|

There are few stars in the refrigerated milk category as numbers drop. Flavored milks are among the few that showed increases in dollar and unit sales.

In the 52 weeks ended Nov. 4, 2012, milk dollar sales were down 0.1% to $15.5 billion, and unit sales dropped 2.3% to 5.3 billion, according to data from SymphonyIRI Group, Chicago. As the milk industry continues to try and remain above water, processors look to single-serve options and chocolate milk as a recovery beverage for relief (see page 38 for more on that story). But, the non-portable gallon side of the industry has its work cut out for it.

As defined by SymphonyIRI, the milk category consists of the following segments:

• Refrigerated flavored milk/eggnog/buttermilk ($959.3 million sales, units down 4.4%)

• Refrigerated kefir/milk substitutes/soymilk ($952.5 million sales, units up 15.2%)

• Refrigerated milkshakes/non-dairy drinks ($82.3 million sales, units down 2.2%)

• Refrigerated skim/lowfat milk ($9.7 billion sales, units down 3.4%)

• Refrigerated whole milk ($3.8 billion sales, units down 2.4%)

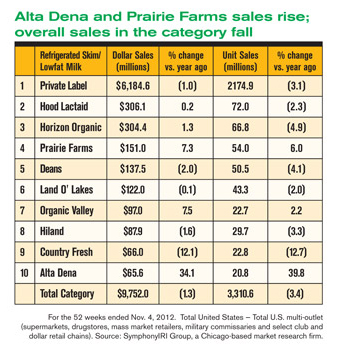

In the refrigerated skim/lowfat milk segment, dollar sales dropped 1.3% to $9.7 billion, and the units were down 3.4% to 3.3 billion in the 52-week period. Among the top five, Prairie Farms showed promise with its dollar sales up 7.3% to $151 million and units rising 6% to 54 million. Horizon Organic also saw an increase in dollar sales by 1.3%, but its unit sales dropped 4.9%.

Whole milk sales

In the refrigerated whole milk segment numbers weren’t quite as dire; the dollar sales dropped 0.5% to $3.8 billion and units were down 2.4% to 1.2 billion. Among its top brands, there were some promising sales increases. Borden’s dollar sales jumped 25.8% to $61.5 million, and its units were up 32.4%. Horizon Organic’s dollar sales were up 4.3%, but unit sales fell 0.9%. HP Hood’s Lactaid also saw a slight dollar sales increase of 1.5%, but units were down 0.3%. Hiland Dairy’s whole milk dollar sales increased 1.9% and its units also went up 1.3%.

Perhaps the most positive numbers in the category came from the refrigerated flavored milk/eggnog/buttermilk segment. While the overall dollar sales were down 0.1% to $959.3 million and its units fell 4.4%, companies in the top five saw promising sales increases. The biggest standout came from Dean Food’s TruMoo milk; the dollar sales jumped significantly (246.4% to $29.9 million), and the units rose 264.1%. The success for TruMoo could be attributed to its single-serve product offerings and that the percentages are calculated from a low base; the milk has been on the market just since 2011. Borden saw dollar sales rise 45.8% to $34.4 million and its units also went up 54.8%. Another dollar sales increase came from Prairie Farms, up 17.3% to $32 million, the unit sales were up 17.2%.

Milkshakes/nondairy sales

In the refrigerated milkshakes/nondairy drinks segment, overall dollar sales showed a 6.1% increase to $82.3 million, but unit sales dropped 2.2%. Among the top five, Bolthouse Farms Protein Plus saw the only increase in both sales and units. The dollar sales were up 94.3% to $14.5 million and its unit sales rose 106%. Also showing a slight increase was Rice Dream (Imagine Foods Inc.) with a 1.3% in dollar sales, but its units fell 1.7%. Rice Dream also led the segment in overall sales of $21.9 million. Hershey’s(processed by HP Hood) showed the worst numbers for this segment, the dollar sales were down 18% to $9.8 million, while the units dropped 23.1%.