The numbers are looking great for makers of refrigerated coffee and tea; each category shows increases in both units and dollar sales. Data in the foodservice market are especially promising for cold coffees.

Research by Chicago-based Mintel shows that cold-served coffee’s share of all coffee on menus of U.S. restaurants and coffee houses increased from 19% to 22% between 2009 and 2012. And in the first quarter of 2013, its share jumped from 22% to 24%, which indicates the interest in iced and frozen coffee is now going beyond the summer-only appeal.

Mintel’s data also show that 18- to 24-year-olds (the Millennials) are the biggest consumers of ice coffee. Overall, one in five U.S. consumers drink iced coffee, but the figure jumps to 38% among those aged 18 to 24, compared to 11% of those aged 55 to 64 and 5% of those aged over 65.

In the 52 weeks ended Aug. 11, 2013, the overall refrigerated teas/coffee category shows dollar sales up by 13.9% to $1 billion, and unit sales up 10.3% to $461.3 million, according to data from Information Resources Inc. (IRI), Chicago.

The refrigerated teas/coffee category includes:

- Refrigerated teas ($858.9 million, units up 6.9%)

- Refrigerated ready-to-drink coffees ($142.5 million, units up 69.2%)

The much larger tea/coffee ready-to-drink category consists of:

- Canned and bottled teas ($2.9 billion, units down 0.2%)

- Cappuccino/Iced coffees ($1.1 billion, units up 5.8%)

The refrigerated ready-to-drink coffee segment saw the biggest success overall, according to IRI’s data (see table). Dollar sales skyrocketed 77.3% to $142.5 million, and units jumped 69.2% to 39.3 million. Dominating the segment in overall sales was International Delight(owned by Whitewave Foods Co.) with $96.2 million. The company’s dollar sales increased by 86.4% and unit sales were up 86.8%. Also seeing huge success among the top five: Bolthouse Farms’ Protein Plus (owned by WM Bolthouse Farms, a unit of Campbell Soup Co.) showed dollar and unit sales increase dramatically by 537.9% and 545.2%, respectively. Though a smaller player in overall dollar sales ($17,866), Zeigler’s(owned by Zeigler’s Beverage Co.) saw dollar sales jump 3,093.7% and units go up 3,434.5%.

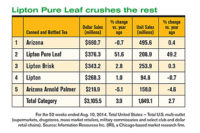

The refrigerated tea segment dominates the refrigerated teas/coffee category with $858.9 million in overall sales (see table). The dollar sales were up 7.5% and units rose 6.9%. Private label led the segment in overall sales with $167.8 million, with dollar sales up 2.4% and units up 1.6%. Among the top five, Gold Peak (owned by Coca Cola Co.) had the biggest increases, with dollar sales up 22.1% and units were up 19.9%. Turkey Hill’s dollar sales were up 7.8% and units jumped 10%. One company among the top 10 saw a dramatic increase in sales. Lipton Pureleaf (part of Pepsi Lipton partnership) saw dollar sales skyrocket 309.2% and units up 301.8%.

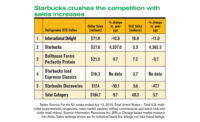

In the ready-to-drink tea/coffee category, the cappuccino/iced coffee segment also showed promising sales. With $1.1 billion overall sales, the dollar sales were up 6.6% and units were up 5.8%. Starbucks(part of North America Coffee partnership) dominated the top five, with its Starbucks Frappuccino leading the charge with $724.8 million. The dollar sales rose 3.6% and units were up 1.5%.