America’s dairy processors are planning to develop an average of seven new products in the next 12 months. While most say this is no different than in past years, 47% said this represents an increase, according to an exclusive new survey by Dairy Foods. (The median number of new products planned is five.)

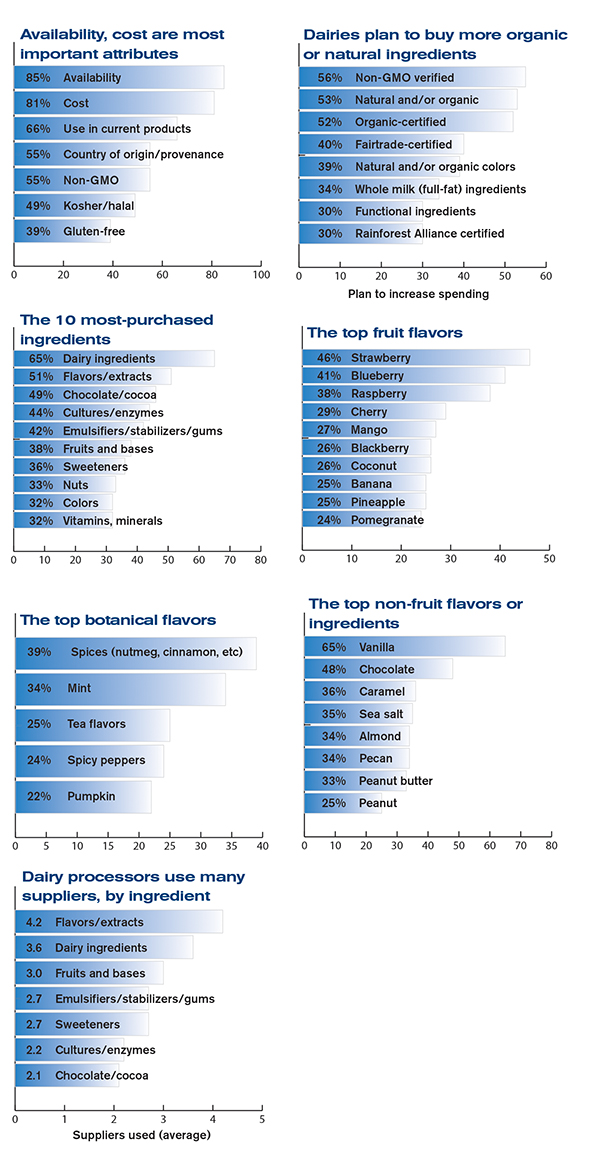

Most (71%) of the dairy processors we surveyed plan to increase their spending on ingredients in 2018. A majority say they will spend more on non-GMO (56%), natural/organic (53%) and organic-certified (52%) ingredients.

As they develop cheeses, yogurts, milks and other dairy foods and beverages, dairy processors will need flavors and sweeteners, among other ingredients, that meet consumer needs. Dairy processors say the top attributes in a dairy product are healthy, natural, convenience and high protein.

The Market Research Division of BNP Media (Dairy Foods’ owner) surveyed dairy processors in early March. The purpose of the ingredients study was to understand the purchase decisions made by dairy processors and to identify the types of ingredients they plan to purchase and use. The study also revealed the spending plans and sourcing strategies of dairy processors.

It takes a team

Dairies tend to take a team approach to sourcing and buying ingredients. An average of six people is involved in buying. Executive managers tend to be on the team, but they typically are not the ones issuing final approval. According to those we surveyed, the main role of executive management is to oversee, advise or guide the process (49%) followed by giving final approval (39%) or being the leader or decision maker (38%).

Most dairies (79%) are buying ingredients because they need them for products they are currently producing. But 58% are buying new ingredients to be used in new products under development, while 41% are substituting ingredients they use in existing products.

Availability and cost of ingredients are the top two purchasing attributes, followed by use in current products, country of origin and non-GMO.

Ingredient buyers gather information from the internet (62%), from colleagues (60%) and trade magazines (59%). A majority of survey respondents also rely on sales reps and trade shows for information.

Our survey respondents are buying a variety of ingredients (see tables), but the most common are dairy ingredients, flavors and extracts, and chocolate and cocoa.

Buyers rely on multiple suppliers, typically from two to four. Survey respondents said they use an average of 4.2 suppliers for flavors and 3.6 suppliers for dairy ingredients. At the other end of the scale, they buy from 2.1 chocolate and cocoa suppliers.

The results of the survey are a reflection of what the respondents manufacture, broken down as:

- 42% ice cream and other desserts

- 41% cheese

- 38% milk

- 33% cultured dairy foods

- 25% butter or margarine

- 24% dairy powders

- 20% juices, teas and other nondairy beverages

Visit www.clearmarkettrends.com to purchase and download the entire report as well as access a wide inventory of other studies done in this industry. Also, send email to info@clearmarkettrends.com with any questions.