You’ll find no signs of a cool-down for the red-hot refrigerated coffee and tea segment. Refrigerated ready-to-drink (RTD) coffee and refrigerated tea both saw significant dollar and unit sales gains during the 52 weeks ending July 9, 2017, according to data from Chicago-based market research firm Information Resources Inc. (IRI).

Traditional coffee formats such as ground coffee and instant coffee have seen declines in recent years, noted the Packaged Facts division of Rockville, Md.-based MarketResearch.com in its December 2016 “Coffee and Ready-to-Drink Coffee: U.S. Retail Market” report. But refrigerated RTD coffee is among the three high-growth coffee segments (the other two are

single-cup coffee and cappuccino/iced coffee).

And consumers’ interest in tea culture at foodservice, as well as trends toward premium and specialized teas, are helping to drive growth of refrigerated and other tea products, Packaged Facts stated in its December 2016 “Tea and Ready-to-Drink Tea: U.S. Retail Market” report.

Double-digit gains for refrigerated coffee

Double-digit gains for refrigerated coffee

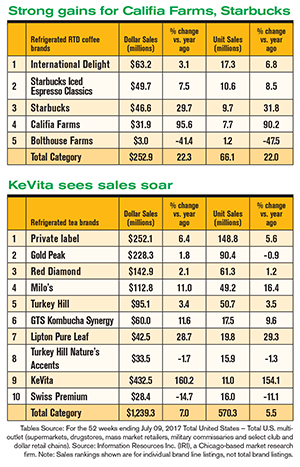

The IRI data show that dollar sales of refrigerated RTD coffee shot up 22.3% to $252.9 million, while unit sales climbed 22.0% to 66.1 million. Making the most impressive gains among the top 10 brands was Caribou Coffee, which posted 159.4% and 183.3% dollar and unit sales increases, respectively. For the second year in a row, Califia Farms also performed very well. The brand’s dollar sales grew 95.6%, and its unit sales rose 90.2%. Stumptown Coffee Roasters fared well, too, with dollar sales increasing by 35.3% and unit sales jumping 38.3%.

Others among the top 10 had a rougher year. Bolthouse Farms (Campbell Soup Co.) saw a 41.4% drop in dollar sales and a 47.5% decrease in unit sales. Another Bolthouse Farms refrigerated coffee brand, Bolthouse Farms Pefectly Protein, also realized declines — dollar sales fell 20.3%, while unit sales shrunk 21.9%.

Steady growth for refrigerated tea

With dollar sales surpassing $1 billion, the refrigerated tea segment dwarfs its coffee cousin. Dollar sales here rose a respectable 7.0% to $1.2 billion, while unit sales here grew by 5.5% to 570.3 million. Private brands collectively led the segment in terms of sales — $252.1 million — but not in growth. Posting the greatest growth among the top 10 brands was ninth-place brand KeVita, which realized a 160.2% gain in dollar sales and a 154.1% rise in unit sales. Another strong performer was Lipton Pure Leaf (Unilever). Dollar sales for the brand rose 28.7%, while unit sales climbed 29.3%.

A couple of brands saw less-than-stellar results. Swiss Premium (Dean Foods) realized a 14.7% drop in dollar sales and an 11.1% decline in unit sales. Turkey Hill Natures Accents also saw a decline, albeit smaller. Dollar sales fell 1.7%, and unit sales declined by 1.3%.