Dollar and unit sales for the ice cream category were looking good as numbers ticked up. Some frozen novelties also enjoyed a sales boost, but many struggled. Meanwhile, sales dropped for sherbet, sorbet and frozen dairy desserts.

The ice cream/sherbet category’s dollar sales increased 3.7% to $6.7 billion and unit sales were up 2.6% to 1.7 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks June 11, 2017. In the frozen novelties category, dollar sales improved 1.6% to $4.9 million, but unit sales decreased 0.8% to 1.5 million.

IRI’s ice cream/sherbet category consists of:

- Ice cream ($6 billion; units up 4%)

- Frozen yogurt/Tofu ($261.6 million, units down 11.7%)

- Sherbet/Sorbet/Ices ($190.6 million; units down 2.4%)

The frozen novelties category consists of:

- Frozen novelties ($4.5 billion, units down 0.9%)

- Frozen ice cream/Ice milk desserts ($234.6 million, units up 4%)

- Ice pop novelties ($149.3 million, units up 0.1%)

Ice cream sales trend up

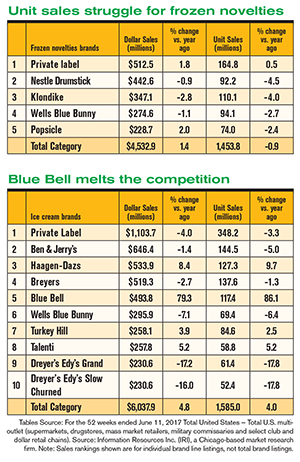

In the ice cream segment, dollar sales climbed 4.8% to $6 billion and unit sales increased 4% to 1.5 billion. Private label dominated the segment with $1.1 billion, but dollar sales dropped 4% and unit sales fell 3.3%. No. 2 Ben & Jerry’s (a Unilever brand) saw dollar sales decrease 1.4% and unit sales decrease 5%. Dollar sales improved 8.4% for Häagen-Dazs (Nestle USA) as unit sales increased 9.7% (See table.)

In the ice cream segment, dollar sales climbed 4.8% to $6 billion and unit sales increased 4% to 1.5 billion. Private label dominated the segment with $1.1 billion, but dollar sales dropped 4% and unit sales fell 3.3%. No. 2 Ben & Jerry’s (a Unilever brand) saw dollar sales decrease 1.4% and unit sales decrease 5%. Dollar sales improved 8.4% for Häagen-Dazs (Nestle USA) as unit sales increased 9.7% (See table.)

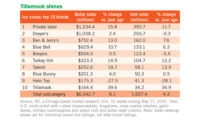

After struggling the past couple years due to product recall challenges, it seems Blue Bell’s sales are on the mend. Dollar and unit sales jumped 79.3% and 86.1%, respectively. Unilever’s Breyers (Good Humor) saw dollar sales drop 2.7% and unit sales were down 1.3%. Turkey Hill’s (Kroger Co.) dollar and unit sales both increased, 3.9% and 2.5%, respectively. Talenti’s (Unilever) dollar sales were up 5.2% and unit sales also improved 5.2%. Dollar sales rose 13.7% for Tillamook and unit sales jumped 21.4%.

In the ice milk/frozen dairy desserts segment, sales did not fare as well. Dollar sales decreased 6% to $219.3 million and unit sales dropped 7.1% to 62.4 million. Segment leader Breyers Blasts (Good Humor) saw dollar sales go down 15% to $100 million, and unit sales fell 14.5% to 27.7 million. Arctic Zero was a bright light among the struggling top 10 — dollar and unit sales both jumped 35.5%. Dollar sales for Friendly’s Ice Cream’s declined 9.3% and unit sales dropped 7.4%.

Frozen novelties unit sales stunted

The frozen novelties segment’s dollar sales improved 1.4% to $4.5 billion, but unit sales declined by 0.9% to 1.4 billion. Private label led the segment with $512.5 million. Dollar sales rose 1.8% and unit sales were up 0.5%. Nestle Drumstick’s dollar sales dropped 0.9% and unit sales were down 4.5%. Dollar sales decreased 2.8% for Klondike (Good Humor) and unit sales also fell 4% (See table.)

Popsicle (another Good Humor brand) saw dollar sales go up 2% (likely due to a price increase), but unit sales dropped 2.4%. It was a similar situation for Häagen-Dazs (Nestle Dreyer’s), dollar sales increased 2% (the price also went up), but unit sales decreased 4.8%. On the other hand, Nestle’s sales were going strong — dollar sales were up 27.8% and unit sales jumped 13.2%. Dreyer’s Edy’s Outshine also saw dollar and unit sales up 1.1% and 1.8%, respectively.