Juice beverages are a multibillion dollar industry, and according to a recent trend report from Fona International, millennials in particular are throwing back more juices as meals and snacks, and for health and hydration. Customization and health attributes are just two of the factors driving Millennials’ juice purchases. The increase in sales for juice blends, smoothies and vegetable juices backs up Fona’s findings.

The refrigerated juices/drinks category showed dollar sales up 1.5% to $6.7 billion, and unit sales up 1.7% to 2.3 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Mar. 20, 2016.

Juice blends are popular

Sales in the refrigerated juice and drink smoothies segment increased 7.7% to $909.1 million, while unit sales rose 9% to 260 million. Naked (The Naked Juice Co.) dominated the segment with $515.1 million sales — dollar sales jumped 10.6% and units 11.1%. Bolthouse Farms (Campbell Soup Co.) had $205.9 million in sales (up 5.7%) as unit sales jumped 12.6%. Also in the top 10, Odwalla saw dollar sales increase 62.9% and unit sales increase 39.3%. Suja Essential’s dollar and unit sales skyrocketed 124.5% and 123.9%, respectively. Dannon’s Danimals also saw success — dollar sales shot up 911.7% and unit sales skyrocketed 1,075.9%.

The refrigerated vegetable juice/cocktail segment saw dollar sales rise 18.9% to $126.7 million, while unit sales improved 14.1% to 31.2 million. Though Bolthouse Farms led the segment with $53.2 million, dollar sales dropped 8.9% and unit sales decreased 8.6%. On the flip side, Bolthouse Farms Organics saw dollar sales jump 49.2% and unit sales increase 44.1%. Naked’s dollar sales were up 88% and unit sales improved 48%. Dollar and unit sales jumped 53% and 53.6%, respectively, for Evolution Fresh (Evolution Juice Harvest Corp.)

Old standbys not so popular

Sales for orange juice and apple juice (the old standbys) struggled, while lemonade and fruit drinks showed promise.

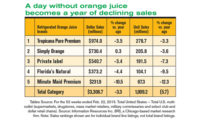

Refrigerated orange juice, the category’s leading segment with $3.1 billion, saw dollar sales decrease 3.4% and unit sales dropped 3.3%. Tropicana led the segment with $951.8 million, but dollar sales were down 1.6% and unit sales decreased 1.1%. Simply Orange came up right behind Tropicana with $751.8 million —dollar sales increased 2.4% and unit sales were up 2.9%. Minute Maid Premium (Coca Cola Co.) and Minute Maid both struggled — dollar sales dropped 6.9% and 17.2%, respectively, and unit sales fell 7.9% and 18.5%, respectively. In the refrigerated apple juice segment, dollar sales increased 0.1% to $63.8 million, while unit sales fell 1.8% to 24.2 million.

It was a different story for the refrigerated fruit drink segment — dollar sales increased 7.1% to $1 billion, and unit sales were up 4.5% to 517 million. Among the top 10, SunnyD (Sunny Delight Beverages) saw dollar sales drop 15.4% and unit sales were down 17.9%. But other brands in the top 10 saw significant increases. Dollar and unit sales jumped 763.8% and 856.1%, respectively, for Simply Fruit Punch (Simply Orange Juice). Simply Tropical also saw dollar and unit sales increase 740.8% and 810.1%, respectively. Dollar sales rose 48.2% and unit sales improved 44.3% for GTS Kombucha Synergy (Millennium Products).

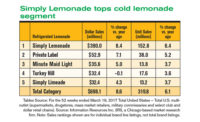

The refrigerated lemonade segment saw impressive numbers with dollar sales up 10.8% to $643.3 million, and unit sales increased 11.1% to 302.1 million. Simply Lemonade (Simply Orange Juice) dominated the segment with $360.1 million (up 8.4%) as unit sales ticked up 9.8%. Private Label’s dollar sales jumped 22.9% and unit sales rose 20.4%. Minute Maid Light and Turkey Hill were neck and neck with $33.9 million and $32.4 million, respectively, in overall sales. Minute Maid’s dollar sales increased 13.8%, while unit sales were up 14.8%. For Turkey Hill, dollar and unit sales improved 13.9% and 11.9%, respectively. Dollar sales were up 10.8% for Newman’s Own, as unit sales improved 12.8%.