Consumers don’t seem to be cutting back on their consumption of caffeine- and electrolyte-packed drinks these days, as sales for both energy and sports drinks are on the rise.

Sales for the energy drink category showed promising numbers as dollar sales rose 10.7% to $11.6 billion and unit sales jumped 8.3% to 4.3 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Nov. 29, 2015. Likewise, the sports drink category saw similar success — dollar sales increased 8.4% to $6.3 billion and unit sales were up 7.2% to 3.4 billion.

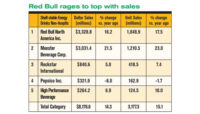

Non-aseptic energy drinks get a kick-start

The shelf-stable non-aseptic energy drink segment saw dollar sales jump 11.8% to $10.3 billion, with unit sales up 9% to 4 billion. Red Bull led the segment with $2.9 billion sales — dollar sales were up 8% and units improved 3.4%. Monster (Monster Beverage Corp.) ruled among the top 10 with six different product lines cracking into the top spots. The Monster Energy showed dollar sales improving 11.6% and unit sales rising 10.2%. Monster Energy Zero Ultra’s dollar sales increased 23.8% and units jumped 17.8%, and Java Monster’s dollar sales rose 13.6% and units were up 12.4%. NOS (High Performance Beverage) saw dollar sales jump 18.2% — unit sales were up 15.4%. Rockstar saw minimal change as dollar sales fell 0.04% and units were up 1.1%.

Energy shot sales holding steady

The shelf-stable energy shot segment saw dollar sales up 2% to $1.1 billion and unit sales were up 2.2% to 349.3 million. 5 Hour Energy (Living Essentials LLC) dominated the segment with $1 billion in overall sales, and dollar and unit sales rose 2.2% and 2.3%, respectively. Also among the top 10, Rhino Rush’s dollar and unit sales skyrocketed 83.5% and 92.1%, respectively. Tweaker’s (Leo Scientific Inc.) dollar sales jumped 28.9% and units increased 28.5%. Street King (SK Energy Shots) showed dollar sales down 6.8%, but unit sales increased 14.2%. The average price per unit went up 43 cents for the company. Stacker 2, 6 Hour Power (NV Pharmaceuticals) struggled, dollar and unit sales dropped 28.2% and 30.6%, respectively.

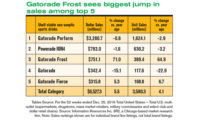

Non-aseptic sports drink sales are hopping

The shelf-stable non-aseptic sports drink segment saw dollar sales improve 8.6% to $6.2 billion, and units sales were up 7.4% to 3.4 billion. Among the top 10, Gatorade (Quaker Oats Co.) dominated with six product lines at the top. Gatorade Perform led the segment with $3.3 billion — dollar sales were up 4.2% and unit sales increased 2.8%. Coming up behind Gatorade’s Perform was Powerade Ion4 (Coca Cola Co.), with dollar sales rising 4% and unit sales increasing 2.1%. Gatorade Sports Drink dollar sales jumped 81.8% and unit sales skyrocketed 131.9%. Gatorade Fierce also saw dollar and unit sales jump 65.1% and 90%, respectively. Though overall sales put BodyArmor at the bottom of the top 10, its dollar and unit sales rose dramatically — 222.8% and 250.2%, respectively.