Yet again, European Union (EU) intervention stocks of skim milk powder (SMP) have effectively been drawn down to zero. When this happened in 2007, EU and U.S. prices ran up to new record highs.

When stocks were drawn down again in 2012, we nearly matched those record highs. With intervention stocks falling to zero in early 2019, will we experience new record-high SMP prices?

First, some background. The EU intervention program operates much like the commodity price support program for dairy once operated in the United States. The EU stands ready to buy huge quantities of SMP to prop up the price and keep farm-gate milk prices from falling further than they otherwise would. The EU then holds the powder and waits for market prices to recover before selling it back to the industry, or it finds other creative ways to use/destroy the powder without negatively affecting marketing prices.

Inventory waiting game

From July 2015 to May 2017, the EU bought about 357,500 metric tons of SMP before market prices rose enough that processors stopped selling to the government. It took until spring 2018 before the market was strong enough to start pulling down the large government stocks.

At that point, much of the powder was two years old or older. There were concerns about quality, and most people believed the powder was eventually destined for animal feed. However, quality tests on the aged product have generally been positive, and most of it will likely end up being used for human consumption.

It’s important to recognize that the product leaving intervention isn’t going straight into people’s stomachs. For now, it is just shifting ownership from the government to commercial hands. So is the emptying of intervention stocks bullish for prices if the powder is still sitting in warehouses?

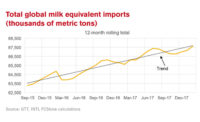

The EU government does not publish data on privately held inventories of SMP, but we estimate commercial stocks of dairy products in the EU on a monthly basis. Thanks to generally weak production and strong exports out of the EU and United States in 2018, combined government and commercial stocks trended lower during the year. We’re expecting combined inventory to continue falling during 2019. Inventories look like they will still be on the heavy side at the end of 2019.

However, we could be looking at a stocks/use ratio close to 2.0, which is right around the long-run average. The statistical relationship between the stocks/use ratio and prices isn’t very tight, but a ratio of 2.0 would suggest prices around $1.15 per pound ($2,500/metric ton) by the end of 2019. This could be higher since inventories look like they could continue to trend down into 2020. We’re probably not headed to a new record high anytime soon, but it does look like the market is making some progress toward working down the large stocks that built up during 2015-2017.

.jpg?height=200&t=1623938483&width=200)