There was no energy crisis when it came to demand for energy drinks in the 52 weeks ended Dec. 25, 2011. The category showed double-digit growth in both dollar sales (up 16.6%) and unit sales (up 17.6%), according to Chicago-based SymphonyIRI Group.

Although it’s the smallest segment in the category, single-serve aseptic energy drinks saw the largest percent gains: dollar sales were up 178% with unit sales increasing 155%. California Natural Products’ CalNaturale Svelte had a 350% increase in dollar sales while unit sales rose 357%.

Also up was the energy shot segment — dollar sales increased 17.5% to $1.1 billion. 5 Hour Energy Extra Strength from Living Essentials, Farmington Hills, Mich., led the segment with unit sales up more than 1,570% and dollar sales up 484% to $54.3 million. The energy drink mixes segment didn’t fare as well, with both dollar sales and unit sales declining (7.3% and 4.9% respectively). 4C Totally Light 2Go Energy Rush from Four C Foods Corp., Brooklyn, N.Y., was one of the few brands in the segment to post gains — dollar sales were up 54.5% to $1.2 million.

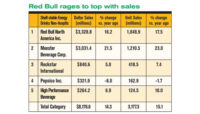

Single-serve non-aseptic energy drinks, the category’s largest segment, had a 16.6% increase in dollar sales to $6.5 billion. In the No. 8 spot, Rockstar International’s Rockstar Recovery’s unit sales increased 132% and dollar sales were up to $137.8 million (a 128% increase). No. 2 Monster Energy, from Hansen Natural Inc., Corona, Calif., had a 23% uptick in dollar sales ($1.4 billion) and a 25% increase in unit sales. The Coca-Cola Co.’s Full Throttle was the one top-10 brand to see a slip: 11.5% decline in dollar sales and unit sales down by 11.2%.

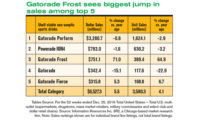

While the increases weren’t as large as the energy category, sports drinks too posted gains: unit sales for the category were up 11.3% and dollar sales were up to $4.1 billion, an increase of 8%. Non-aseptic sports drinks — the largest of the three segments — saw an uptick of 8.1% in dollar sales to $4 billion. While Purchase, N.Y.-based PepsiCo’sGatorade has seven of the top-10 spots including No. 1, not all were up. Sales slipped 18.5% for No. 3 Gatorade; 27.1% for No. 6 Gatorade Frost; and 58.8% for No. 8 G2. The largest gains in the segment came from No. 4 Gatorade G2 Perform with a 36.4% increase in dollar sales to $421 million.

In the aseptic sports drinks segment — up 39.6% in dollar sales to $25.9 million — Gatorade Prime had the No. 1 spot. Dollar sales rose 50% to $24.3 million. The sports drink mixes segment saw a decrease in both dollar sales (down 10.4%) and unit sales (down 14.6%). No. 8 Powerade Ion4, from Coca-Cola, saw the largest dollar sales increase of 176.6%. n