It appears that consumers want to have their tea and coffee — and drink it too. The numbers are looking good for makers of refrigerated and ready-to-drink tea and coffee. The dollar and unit sales across these categories are up all around.

In the 52 weeks ended Aug. 10, 2014, the tea/coffee ready-to-drink category’s dollar sales were up 5.8% to $4.4 billion and units were up 4.3% to 2.2 billion, according to Information Resources Inc. (IRI), Chicago. In the corresponding refrigerated teas/coffee category, dollar sales were up 9.5% to $1.1 billion, with units up 8% to 501.2 million.

The tea/coffee RTD category consists of:

- Canned and bottled tea ($3.1 billion, units up 2.7%)

- Cappuccino/iced coffee ($1.3 billion, units up 11%)

- The refrigerated teas/coffee category (where many dairy processors compete) consists of:

- Refrigerated teas ($928.1 million, units up 6.5%)

- Refrigerated RTD coffee ($169 million, units up 24.7%)

- Refrigerated coffee concentrate ($2.7 million, units up 25.2%)

In the canned and bottled tea segment, dollar sales rose 3.9% to $3.1 billion, and units were up 2.7% to 1.8 billion. The sales of Lipton (Pepsi Lipton Tea partnership) and Arizona dominated the top 10 of this segment. Arizona led the segment with $660.7 million overall sales, despite a dip of 0.7%; units were up slightly, 0.4%. Lipton Pure Leaf’s dollar sales jumped 51.6% to $376.3 million, with units also up 49.2%. Next in line were Lipton Brisk and original Lipton; both saw only minimal success. Brisk’s dollar sales were up 2.8% to $343.2 million, with units up 0.3%; and Lipton original’s sales were up only 1% to $268.3 million, while units fell 0.7%. Also in the top 10, Snapple (Dr. Pepper/Snapple Group) saw little change: dollar sales were up 1.4% to $209.4 million, and units increased a scant 0.05%. Not in the top 10, but blowing away everyone else was Nestea— dollar sales skyrocketed 266.5% and units jumped 195.9%.

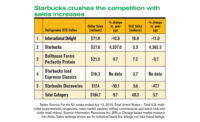

The cappuccino/iced coffee segment had similar success, dollar sales rose 10.7% to $1.3 billion, with units up 11% to 449.6 million. Starbucks’ brands (North American Coffee Partnership) took all five top spots for sales. Starbucks Frappuccino led the segment with $801.6 million (up 8.9%) and units up 8.3%. Starbucks original had the biggest jump; dollar sales were up 70.1% and units rose 59.3%. Starbucks Frappuccino Light struggled, with dollar sales down 4.3% and units down 3.5%. Coco Café Co. blew away the rest in the segment with dollar sales and units jumping 112.3% and 114.9%, respectively.

In the refrigerated teas segment, sales increased 7% to $928.1 million, with units up 6.5% to 455 million. The top five had a few standouts. Private label saw dollar sales up 11.7%, with units up 17%. Gold Peak’s (Coca Cola Co.) sales rose 19.6%, while units were up 21.2%. Milos Tea saw sales go up 15% and units increase 17.6%.

The refrigerated RTD coffee was the real winner. Sales for this segment were up 25.4% to $169 million, and units rose 24.7% to 45.7 million. Several companies in the top 10 had significant sales increases.Starbucks Discoveries saw dollars sales and units jump 473% and 491.9%, respectively. Bolthouse Farms’ dollar sales jumped 503.2%, and units were up 530.5%. Blue Diamond Almond’s dollar sales and units were up 414.5% and 387.1%, respectively. Califia Farms crushed its competition with dollar sales up a dramatic 1,348.6% and units up 1,476.5%. The average price for this company’s product went down 39 cents.