Sales were ticking up for the energy drink category according to data from Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Dec. 28, 2014. The $10.5 billion category saw dollar sales up 4.9% and units improved 5.4% to 4 billion.

The shelf-stable non-aseptic energy drinks segment, the largest in the category, showed dollar sales increase 6.3% to $9.3 billion, and units rose 6.5% to 3.7 billion.

Shelf-stable energy shots, did not fare as well — dollar sales fell 4.3% to $1.1 billion, and units dropped 3.9% to 341.8 million.

Though not quite a fumble, sales for the sports drinks category showed little improvement. While dollar sales increased 3.7% to $5.8 billion, units barely moved 1.5% to 3.2 billion. The shelf-stable non-aseptic sports drinks segment showed similar numbers. Dollar sales rose 4.1% to $5.7 billion, while units were up only 1.7%.

Shelf-stable aseptic sport drinks, the other (much smaller) segment in the sports drink category, struggled — dollar sales fell 55.9% to $4 million and units dropped 48.1%.

Shelf-stable non-aseptic energy drinks

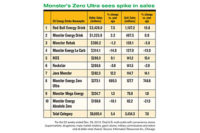

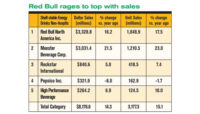

Among the top 10 in the shelf-stable non-aseptic energy drinks segment, Nos (owned by High Performance Beverage) had the biggest increase in unit sales, up 22.3% to 169.9 million, and dollar sales jumped 25% to $355 million. Segment leader Red Bull had a 7% increase in dollar sales to $3.7 billion, with units up 7.3% to 1.2 billion. Monster Energy took the second and third spots in the segment. Dollar were sales up 9.7% for its regular shelf-stable drinks, and units up 9.9%, while its Zero Ultra line saw dollar sales jump 25% and units increase 14.4%. However, Monster Energy’s Lo Carb and Absolute Zero took a hit: dollar sales fell 7.1% and 18.6%, respectively, and units were down 7% and 19.3%, respectively. Rockstar’s unit sales improved 6.3% and dollar sales were up a slight 3.8%.

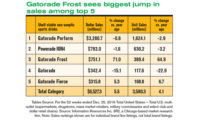

Sports drinks not hitting it out of the park

Gatorade (Quaker Oats Co.) and Powerade (Coca Cola Co.) dominated the top 10, though sales were up for one and down for the other. Gatorade’s Perform led the segment with $3.1 billion, but sales improved only 1.3%, and units increased 2.6% to 1.6 billion. Second in line, Powerade Ion4 saw dollar sales decrease 11.1% and units drop 14.2%. Winning the segment was Gatorade’s Fierce, units skyrocketed 5,381.1% and dollar sales jumped 735.1%. Original Gatorade also showed promise, units jumped 100.1% and dollar sales increased 44.2%. Original Powerade’s numbers were up significantly as well; sales improved 77.4% and units rose 67.6%. Gatorade’s X Factor saw unit sales skyrocket 89.2%, while dollar sales were up only 9.9%.