We reported last month, ice cream sales seem to be improving (see our August issue), but the same can’t be said about the rest of the frozen dessert aisle. Frozen cheesecakes, sweet goods and toppings all show sales down or barely moving. On the other hand, frozen puddings (albeit a small segment) shows sales on the rise.

The frozen desserts/toppings category showed dollar sales down 4.5% to $672 million, and unit sales decreased 4.6% to 285.4 million, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended May 17, 2015.

The frozen desserts/toppings category consists of:

- Frozen whip toppings ($331.7 million, units down 4.2%)

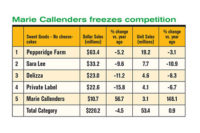

- Frozen Sweet goods – no cheesecakes ($205.9 million, units down 7.9%)

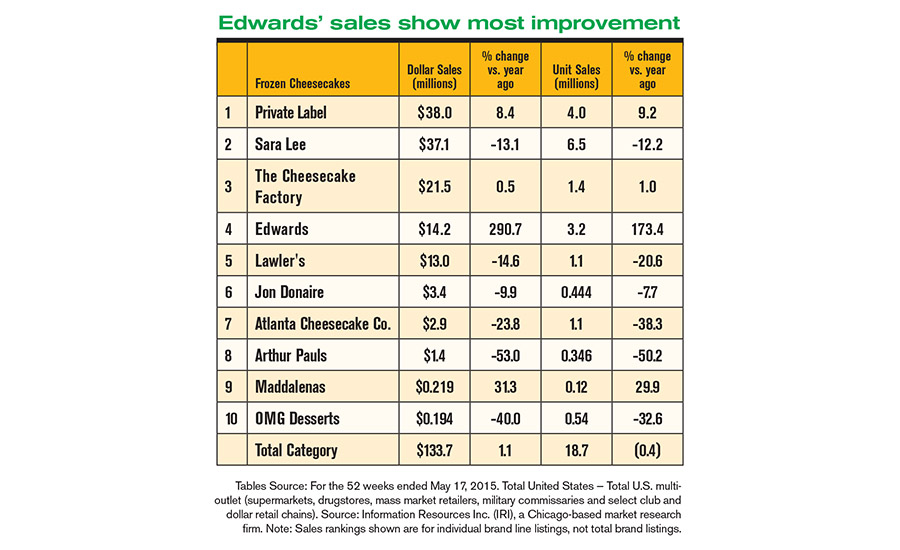

- Frozen cheesecakes ($133.7 million, units down 0.4%)

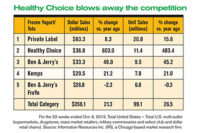

- Frozen pudding/mousse ($683,292 thousand, units up 303.7%)

Whip toppings take a beating

Dollar sales for frozen whip toppings, the largest segment in the category, decreased 4.7% to $331.7 million, with units down 4.2% to 216.8 million. Among the top five, Kraft Cool Whip dominated with overall sales at $237.8 million, but dollar sales dropped 1.2%, while unit sales increased slightly, 0.2% to 151.9 million. Private label came up second with $88.4 million, though dollar sales dropped 9.3% and units fell 12.2%. There’s a large gap from this point, as Kraft’s Cool Whip Frosting is third in line with sales at $1.9 million, with dollar and unit sales decreasing dramatically, 71.2% and 70.5%, respectively. The one company in the top five that showed promise was Truwhip (Peak Foods). Dollar sales increased dramatically, up 104.8% to $1.7 million, with units skyrocketing 158.3%.

In the frozen sweet goods – no cheesecakes segment, dollar sales were down 7.6% to $205.9 million, and units decreased 7.9% to $49.7 million. Pepperidge Farm was the segment leader with $58.2 million, but dollar sales were down 9.1% and units fell 11.2%. Most of the companies in the top 10 struggled, with a couple exceptions. Dollar sales for Marie Callender’s (Conagra Foods) improved 18% and units increased 11.4%. Poppies’s showed dollar and unit sales also up, both at 14.6%.

In the frozen cheesecakes segment, dollar sales rose 1.1% to $133.7 million, though unit sales fell 0.4% to 18.7 million (see table). Private label led the segment with overall sales at $38 million; dollar sales increased 8.4% and units were up 9.2%. Sara Lee (Hillshire Brands) struggled with dollar sales down 13.1% to $37.1 million as units decreased 12.2%. Among the top five, Edwards (Schwan Food Co.) showed real promise: dollar sales jumped 290.7% and units improved 173.4%. Lawler’s didn’t fare as well: dollar sales dropped 14.6% and units fell 20.6%. Jon Donaire (Rich Products) also saw dollar and unit sales down, 9.9% and 7.7%, respectively.

Hunting for mousse

The one beacon of hope for the frozen desserts category is the frozen puddings/mousse segment which saw dollar sales skyrocket 172.7% to $683,292 thousand, and units jumped 303.7% to 181,530 thousand. Private label success seems to be driving this segment’s improvement, with dollar sales up 92.3%, while units increased 331.1%. Alongside that, S and P Syndicate Public Co. showed both dollar and unit sales improve 124.7%. Not doing well in the segment was Stevenson’s (Lone Star Bakery Inc.). Its dollar and unit sales decreased 90.1% and 89.6%, respectively.