The Kroger Co. had lofty ambitions when it set out to build its first new fluid milk plant in more than 20 years.

“We wanted to build a plant that would set us apart from other dairies in the U.S., both from a capability, flexibility and future innovation standpoint,” said Erin S. Sharp, Kroger’s group vice president for manufacturing.

The Cincinnati, Ohio-based grocery chain got its wish with the Mountain View Foods plant in Denver that opened Memorial Day weekend 2014. The facility processes fresh conventional and organic milk in half-gallons and gallons and it packages aseptically processed milk, creams and juices in quarts and smaller bottles.

I met Sharp in Denver in early January. Site Leader Art Shank, who oversees the plant, gave me a tour. We were joined by Mike Nosewicz, the vice president of network optimization and fresh dairy CCE; Robin Dubuc, the senior director of engineering and operations in the manufacturing division; and Larry Noe, a manager of manufacturing engineering.

Sharp said the new plant will help the company develop new products, calling dairy an “under-innovated” category. She added, “We think there’s a lot of future for dairy innovation.”

That’s a view shared by President and COO Mike Ellis, who said in a conference call with analysts on Dec. 4, 2014 that the “state-of-the-art dairy processing plant” was built and engineered “to deliver exceptional quality and freshness for our customers and to provide an avenue for innovation in the dairy category,” according to a transcript made by Seeking Alpha.

The plant currently supplies milk to about 150 King Soopers and City Market stores (chains owned by Kroger). But at full capacity (Shank said the plant is still in start-up mode), Mountain View Foods will service a few thousand groceries and convenience stores in the Kroger network in Colorado and nearby states. Eventually, the plant will supply all of Kroger’s 2,640 grocery stores and about 75% of the company’s convenience stores with aseptically processed milk and juices.

To get to opening day, May 25, 2014, was an eight-year journey. Initially the company thought about building a traditional dairy plant. Denver was the only major market not being served by one of Kroger’s dairies. The company was buying milk from several Dean Foods plants. But then Kroger started thinking bigger. A cross-functional team consisting of Sharp, Nosewicz, Dubuc, Noe and Shank began studying European technology and practices. The executives hit the road and toured dairy processing facilities in Europe and met with equipment manufacturers there.

“We talked to people who were running the equipment. We didn’t just go talk to the OEM or the leaders running the plant. We talked to the operator running the filler or whatever the piece of equipment was,” Nosewicz said.

Noe, Dubuc, Shank and Nosewicz took turns changing molds on the PET blow molder at one equipment manufacturing facility. (“We did pretty good,” Nosewicz said, and Noe joked, “They didn’t have a clock on us.”)

A focus on freshness

What made the most impact on the Kroger team was how the Europeans handle milk to keep it fresh for as long as possible.

In approaching the design of the plant, Nosewicz said, “We started with: How can we bring in a milk supply and protect it from contamination by any means? We worked on a process to keep product completely clean on its journey through the entire plant.”

While the plant does use some traditional pasteurization equipment, “we’ve done some things with processing techniques that are new to us,” Shank said. “What we were able to do is take what Europe has done and combine that with what we believe in the U.S. is a better milk supply [and refrigeration systems] and give our customers something that, at the end of code life, tastes the same as it did the day we made it. That’s important because freshness is very important to our customers.”

Even Kroger CEO W. Rodney McMullen waves the freshness banner. In his letter to shareholders, McMullen wrote: “We are innovating up and down our supply chain so that Kroger milk stays fresher longer in customers’ refrigerators. Through process improvements, our dairy suppliers, milk plants, logistics operation, and stores worked together so that we can promise our customers that Kroger’s milk is among the freshest in the industry.”

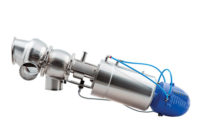

Without revealing too many details, Shank said the plant incorporates the latest in mix-proof technology, aseptic and extended-shelf-life filling systems, processing equipment and CIP systems.

Another objective in building the plant was efficient use of water, energy and labor.

“We wanted to be an energy-efficient plant,” Noe said. “We looked at using water as a primary cleaning, driving force. How do we better manage that operation so we can be more effective in our uses of water and other utilities? Those are some of the principles we built the plant on.”

Kroger had land in Denver. It is supplied by a refrigerated warehouse and distribution facility that was built on the site of the former Stapleton Airport. Where jumbo jets used to land, milk tankers now make deliveries.

