Sales in the ice cream category look promising as dollars and units rose in the last year. Meanwhile unit sales in the frozen novelties category were frozen in place.

The ice cream/sherbet category’s dollar sales increased 4.7% to $6.6 billion and unit sales also improved 4.7% to 1.7 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Oct. 2, 2016. In the frozen novelties category dollar sales were up 3% to $4.8 billion, but unit sales in the last year were unchanged at 1.5 billion.

IRI’s ice cream/sherbet category consists of these segments:

- Ice cream ($5.9 billion, units up 6.5%)

- Frozen yogurt/Tofu ($277.7 million, units down 11.7%)

- Ice milk/Frozen dairy dessert ($225.9 million, units down 8.9%)

- Sherbet ($191.4 million, units down 2%)

The frozen novelties category consists of these segments:

- Frozen novelties ($4.5 billion, units up 0.1%)

- Frozen ice cream/ice milk desserts ($226.6 million, units up 3.5%)

- Ice pop novelties ($151.9 million, units down 2.5%)

Ice cream numbers tick up

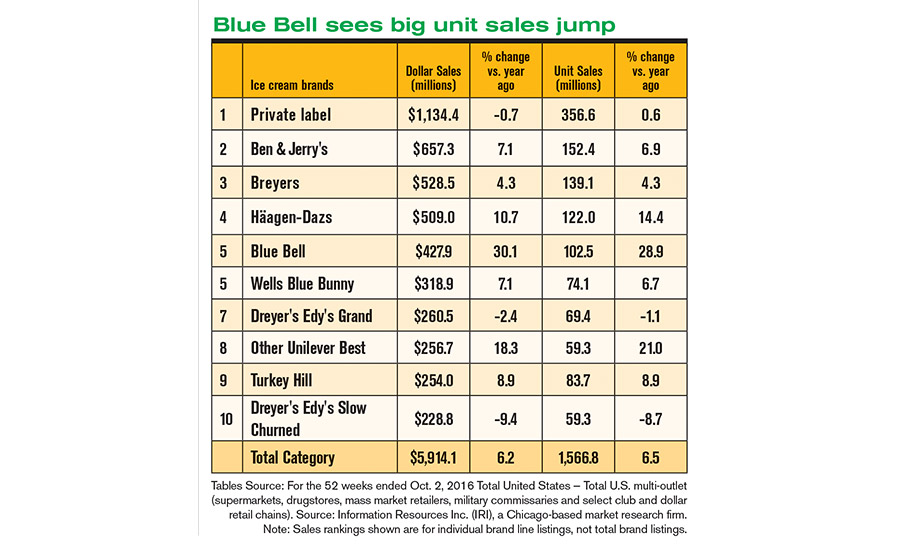

In the ice cream segment, dollar sales increased 6.2% to $5.9 billion and unit sales jumped 6.5% to 1.5 billion. The top 10 was dominated by private label, with $1.1 billion sales, but dollar sales dropped 0.7% and unit sales were up just 0.6%.

Unilever brands performed well. Coming up second in the segment was Ben & Jerry’s with $657.3 million — dollar sales jumped 7.1% and unit sales increased 6.9%. Breyers saw dollar and unit sales up 4.3%.

The story was mixed for Nestlé brands. Dollar sales for Häagen-Dazs rose 10.7% and unit sales improved 14.4%. Dollar sales for Nestlé’s Dreyer’s Edy’s Grand were down 2.4% and for Dreyer’s Edy’s Slow Churned sales were down 9.4%. Unit sales also dropped for each brand — down 1.1% and 8.7%, respectively.

Blue Bell Creamery saw the biggest sales boost among the top 10, with dollar sales up 30.1% and unit sales up 28.9%. The Texas-based ice cream maker is still recovering from product recalls in 2015 and 2016. Wells Blue Bunny saw dollar sales rise 7.1% and unit sales climbed 6.7%.

Frozen novelty sales are frozen

In the frozen novelty segment, dollar sales rose 3% to $4.5 billion, but unit sales only increased 0.1% to 1.4 billion. Among the top 10, Nestlé Drumstick saw dollar sales climb 6.3% and unit sales were up 2.8%. Dollar sales for Dreyer’s Edy’s Outshine (also a Nestlé brand) improved 3.9% and unit sales jumped 7.6%. The Nestlé brand saw the most impressive numbers in the top 10. Dollar and unit sales jumped 46.1% and 23.7%, respectively. Meanwhile, another Nestlé brand, Skinny Cow, did not fare as well — dollar sales fell 7.5% and unit sales dropped 8.4%.

Sales for Klondike (Good Humor from Unilever) improved 2.5%, with unit sales up only 0.6%. Popsicle (Good Humor) saw dollar sales tick up 1.7%, but unit sales dropped 2.6%.

Wells Blue Bunny’s dollar and unit sales increased 3.5% and 1.5%, respectively.

The frozen ice cream/ice milk desserts segment saw a boost with dollar sales up 3.6% to $226.6 million, and unit sales rising 3.5% to 13.9 million. Carvel led the segment with $125.8 million — dollar sales improved 4% and unit sales were up 3%. Dollar sales for Jon Donaire (Rich Products) were in a standstill at 0%, and units decreased 1.4%. Friendly’s Ice Cream got a boost — dollar sales increased 16.8% and unit sales jumped 25.7%. Dollar and unit sales for Kroger’s Turkey Hill brand improved 3.1% and 1.1%, respectively. Struggling was Tickleberry Desserts with dollar sales down 55.5% and unit sales dropping 51.4%.