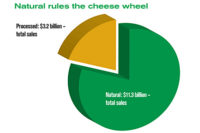

Consumers’ preference for natural over processed shows in cheese sales.

While natural cheese sales remained positive, processed cheese continues to see declines. Consumers are opting for natural slices, sticks and shredded cheese.

Among processed cheeses, aerosol/squeezable spreads and spreads/balls showed increases, but overall, the processed cheese category was down.

In the natural cheese category dollar sales rose 1.5% to $12.8 billion and unit sales increased 4.3% to 3.7 billion, according to Information Resources Inc. (IRI), for the 52 weeks ended Feb. 21, 2016. Dollar sales fell almost 5% in processed cheese to $3 billion and unit sales were down 5.4% to 808 million.

As measured by IRI, the natural cheese category includes these segments:

- Shredded ($4.7 billion, units up 4%)

- Chunks ($3.7 billion, units up 0.5%)

- Slices ($2 billion, units up 11.6%)

- String/Stick ($1.3 billion, units up 6.6%)

The processed cheese category includes these segments:

- Processed/imitation cheese slices ($1.9 billion, units down 7.1%)

- Cheese spreads/balls ($485 million, units up 2.7%)

- Processed/imitation cheese-loaf ($425 million, units down 0.6%)

The largest segment in the natural category, shredded cheese saw unit sales up 4% to 1.5 billion although dollar sales had a slight decrease, down 0.3% to $4.7 billion. Private label leads the segment at $2.7 billion in sales, up just 0.9% but unit sales were up 6.2%.

In the top 10, Kraft Philadelphia didn’t fare so well; dollar sales decreased 23.7% and unit sales dropped 15.8%. Kraft, in the second spot, also had declines: down 4.6% in dollar sales and 4% in unit sales. Sargento saw unit sales increase by 3.5% but dollar sales were down 1.7%. American Heritage (Schreiber Foods) made some strides with dollar sales up 13.8% and unit sales up by 18.7%. Tillamook also showed some promise with dollar sales up 16.1% and units improved 16.6%.

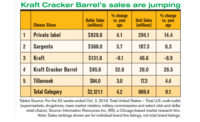

Sales of natural slices rose nearly 12%

The natural slices segment had a double-digit increase in unit sales (11.6%) to 632 million and dollar sales were up 7.2% to $2 billion (see table). Leader of the segment again is private label and both dollar and unit sales were up — 2% to $795 million and 6.6% to 264 million. Kraft Cracker Barrel had the most significant gains among the top 10; dollar sales were up 62% and units increased by 69.6%. Boars Head was up 26.6% in dollar sales and 23.7% in units. Crystal Farms increased 23% in dollar sales and units were up 24.8%. Tillamook had unit sales up 25.6% and dollar sales increased 22%.

Unit sales were up 6.6% in the natural string/stick segment, with dollar sales also increasing by 5% to $1.3 billion. Galbani (Lactalis American Group) saw tremendous gains here — dollar sales were up 16,120.8% and units were up 18,947.8%. Kraft Cracker Barrel had large increases as well; dollar sales were up 398.2% and units up 114.3%. Units were up 64.4% for Kraft who also saw dollar sales increase by 23.3%.

Although the processed cheese spreads/balls segments was up: dollar sales improved 4.3% to $485 million and units increased 2.7% to 122 million—it wasn’t enough to lift the processed cheese category as a whole. The largest segment, processed/imitation cheese slices saw both dollars and units decrease, 7.9% and 7.1% respectively. In the top 10, American Heritage had large increases, dollar sales were up 98.5% and unit sales jumped 125.9%. Kraft Velveeta stayed pretty much flat with unit sales up 0.4% and dollar sales increasing 0.6%.