Based on the sales numbers, the popularity of natural versus processed cheese remains high as consumers continue to seek local, artisan options and clean labels. But one option has ticked up in popularity for both natural and processed — cheese shreds. On the flip side, the same can’t be said about grated cheese options.

The natural cheese category’s dollar sales were up 5.6% to $12.5 billion and units were up 2.2% to 3.6 billion in the 52 weeks ended Oct. 5, 2014, according to Information Resources Inc. (IRI), Chicago. In the processed cheese category, numbers improved very slightly with sales, up 0.1% to $3.1 billion, but units were down 5.3% to 873.4 million.

The natural cheese category includes:

- Shredded cheese ($4.5 billion annual sales; units up 1.2%)

- Chunks ($3.5 billion; units up 2.2%)

- Slices ($1.8 billion; units up 6.3%)

- String/stick cheese ($1.1 billion; units up 0.4%)

The processed cheese category includes:

- Processed/imitation cheese slices ($2 billion; units down 5.4%)

- Cheese spreads/balls ($451 million; units down 4.3%)

- Processed/imitation cheese-loaf ($360.7 million; units down 1.4%)

- Processed/imitation cheese-shredded ($75.9 million; units up 3.3%)

The natural shredded cheese segment saw dollar sales increase 6.4% to $4.5 billion and units were up 1.2% to 1.4 billion. Private label dominated sales in the category with $2.6 million, up 5.4%, but units were actually down 0.7%. Kraft Foods came in second in the category with dollar sales rising 7.2% to $842.7 million, with units up 2.9%. Among the top 10, American Heritage (owned by Schreiber Foods Inc.) saw numbers increase dramatically — sales jumped 1,184.8% and units went up 914.8%. Borden (produced by Dairy Farmers of America) saw a 16% sales increase, with units up 12.7%. Crystal Farms and Sargento’s Artisan Blends both struggled; sales were down 3.8% and 12%, and units were down 8.7% and 12.8%, respectively.

The natural slices segment saw the biggest sales increase (for the category), with sales rising 10.2% to $1.8 billion and units increasing 6.3%. Among the top five, Kraft’s slices jumped 35.9%, with units up 37.6%. Crystal Farms’ dollar sales rose 26.5% in this segment, with units up 28.7%. Kraft’s Cracker Barrel brand also saw dollars and units improve, 39.7% and 40.5%, respectively. In the natural chunks segment dollar sales were up 4% to $3.5 billion, units went up 2.2%. Once again private label dominated the segment with $1.2 billion sales (a 3.7% gain) and units increasing 1.1%. Cabotsaw a significant increase — dollar and unit sales jumped 33.1% and 20.1%, respectively. While Cabot’s Vermont brand struggled, sales dropped 27.2% and units fell 28.8%.

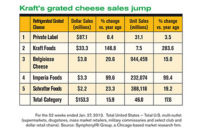

The refrigerated grated segment did not fare well for the natural category. Dollar sales were down 3.1% to $105.4 million, and units dropped 5.3%. Kraft’s dollar sales dropped 34.8%, and units fell 35.1%, in this segment. Doing well was Bella Rosa (Arthur Schuman Inc.), dollar sales rose 61.6% and units jumped 62.5%.

Sales in the processed/imitation cheese-shredded segment showed some promise for the processed cheese category. Dollar sales rose 15% to $75.9 million and units went up 3.3%. Kraft’s Velveeta brand beat out private label, with dollar sales up 52.5% to $47 million, and units up 28.3%. Go Veggie (Galaxy Nutritional Foods) saw dollar sales jump 223.6% and units rise 228.3%.

The processed/imitation cheese-slices segment dollar sales increased 1.4% to $2 billion, but units went down 5.4%. Kraft’s Velveeta had the greatest sales increases: 27.2% in dollars and 20.5% in units. Kraft actually held four out of five of the top five spots in this segment, while private label struggled with dollar sales down 1.9% and units down 9.4%.