Staying competitive means keeping one eye on your own company’s operational costs and the other on the costs of your peers in your industry.

Financial and non-financial benchmarks

A business benchmark is any type of measurement used to compare some quantifiable component of a company’s activity or performance. These benchmarks can be financial such as plant cost per gallon of milk, manufacturing cost per pound of cheese, distribution cost per case, EBITDA (earnings before interest, tax, depreciation and amortization) and so on.

Benchmarks can also be non-financial such as inventory out-of-stock rates, gallons processed per hour and product yields. Business benchmarks provide valuable intelligence to help an enterprise make more enlightened business decisions. Benchmarks can be used to shape an enterprise’s business strategy by setting specific and quantifiable goals and monitoring the company’s performance relative to those goals.

Benchmarking is also the process of using comparable data to determine who or what is the very best and what that standard is. The key to using benchmarks is gathering relevant comparable information to determine an average or best practices standard and then comparing your information to that standard. Sounds easy, but how do you gather the benchmark information?

Some practical ways of securing this information in the dairy industry include:

• Active involvement in industry trade organizations where information is shared

• Review of available public company information

• Engaging an industry consultant that has access to comparable information

• Review of information available through the U.S. Department of Agriculture

To make benchmarking beneficial, the development of the standards must use information that is truly comparable. Since many dairy products are somewhat homogeneous, benchmarking for the dairy industry can be very helpful. However, comparing information from a fluid plant that primarily bottles gallons and half gallons serving large grocery chains to a fluid plant producing large half-pint quantities serving schools may not be very helpful. To benefit from a benchmarking study, the key component is to obtain the most comparable company information. Strategies and decisions could be misdirected if the right information is not used. Companies with multiple locations producing similar products should also consider comparing benchmarks for each location.

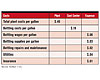

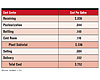

Detailed benchmarking information will produce more insightful results. Many companies know total plant costs, but it is more valuable to know unit costs for cost centers or departments within the plant and even more valuable to know unit costs for expense categories with those departments. To illustrate the levels of detail, see the following example of a fluid milk plant:

Best practices in a milk plant

An example of best practice benchmarks for a fluid milk plant using cost center levels are:

A fluid milk plant comparing its costs per gallon to the benchmarks in the table above would identify opportunities for improvement, whether it is process redesign, cost-cutting measures or productivity reviews. Such an analysis provides management with the insight to focus in the areas more likely to produce positive results. Benchmarks can also be used as goals for managers to achieve, often tied to employee incentive plans.

Financial benchmarks can also be useful in analyzing raw product and packaging costs. In a federally regulated market, class price differences based on location are readily determinable. However, financial benchmarks for other costs of milk procurement, such as premiums paid, could also prove beneficial. Benchmarking milk shrinkage amounts and fat content in the product are often enlightening. Benchmarks for the cost of containers and ingredients would indicate if you are purchasing these items at the best price.

You can find costs for butter, cheese and powder plants online. The U.S. Department of Agriculture (USDA), Washington, D.C., accumulates cost data from plants in California to establish and monitor allowances within the federal order pricing system.

Once the most relevant comparable data are obtained and the findings are analyzed in a benchmarking exercise, you will often realize your areas of strengths and weaknesses. Then, you determine ways to close any gap between what you and others, including competitors, are doing. For example, you may design a more efficient process to cut costs or explore ways to streamline certain processes and functions.

The ultimate goal is to bring your operation up to the standard considered the best in your industry, likely to result in productivity gains and increased profitability. n

By Carl Herbein, a certified public accountant and CEO and founding partner of Herbein + Co., Reading, Pa. He leads a team serving clients nationwide, including large multi-plant and small niche dairy processors.

Giffords Dairy, Babcock Hall Named Grand Champions at World Dairy Expo

Babcock Hall Dairy Plant, Madison, Wis., was selected as the Cheese and Butter Grand Champion, while Gifford’s Dairy, Skowhegan, Maine, was chosen as the Grade A & Ice Cream Grand Champion in this year’s Championship Dairy Product Contest, sponsored by the Wisconsin Dairy Products Association (WDPA) and Dairy Foods magazine.

The contest received a record number of 705 entries for cheese, butter, fluid milk, yogurt, cottage cheese, ice cream, sour cream, sherbet, cultured milk, sour cream dips, whipping cream, dried whey and creative/innovative products from throughout the United States.

Judging was held Aug. 16 at UW-Madison’s Babcock Hall and Aug. 17-18 at the Madison Area Technical College (MATC) Culinary School, Madison, Wis.

On Oct. 4, the contest’s auction was held at World Dairy Expo in Madison, Wis., where all category first-place winners were auctioned off. A portion of the proceeds went to fund the Dr. Robert Bradley Scholarship Fund, which is awarded annually to a deserving student pursuing a career in the dairy industry.