The plant bottles fresh milk in paper and plastic half-gallons and gallons. It also processes flavored milk, drinks, and what Kroger calls a “carafe” orange juice. On the aseptic side, the company makes milk, juices and creams (half-and-half and whipping) in 8-ounce, 16-ounce and 32-ounce PET bottles. It processes conventional and organic milk. At full capacity, the plant will manufacture aseptic beverages for all of Kroger’s stores. It does not co-pack for other accounts at this time, nor does it produce a school milk line.

A tour of the plant

Sharp said her colleagues have noted the scarcity of workers in the plant. “One of the first things that they comment on is ‘Where are all the people?’ Because of the level of automation that we’ve put in here, it takes far fewer people to run this plant than it would a traditional dairy.”

Another benefit of automation is that it removes variables from manufacturing. Kroger can produce a consistent product, time after time. The plant currently employs 115, and a shift requires about 30 associates. The facility runs 24/7.

Milk arrives seven days a week in 5,600-gallon tankers or super-tankers holding 8,000 gallons. Conventional milk comes from Colorado dairy farms (packages will bear the “Colorado Proud” label) and organic milk comes from Idaho and New Mexico. Flow meters give an accurate reading of the volume each tanker delivers. The receiving area’s goal is to unload the milk and clean the truck in two hours.

One way Kroger assures freshness is by keeping the milk cold. It flows through cooling units that maintain temperatures between 34F and 35F. Kroger installed bacterial clarifiers with centrifuges that spin out bacteria and reduce the plate count. According to one maker of clarifiers, reducing the amount of bacteria and aerobic and anaerobic spores means that pasteurization temperatures can be reduced. Milk bacteria clarification also improves shelf life and organoleptic properties of the milk.

While Kroger won’t quantify shelf life in days, Nosewicz said “we are very happy with the quality coming out of this plant.”

One processing room has a high temperature/short time pasteurizer, homogenizer, separator and two powder blending tanks for flavored milks and other beverages. The room contains six 15,000-gallon hygienic pressurized tanks, but the room is large enough to accommodate two additional tanks. From a glass-walled control room, operators monitor computer screens. They can open and close valves to send milk through pasteurizers, blend tanks or fillers.

In the aseptic processing room, an in-line filler fills 24 bottles at a time. It bottles whole milk, 2%, skim milk and chocolate milk, cream, half-and-half, whipping cream and orange juice in 8-, 16- and 32-ounce bottles. After the bottles are filled, they run through a squeezer that checks for leaks. Then the bottles are sleeved and code-dated. The output is held for three to four days at 80F before being released for sale.

The plant has a separate room for blow molding plastic bottles and a separate case washing room.

Gallons and half-gallons of fresh milk in plastic or paper cartons are conveyed from the filling room to the cold room where a robot picks and palletizes crates for deliveries to stores. Shank described this as a “lights out” operation because the work can be performed in the dark since no human involvement is required. In fact, though, an associate does monitor the operation.

COO Ellis said Kroger is “the first dairy in the U.S. to deploy robotic technology that enables us to pack cases and pick and palletize orders entirely by automation.”

Another series of robots palletizes aseptically processed product. These pallets are stretch-wrapped in plastic and stored on racks then shipped to a warehouse elsewhere on the site.

The advantage of vertical integration

Milk processing is a low-margin, competitive business. Independent dairies fight for accounts. Kroger is different because it is vertically integrated; the milk it processes goes to stores it owns. Still, the manufacturing division is held to the corporate’s “make or buy” accounting philosophy so it has to be efficient.

Nosewicz pointed out some advantages to vertical integration. “We know the volumes. We know where we’re expecting to grow,” he said. That helps in planning, purchasing, staffing, manufacturing and merchandising.

The company has 37 manufacturing plants (including 18 dairies, two cheese plants and nine deli or bakeries) that produce about 40% of the corporate brand units sold in its stores. Private label brands (which Kroger calls corporate brands) include Private Selection and Simple Truth. The latter is a natural and organics brand (including dairy foods and beverages) that has existed for only two years. Simple Truth alone rings up $1 billion in annual sales and Kroger expects to double that soon.

Because of the importance Kroger places on corporate brands, I asked Sharp if Kroger might be more market-oriented than a free-standing dairy processor that is more operations-driven.

“We have a team that is responsible for marketing and innovation of [private label brands]. Having that group helps us [the manufacturing group] think more as marketers and innovators than maybe a traditional dairy does, where you’re just trying to get the lowest-cost product out the door. So I think that’s what makes us unique. [It] really challenges us as manufacturers to think beyond what we’re making today, when we’re putting a plant like this together.”

That down-the-road point of view was why the company selected the technology it did. “We know what we need to make when we started up but we need to be building a plant that’s capable of making the products that our customers want five years from now,” she said.

