling restrictions end?” asks Hirshberg. “Will the next step be banning the words ‘local’ or ‘free range?’ This is a very slippery slope.”

Hirshberg points out organic products “will continue to represent the ‘gold standard’ for consumers wanting products made with milk from untreated cows, since strict federal organic standards prohibit the use of artificial growth hormones as well as the use of toxic and persistent chemicals, antibiotics and genetically modified organisms.”

Christine Bushway, executive director of the Organic Trade Association, Greenfield, Mass., adds: “Consumers have a right to know how the food they feed their families has been produced, and organic farmers and manufacturers should be allowed to tell them.”

The Consumer Reports National Research Center polled more than 1,000 people nationwide on various food labeling issues and found 93% of consumers agree dairies that produce products without artificial growth hormones should be allowed to label their products as being made without these hormones.

“Consumers have spoken, and we are very disappointed the court disagrees,” says Bushway.

Consumers, retail sales stay groovy

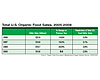

While the overall economy has been losing ground, sales of organic products reflect very strong growth during 2008. “Organic products represent value to consumers, who have shown continued resilience in seeking out these products,” says Bushway.According to OTA’s 2009 Organic Industry Survey, sales of organic food products reached $22.9 billion at the end of 2008, growing an impressive 15.8% over 2007 sales despite tough economic times (see table on page 42). The survey, conducted by Lieberman Research Group on behalf of OTA, measured the growth of U.S. sales of organic foods and beverages as well as non-food categories during 2008.

Results show organic dairy food sales grew in 2008 by 12.7% to reach $3.6 billion, which reflects an impressive 5% penetration of all U.S. dairy food dollar sales. Further, organic dairy food share of all organic food was 16% in 2008, according to OTA.

Total organic food sales accounted for 3.5% of all food product sales in the United States. Organic penetration has been increasing annually. From 2005 to 2008, penetration increased one percentage point.

With tough economic times, consumers have used various strategies in continuing to buy organic products. Because most venues now offer organic products, consumers have the opportunity to shop around. Increased use of coupons, the proliferation of private label brands and value-positioned products offered by major organic brands all have contributed to increased sales.

Organic food producers sell to consumers via a variety of channels. National, natural and mass-market food chains are the leading channels (each accounts for about 30% of sales). Regional natural food chains and independent health food stores are a smaller presence, making up the remaining 10%.

The national debate

Because it is regulated, the organic industry has a much better handle on tracking sales than the natural foods category. Some of the best info one can secure comes from the Natural Marketing Institute, Harleysville, Pa.In May, NMI announced that retail sales within the U.S. consumer packaged goods health and wellness industry reached more than $112 billion in 2008, representing growth of 9% over 2007. Specifically, natural foods and beverages had sales of $14.6 billion, which was a 4% increase from 2007. These figures include sales across all retail and direct-to-consumer channels.

“NMI research clearly shows that the current economic downturn is changing consumer behavior on many levels, including spending related to health and wellness. So while sales in each category continue to grow, consumers are becoming more discerning and are looking for real value in their purchases and not just the perceived value,” says NMI President Maryellen Molyneaux. “This shift in behavior will impact manufacturers and retailers not just short-term but also in the future.”

With the economic future unclear, NMI projects that the health and wellness industry as a whole will remain relatively stable over the next five years at approximately 7% growth each year.

Organic and natural labeling will continue to thrive, and will remain an important sector within dairy foods. “Americans,” concludes Walt Freese, chief euphoria officer at Ben & Jerry’s, “should have the basic right to choose the foods they want to eat.”

Sidebar: Entering Organics

After achieving national distribution of its extended-shelf-life, single-serve fluid milk bottles through the Subway sandwich shop chain, Shamrock Farms, Phoenix, decided the time was right to enter the organic fluid milk business.For now the new Shamrock Farms Organic milk has a code life of 19 days and is touted as being local. The milk is direct from the company’s own herd, which is raised down the road from the processing facility. The company claims the milk comes from the cows to the grocery store in less than three days. And, it comes in a unique package design that creates a point of differentiation in the growing organic fluid milk case.

“Shamrock wanted to enter the organic category with a new, unique container that looked fresh and far removed from what you would expect to see in the dairy aisle,” says Brad Ghormley, partner/creative director, Catapult Strategic Design, Phoenix. “We set out to create a family-friendly container that is unique to Shamrock Farms. We wanted a simple container that would be easy for kids to handle and pour and fit in the refrigerator door. The new 96-ounce container provides an upscale look with an equally matching quality product inside.”

The new organic line is available as whole, reduced-fat, low-fat and fat-free milk. There’s also a new organic sour cream.

Sidebar: Promote Your Earth-Saving Efforts

A calculator has been developed to help consumers, dairy farmers and food companies estimate the avoided environmental, public health and animal welfare impacts associated with shifting dairy cows from conventional to organic management. The “avoided impacts” stemming from applications of synthetic nitrogen fertilizer, herbicides and insecticides, and several classes of animal drugs can now be estimated for a single milking cow, a given herd of milking animals, across all cows in a region or all farms shipping to a given dairy processing company, or even for a gallon of milk. The design of the calculator, equations within it and data sources are described in the Organic Center report, Shades of Green: Quantifying the Benefits of Organic Dairy Production.There were about 120,000 milking cows on organic dairy farms in 2008 that followed USDA organic certification guidelines. Using the Microsoft Excel-based calculator, these U.S. dairy operations avoided the use of an estimated 40-million pounds of fertilizer and 758,000 pounds of pesticides on the 761,000 acres of farmland now used to grow organic feed or organic pasture. In addition, cows were administered more than 1.7 million fewer treatments with animal drugs, such as antibiotics, reproductive aids and growth hormones.

“This calculator gives us the means to uniformly measure the extent to which organic dairy operations prevent toxic materials from entering our air, water, soil and in some cases, our food and drinking water,” says report author Charles Benbrook, chief scientist of the Organic Center, Boulder, Colo.

The tool is available free of charge atwww.organic-center.org.

Sidebar: Global Organic Innovations

Organic and natural food and beverage formulators know that to be innovative it is critical to explore all aspects of the industry, which includes learning from peers in other countries. This is why companies involved in product development are sending their employees to Anuga, the distinguished global food and beverage food fair held every two years in Cologne, Germany.Anuga 2009 runs Oct. 10 to 14 in the prominent Koelnmesse Convention Center. Unlike any other trade show, Anuga’s unique concept of featuring 10 specialized trade show segments in one location has been highly successful in matching exhibitors with their right target audience. The 10 segments are 1) Bread & Bakery, Hot Beverages, 2) CateringTec, 3) Chilled Food, 4) Dairy, 5) Drinks, 6) Fine Food, 7) Frozen Food, 8) Meat, 9) Organic and 10) RetailTec.

Show organizers have announced that the organic segment is one of the fastest growing for the fair. In 2007, the organic hall had 317 exhibitors, and 2009 projections indicate this figure will be closer to 350. Further, in 2007, of the more than 163,000 visitors from around the world, 42.1% visited the organic hall.

For more information on Anuga 2009, visitwww.anuga.koelnmessenafta.comorwww.anuga.com.