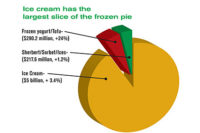

In this time when consumers are searching for those good-for-you foods and low-fat options, it appears that frozen yogurt is still in high demand. The dollar and unit sales for frozen yogurt are high above the rest of its frozen counterparts, with ice cream seeing minimal increases.

In the 52 weeks ended Oct. 6, 2013, the ice cream/sherbet category showed dollar sales up 1.4% to $6.1 billion and units up 2.7% to 1.6 billion, according to data from Information Resources Inc. (IRI), Chicago. Elsewhere in the frozen treats aisle, the frozen novelties category saw dollar sales drop 3% to $4.5 billion and units fell 5% to 1.5 billion in the same time period.

The ice cream/sherbet category consists of:

- Ice cream ($5.5 billion, units up 1.8%)

- Frozen yogurt/Tofu ($358.1 million, units up 26.5%)

- Sherbet/Sorbet/Ices ($212.5 million, units down 4.1%)

The frozen novelties category consists of:

- Frozen novelties ($4.2 billion, units down 4.4%)

- Ice cream/Ice milk desserts ($218.4 million, units down 24.9%)

- Ice pop novelties ($149.2 million, units down 11.2%)

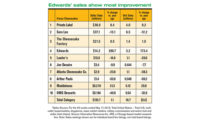

The frozen yogurt segment beat out its frozen competition with dollar sales up 21.3% to $358.1 million, and units jumping 26.5%. Among the top five, Healthy Choice (a ConAgra Foods brand) skyrocketed above the rest with dollar sales up 603% and units up 483.4%.Ben & Jerry’s (Unilever) also saw success with dollar sales up 48% and units jumping 45.2%. Kemps (Dairy Farmers of America) also showed dollar sales up 21.2% and units up 21%.

In the ice cream segment, sales went up, but minimally. The dollar sales were up 0.6% to $5.5 billion and units were up 1.8%. Among the top five, private label dominated in overall sales ($1.1 billion) but dollar and unit sales were down 4.3% and 3.2%, respectively. Häagen-Dazs (a brand of Nestlé) had success with dollar sales up 14.3% and units up 17.6%. Ben & Jerry’s showed promise, the dollar sales were up 5.6% and units also up 6.5%. Blue Bell saw its dollar sales go up 5.8% and units were up 3.8%. Breyers (Unilever) didn’t fare so well; the dollar sales were down 7.8% and units fell 3.3%.

Struggling even more than ice cream was the frozen novelties category, where dollar sales dropped 3% to $4.5 billion, and units fell 5% to 1.5 billion. In the frozen novelties segment, numbers were similar; dollar sales dropped 2.6% to $4.2 billion and units were down 4.4%. Among the top five in frozen novelties, the only company with numbers not in the negative was Nestlé Drumstick. Its dollar sales were up 5.1% (but units were down 3.1%). Skinny Cow (another Nestlé brand) struggled with dollar sales down 14.4% and units down 19.2%. Also struggling was Wells Dairy Weight Watchers — dollar sales dropped 12.7% and units fell 13%.

In the ice cream/ice milk desserts segment, dollar sales were down 4.8% to $218.4 million and units were down dramatically by 24.9%. Within the top five, Jon Donaire (a brand of Rich Products) saw some success with dollar sales up 5.2% and units up 8.8%. Private label saw the most struggles, as dollar sales decreased 24.5% and units dropped 11.4%. Carvel (Celebration Foods) led the segment in overall sales of $96.5 million, but dollar sales and units dropped 1.7% and 0.5%, respectively.