I asked Sharp if she sees any best practices in Kroger’s nondairy plants that can be applied to dairy. Besides the dairies and bakeries, Kroger has five grocery product plants, two meat plants and two beverage plants.

“That’s an interesting question,” she said. “The way we are structured currently is we really don’t have bakery divisions or dairy divisions. We are a single manufacturing network. We really looked at best practices — whether it is from a process standpoint, safety, quality — as universal. Then our different category leaders would take some of those best practices and say ‘How do they apply to dairies?’”

Food and employee safety

As noted, Kroger focuses on keeping milk clean, from receiving to packaging. Everything is built around cleanliness and cost efficiency, Nosewicz said.

Shank said, “Whether you’re on the fresh side of the plant or you’re on the aseptic side of the plant, we treat the rooms the same [with] all the precautions you would take normally when you go in an aseptic organization.”

There is also a strong emphasis on associate safety. At the time of my visit in January, the plant had no recordable accidents in the nearly eight months since it opened. “Safety is our No. 1 goal,” Noe said. Safety practices are posted outside the door to each processing room. The Mountain View associates are passionate about workplace safety, the company said. Behavior observations are an important component of the safety process at the plant.

Besides the equipment selection, Kroger also made decisions about the plant design that affect the well-being of associates. For example, the glass-walled break room gives associates a view of the Rocky Mountains. On warm days, they can grill on the patio.

The administration area of the plant encourages interaction between line associates and managers. For example, equipment operators have to pass Shank’s office as they walk from the locker room to the plant floor. His office has a glass wall (with blinds for privacy) and Shank keeps his door open.

Conference rooms (called team rooms) are located outside of the processing area where line associates hold pre- and post-shift meetings. That’s unusual. In many plants I have visited, meeting rooms (when they do exist) are located far from where the actual work gets done.

Much of the teaching and education of line employees is on-the-job training. Some discussion of a process might go on in a classroom but a lot of the learning is on the plant floor.

“We’ll talk [in a classroom] about how we’re going to look at the process on the line and then we’re going to go out to the line and go look and make some changes and identify some opportunities for change,” Sharp said. “This is really bottoms-up, really getting our associates involved and giving them the keys to decision-making.”

I saw an example of decision making in the quality assurance lab. In a typical milk plant, testing is done by technicians. And while the Denver lab has a staff, it is not unusual to find line operators themselves testing jugs of milk that they filled earlier in the day.

Kroger sold its ice cream plant in Denver just before opening Mountain View Foods. All the ice cream employees either kept their jobs or were hired to work in the new milk plant. I asked Shank about the skills and attributes he looks for when hiring. I wanted to know if experience with operating equipment was a prerequisite.

“The first thing we look for [is] are they team-oriented. Is it about me or is it about us? Then obviously we have to look at technical ability. Are they able to be trained?” he said.

Kroger hires for self-directed teams. “We want to get to a place where we have high-performance work teams operate the plant,” Shank said. The vision is that “our associates understand what the goals are for the company and they also understand what the goals are for their team.” He added that he wants associates to “have a lot of engagement in what takes place within the operation.”

His role as site manager is to give feedback to the teams so they become stronger. Shank said an associate does not have to have the technical ability “right now” but he or she must have the ability to learn “to think things through and to engage in the process and really understand the process along the way. What we are trying to do is create a sense of family here” because associates spend almost as much time with co-workers as with their own families.

“We have to be able to take our [six core] values as a company — honesty, integrity, safety, diversity, respect and inclusion — and be able to build what we do and ultimately [understand] we have a customer to take care of,” Shank said.

Kroger, Sharp said, is trying to invert the pyramid that has management at the peak and line employees making up the broad base. It wants the people closest to the customer making decisions.

The goal is “allowing people to use their creative ability — what they learned, what they are doing on the job — and being able to improve processes and ultimately improve our products as we get them out to the customers,” Shank said.

“You have to be prepared for associates to make mistakes and have it be safe,” Sharp said. “Art’s done a great job in selecting leaders here. If [the leaders] don’t believe and they don’t realize how their jobs change, then a high-performance system doesn’t work.”

She said when organizations fail to make this transition, it’s because they have not had the leadership buy-in throughout the front-line and mid-line leaders. Without that buy-in, “it won’t work because teams expect that when you’ve empowered and given them [a] level of autonomy, they don’t want to be micromanaged by a supervisor who told them what to do before.”

Sustainability

Three years ago Kroger started a zero-waste-to-landfill initiative. According to the company’s 2013 Corporate Sustainability Report, 27 of its then 32 manufacturing plants were designated as “zero-waste” facilities. These plants reduced the amount of waste sent to landfill by 3.5 million pounds, a 27.5% reduction from 2012. The plants recycled more than 300 million pounds of material.

