The healthy halo of orange juice became a tad smudged in the last year. While the beverage continues to dominate the refrigerated juices and drinks category, dollar sales dipped 1.2% and units were down 3.2% in the 52 weeks ending April 17, according to SymphonyIRI Group, a Chicago-based market research firm. For the period, the entire $4.4 billion refrigerated juices and drinks category increased 1.8% in dollar sales and 1.5% in units. Orange juice, at $2.5 billion, accounts for 57% of the sales in that category. Fruit drink was the second-largest segment of the category.

Meanwhile, three other beverage categories shot up the charts, showing double-digit sales increases. They were: No. 5 juice and drink smoothies (21%), No. 3 lemonade (16%) and No. 10 vegetable juice/cocktail (13%), which totaled $41.3 million in sales. There’s a large drop-off after that. Fruit nectar, No. 11, claimed just $15.7 million in sales.

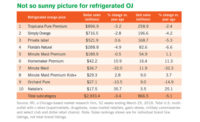

Tropicana Pure Premium refrigerated orange juice from Tropicana Dole Beverages led the orange juice category with sales of $805.4 million (down 5.3%). No. 2 was Minute Maid’s Simply Orange ($456.8 million, up 15%) and No. 3 was private label, with sales of $451.3 million, down 3.7%.

Fruit drinks and lemonades

The fruit drink category rung up $685.2 million in sales and showed a 7.4% increase in units. Top brands in the category were Minute Maid Premium ($136.5 million), Tropicana Dole’s Trop 50 ($106.7 million) and two from Sunny Delight Beverage Co.-Sunny Delight, $93.9 million and Sunny D, $92.2 million.

Minute Maid captured the top three spots in the lemonade category, with its Simply Lemonade leading with $154.6 million, followed by Minute Maid Premium ($38.2 million) and Simply Limeade Refrigerated Lemonade ($25.8 million). Dairy processor Turkey Hill claimed the fourth spot with sales of $23.4 million.

In the single-serve bottled juice category, sales decreased 0.3% to $3.8 billion, while units increased 2.3%. There was no growth in average price per unit.

The star of the category was bottled fruit drinks - sales rose 8.2% to $903.1 million and units increased the same percentage to 551 million. Tomato/vegetable juice/cocktails also fared well, with dollar sales up 3.3% and unit sales up nearly 3%. Other flavors of single-serve bottled juices were not so fortunate. Fruit juice blends dropped nearly 15% to $271 million and grape juice sales dropped nearly 13% to $230 million.

Among fruit drinks in single-serve bottles, the Big 3 brands were Hawaiian Punch (Dr Pepper/Snapple Group) with sales of $157.2 million, up 6.6%; Tampico (Marbo) $88.6 million, down 9.4%; and V 8 Splash (Campbell Soup Co.) $77.3 million, up 15%.

Ocean Spray Cranberries Inc. had two of the leading brands in the $683 million cranberry cocktail/juice category: No. 1 Ocean Spray Cranberry Cocktail/Juice drink ($335.7 million) and No. 3 Ocean Spray Light ($75.7 million). Private-label brands ($129.3 million) were No. 2.

Single-serve bottled apple juice was a $548.3 million category, showing a 0.4% dip in sales but a nearly 2% increase in units. Private-label brands accounted for $206.2 million in sales, followed by Dr Pepper/Snapple Group’s Motts brand ($100.7 million).

Up-and-coming flavors in the single-serve bottled juice category were aloe vera juice (sales up 30%, units up 61%), smoothies (22%, 34%) and pineapple juice (17.5%, 27%). Admittedly, the increases come from a small base. Of these three flavors, pineapple juice sales, at $15.7 million, were the greatest. Players in the aloe vera juice space include Fruit Of The Earth, Vera Products, Southern Fields Aloe, Faraon Foods, Jayone Foods and Warren Laboratories.

Aloe vera could be the flavor and ingredient to watch, as Americans continue to show interest in their health and wellness.