Perhaps the unprecedented warmer fall weather in much of the United States was to blame for the melting of unit sales for frozen novelties and ice cream. Whatever the cause, only a few ice cream brands saw increases at the end of 2012.

In the 52 weeks ended Nov. 4, 2012, dollar sales in the ice cream/sherbert category went up 4.2% to $5.5 billion, but the unit sales were practically frozen, up 0.1% to 1.5 billion, according to data from SymphonyIRI Group, Chicago. (See the pie chart for a sales break down in segments for this category).

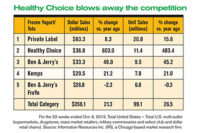

Dig a little deeper in the ice cream segment and it shows that only one brand (Blue Bell) in the top five saw a significant increase in unit sales; most dropped. (See table). Dollar sales were up 9.1% to $497.3 million for Blue Bell ice cream, and units were up 7% to 122.4 million. Private label led the segment with $1.1 billion dollar sales, up 4.1%, with units up 1.1% to 358.3 million. Also among the top five, Breyers’ dollar sales dropped 8.5% to $478.2 million, and units were down 12.9% to 129.3 million. Ben & Jerry’s dollar sales were up 3.8% to $312.7 million, but units were down 2.6% to 82.1 million.

In the frozen novelties category the numbers continue to melt. In the 52-week period, dollar sales were up 2.3% to $4 billion, but unit sales dropped 2.6% to 1.2 billion.

The frozen novelties category consists of the following segments:

- Frozen ice cream/ice milk desserts ($228.7 million sales, units down 38.8%)

- Frozen novelties ($3.6 million sales, units down 1.5%)

- Ice pop novelties ($165.3 million sales, units down 5.5%)

Among the top five in the frozen novelties segment, Nestle Drumstick’s dollar sales were up 8.6% to $232 million, the units were up 3.2%. Private Label led the segment in dollar sales, with a 1.4% increase to $464.1 million, but units fell 5.9%. Others struggled as well, like The Skinny Cow (owned by Dreyers Grand ice cream, a unit of Nestle), which saw its dollar sales fall 8.2% to $225.6 million, and units dropped 14.2%. Weight Watchers novelties (produced by Wells Dairy) also saw dollar sales down 6.1% to $203.9 million, and units dropped 7.6%. (See table).