“Our people are more conscientious about the environment and recycling. Our goal is to reduce energy usage per unit by 3% per year,” said Dubuc.

Each plant separates waste streams. The Denver plant has a “trash corridor” where waste is divided up into product, plastic and cardboard. The plant is recycling about 75% to 80% of its trash, Dubuc estimated.

To help reduce trash and energy use, Kroger appoints “a sustainability champion” at every site. During monthly conference calls, the champions share measurements and best practices. Kroger also works with Dairy Management Inc.’s Innovation Center and its PlantSmart program to identify areas and methods in which dairy processors (and dairy farmers) are reducing their carbon footprints. The Denver plant uses hydrogen-fueled lift trucks, a decision that saved on installing infrastructure for battery charging stations and related costs.

Kroger also built this plant with an eye towards water conservation. Sharp said the company calls Mountain View Foods a “dry plant. We want to use water as a last resort to move product or even to wash floors and all that.”

It’s a lesson learned in Europe where “plants are taxed on what’s going out of their plant very heavily and so they really work on that area to reduce their effluence rates,” Sharp said.

According to Kroger’s Annual Sustainability Report, the manufacturing group reduced water use by 61 million gallons, equivalent to the yearly water usage of 1,455 American homes. Among the ways in which Kroger plants reduced water use were recycling water on pre-rinse, recirculating cooling water, reprocessing rejected water from reverse osmosis plants, reducing water leaks and improving condensate return systems. Many water conservation techniques also reduce energy consumption.

Limiting employee movement through the plant has a water conservation aspect. Noe explained that “every room is a room. We do not do foot baths here. If you’re going to enter a highly sensitive area, we’re going to make you do a hygiene change and there are foot covers or we’re going to sanitize them with a spray.”

Those procedures make everyone focus on where they are going and why, he said.

“If you’re going to go into a micro-sensitive room, you’re going to have to go through a process,” Noe said. It forces associates to think about hygiene. They might think “Maybe I don’t even need to go in there. So that’s our point: Only people that need to be in those rooms should ever go in those rooms and they know the process.”

“I think Larry hit it on the head,” Sharp said. “Any of those hygiene issues can take away or can add a micro-load to milk that would take away from the quality.”

Conclusion

Kroger’s investment in Mountain View Foods shows its commitment to the dairy category, even though there is a long slow national decline in milk sales. But Sharp made an important point. Only sales of commodity milk sold in gallons are down.

“When you add in all of the ‘designer’ milks and milk innovations, it’s more flat than down. So what you’ve got is a shift of customers that are moving away from some of the traditional milks and going to some of these other higher-protein, lactose-free or other types of modified but still milk-derived products.”

For example, Kroger makes an ultra-filtered, low-lactose milk called Carbmaster at a plant in Kansas. The Denver plant plans other innovations.

“We didn’t call this Mountain View Dairy. We call it Mountain View Foods,” Nosewicz said. “And we called it Mountain View Foods for a number of reasons. But our primary reason is, we’re leaving ourselves open for all kinds of innovations.”

Before I left Denver, I asked Sharp if she got everything on her wish list for the plant.

“You never do,” she said. “It’s not that you didn’t start out that way but once you get into it, some things end up costing you more. We were subject to the euro. We didn’t get everything we wanted to but that’s okay, we’ll get it when we need it.”

As a manufacturing unit of a retailer, “we are very, very conscious of the return on capital that we provide the organization,” she said. “We only exist when we have a positive return on capital. So our team understands that. We understand that our role is to drive value out of the investment the company provides.”

At-A-Glance

Kroger Mountain View Foods, Denver

Interstate Milk Shippers plant 08-06 (100% enforcement rating, January 2015)

Opened: May 2014

Size: 215,000 square feet on 12 acres

Products made: Fresh conventional and organic milk, flavored milk, half-and-half, whipping cream, orange juice; aseptic liquid dairy products

Formats: Plastic and paper half-gallons and gallons; PET plastic 8-ounce, 16-ounce and 32-ounce bottles

Pasteurization: High temperature/short time

Blow molding: One stretch blow molder using pre-forms for PET bottles; two molders for HDPE half-gallons and gallons

HT/ST fillers: Three lines of half-gallon and gallon fillers

Aseptic fillers: Two in-line fillers filling 8-ounce, 16-ounce and 32-ounce bottles

Silos: Number and capacity (200,000 gallons) for raw milk, 8,000 liquid sugar