Go to www.dairyfoods.com /Articles/Dairy_News to see a list of all of the first-place winners.

Dairy Producers at Odds Over Proposed Policy Reform

Dairy producers are not solidly behind Foundation for the Future (FFTF), a dairy reform program from National Milk Producers Federation (NMPF), Arlington, Va.

On March 1, House Agriculture Committee member Collin Peterson (D-MN) and Congressman Mike Simpson (R-ID) put forward a draft legislation for a dairy policy program, based on FFTF that is designed to compensate farmers for the gap between feed costs and the milk price by providing a floor for producer margins during times of low margins to prevent an erosion of equity.

On Sept. 8, the House Agriculture Livestock, Poultry and Dairy Subcommittee held a dairy policy hearing with witnesses such as the U.S. Department of Agriculture (USDA) and officials from the Farm Service Agency (FSA) and Agriculture Marketing Service (AMS).

After attending the hearing, NMPF president and CEO Jerry Kozak, said “The general tone…indicates a concern that current dairy programs are not up to the task of providing a meaningful farm-level safety net. NMPF shares that concern, and that’s what has driven the creation of Foundation for the Future. We believe we have the best answer to the bottom line question of what should come next for dairy policy.”

Land O’Lakes, Inc., Arden Hills, Minn., endorsed the draft legislation, stating that “this bill will help ensure that America’s dairy producers, including Land O’Lakes members, are able to thrive in the future, after some very economically challenging years,” says Pete Kappelman, chairman of the Land O’Lakes board of directors and a Wisconsin dairy producer.

But John Pagel, owner of Pagel’s Ponderosa Dairy, Kewaunee, Wis., launched a website, www.stopsupplymanagement.com, to outline why he and other dairy farmers are opposed to the FFTF proposal. This site provides a forum for farmers, legislators and the public to share ideas, thoughts and facts about the topic.

“While I applaud NMPF for starting the much-needed conversation about dairy policy reform, I am strongly opposed to the supply management portion of the FFTF proposal,” Pagel adds. “Penalizing farmers for producing too much milk when the milk price declines takes money out of our milk checks when we need it the most.”

The National Dairy Producers Organization, Fresno, Calif., opposes part of FFTF, including the margin protection program and the stabilization program. In August, the group also urged “all dairy producers whose milk goes into making Class III inventoried products to voluntarily reduce their milk production by 5%.”

The International Dairy Foods Association (IDFA), Washington, D.C., urges all dairy processors to ask their representatives to oppose the bill.

“Most everyone now agrees that the price support program hurts dairy exports because it temporarily raises U.S. prices above international prices, yet the stabilization program operates in exactly the same way,” says Jerry Slominski, IDFA senior vice president. “National Milk [Producers Federation’s] proposal openly admits that its program will likely have this impact because it includes a provision that allows the secretary of agriculture to suspend the program if dairy prices are 20% above world prices for more than two months.”

This article was modified on Oct. 25, 2011 to clarify an editing error.

Dannon Opens R&D Center at Corporate Headquarters

The Dannon Co. opened a new research and development facility at its corporate headquarters in White Plains, N.Y., on Sept. 1. The $9 million facility occupies 14,000 square feet on the first floor of the headquarters.

Previously, the R&D team was based in Dannon’s pilot plant at its Fort Worth, Texas, processing plant. The White Plains facility, officially called the Dannon Discovery & Innovation Center, includes equipment for manufacturing dairy foods. The move to corporate headquarters will allow the R&D team to work more closely with the marketing team, which Stewart Townsend told Dairy Foods is “a great benefit.”

Townsend, the senior director of R&D, called the innovation center a scalable “state-of-the-art processing facility” where Dannon can perform the batching, pasteurizing, fermenting, cool down and packing processes and procedures involved in yogurt making. The plant, which has an Interstate Milk Shippers certificate, received milk the day after opening and began yogurt processing, Townsend said. Dannon will not be selling any product it makes here, however.

Townsend said the location of the R&D center within a headquarters building is unique within the Dannon organization. In France, Danone is located in Paris and its pilot plant is in the suburbs.

The innovation center occupies what once was office space. The second floor of the headquarters is home to marketing, finance, administration and other departments. The 40 R&D center employees consist of technicians, product developers, sensory experts and scientists. A separate section of office space is reserved for suppliers who will work on-site with Dannon employees. This arrangement will “accelerate collaboration, spur innovation and ensure integration at every stage of the development process,” according to a press release.

Current research involves improving the existing portfolio of products and developing new product concepts, Michael Neuwirth, senior director of public relations, told Dairy Foods.

In addition to developing new foods, Dannon will be researching processes and packaging.

Dannon, with 2010 sales of approximately $1.25 billion, ranks No. 24 on the Dairy 100, Dairy Foods’ annual ranking of North American dairy foods processors. In February of this year, Dannon introduced a French-style yogurt to the U.S. market.