“There are cheaper, less tasty ingredients available - we simply choose not to use them,” says Mallory Kates, CEO of Tellory. “We have been approached before by companies interested in buying us; Sartori is clearly the right fit. They understand and share our values and commitment to quality and customers. It’s very exciting for us to become part of a team that will not only help us continue to grow, but who can bring us so much in terms of production expertise and quality assurance.”

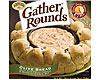

Upscale and easy are two terms that appeal to consumers who enjoy hassle-free home entertaining. These terms also describe new La Terra Fina Gather Rounds, a line of artisan breads with gourmet dips from Circle Foods Group, San Diego. More than a mere appetizer and far from just another frozen bread, Gather Rounds are a new way to entertain and a new category for the frozen foods department. These puffy, golden-brown bread rounds are designed to be pulled apart and dunked into a warm and creamy dip center. Consumer preparation is a snap: retrieve from the freezer, heat the pre-baked bread in the oven for 20 minutes, microwave the dip for four minutes and place it in the middle of the bread. All five varieties include dairy components, some more than others. Paprika Focaccia with Cheddar Beer Dip uses Cheddar and sour cream in the dip base. The Italian-style Garlic Bread with Basil Marinara and Melted Mozzarella Dip includes diced mozzarella in the red sauce. The Potato Bread with Asiago Bacon Dip combines asiago with cream cheese, while both Olive Bread with Sun Dried Tomato & Roasted Garlic Dip and Rosemary Bread with Spinach Parmesan Dip use sour cream as a dip base. The latter variety includes Parmesan cheese.

General Mills Inc., Minneapolis, is test marketing Yoplait Parfait, a container of fat-free vanilla yogurt accompanied by a dome filled with Nature Valley granola. Sold in six-packs of 6-ounce servings that provide 15% of the Daily Value of vitamins A and D, the product can be found in select Sam’s Club outlets. A single cup contains 170 calories and 2.5 grams fat.

Many processors spent a good part of 2010 reformulating products to contain less sodium, a buzzword in the health and nutrition community. As a result, Kraft Foods Inc., Northfield, Ill., introduces Breakstone’s 30% Less Sodium Cottage Cheese. Available in both 2% and 4% milkfat formulations, a 3.5-ounce serving now contains 290 milligrams of sodium.

Two Chicago

entrepreneurs developed Sleepyhead, a fluid dietary supplement based on milk and soy and designed to promote the onset of sleep. Bayswater Beverages LLC, markets the product in 5.5-fluid-ounce individual servings. Cans cost $2.59 and are typically merchandised in a countertop display at convenience stores, much like energy shots, which have the opposite effect. Each serving contains 278 milligrams of the sleepyhead proprietary blend of valerian extract root, gamma-aminobutyric acid, more commonly referred to as GABA, and melatonin; all ingredients associated with putting the “zzz” back into one’s bedtime routine, as the “counting sheep” caricature shows on the product label. It is designed to be consumed 15 to 30 minutes before one plans to hit the hay, and is said to be delicious warm or cold. Each can contains 80 calories and the drink is sweetened with sucralose, which prevents anyone from experiencing a sugar rush.Subscribe to Dairy Product Innovations (www.dairyfoods.com/dpi), an e-newsletter focused on new dairy products and new products and services from dairy industry suppliers. Subscribers receive Dairy Product Innovations monthly with the occasional special installation or themed issue focusing on specific niches such as artisan cheese or organic and natural foods. To subscribe, visitwww.dairyfoods.com.

Noteworthy Introductions

Polly-O is a Kraft Foods brand of Italian cheeses manufactured at the company’s remaining natural cheese production facility in Campbell, N.Y. Jalapeño String joins the growing category of snacking cheese.Lancaster County, Pa.-based Turkey Hill Dairy offered its egg nog fans a lower-calorie, half-the-fat version this winter. With 150 calories and 4.5 grams fat per half-cup serving, new Light Vanilla Nog provides guilt-free indulgence.

International

Co-branding is among the most common product innovation strategies in the food industry, but in the dairy industry, efforts to simultaneously promote two brands are often confined to the yogurt and ice cream segments. Now cream cheese can add itself to that list, with Kraft’s launch of Philadelphia Cream Cheese with Milka Alpine Chocolate in Germany. Milka is a leading confectionery brand throughout Europe, which Kraft acquired with its purchase of Cadbury in early 2010. Not only is the co-branding unique, but the chocolate flavor is also something not normally found in the cream cheese category.Squeezable pouch packaging has been an important trend in European kids’ beverages and snack foods for several years. These products are generally based on fruit purée or juice and are positioned as smoothies or drinkable snacks. But now Asda, a major U.K. discount retailer with a strong private-label program, introduces this packaging to the dairy category. Chocolate Dairy Squeezy Pouch is chocolate milk in reclosable flexible plastic. The pouch appeals to kids because it is fun and easy to drink, making it easier for parents to get kids to drink more bone-building, nutrient-dense milk.

Contributed by Krista Faron, director of innovation and insights, Mintel Research Consultancy, Global New Products Database (GNPD). For more information call 312-932-0400 or visitwww.gnpd.com.

Focus on cheese

Though the ingredient statement of most cheeses consists of just four ingredients - milk, cultures, enzymes and salt - the type of each of these ingredients, as well as the aging process is what makes Cheddar and Swiss so different. An increasing number of cheesemakers are further creating points of difference by promoting their use of milk from family farmers. For example, to kick off the New Year, St. Louis-based Swiss-American Inc. introduced the American Farmhouse brand, which is a full-range of private-label commodity cheeses made from family-farmed milk.Private-label cheese offerings continue to grow, and for some, have gone gourmet. At the end of 2010, Publix Super Markets, Lakeland, Fla., introduced a line of domestic and imported specialty cheeses to its self-service deli case, marking the first time that the retailer has offered store brand (Publix Deli) specialty cheeses. The domestic varieties include asiago, brie, Cheddar, goat and Swiss. The imports are French Brie, Italian Parmigiano-Reggiano, Italian pecorino romano and Spanish manchego. Other varieties will be added throughout 2011, in particular more imports. According to the company, associates from the Publix Deli retail business unit traveled overseas to the best cheese-producing regions of the world to learn more about specialty cheeses. They believe they identified the best product mix to offer their customers who have expressed interested in exploring new cheeses with unique tastes.

Better-for-you is another growing trend in the cheese category, both here and abroad. Lifeline Food Co., Seaside, Calif., debuts Lifetime Fat Free Cheese Snack Sticks, which should be hitting retailers’ shelves in March. At only 33 calories per stick (0.83 ounces), these pasteurized process cheese snacks are high in protein (7 grams) and void of fat, which makes them a satiety-inducing, adult-friendly snack from lunch to dinner. Sold in packs of six individually wrapped sticks, there are four varieties: Cheddar, mozzarella, sharp Cheddar and Swiss.

Overseas, Kraft is the first to offer Australians a pasteurized process cheese product enhanced with plant sterols to lower cholesterol. New Kraft Live Active Light Cheese Slices also contain 50% less fat than regular processed cheese and are an excellent source of calcium. Only time will tell if the company will offer Americans a similar product.

Puteaux, France-based Campagnie

des Fromages et Richesmonts, introduces a 25% reduced sodium version of its award-winning Coeur de Lion Camembert cheese. The 17% fat cheese has a refrigerated shelf life of 45 days.

Snacking cheese is growing throughout Asia. In South Korea, Dongwon Dairy Food rolled out Walnut & Dutch Gouda Cheese Sticks to appeal to an older demographic. The marketer makes claims that, in addition to possessing a more sophisticated flavor profile, the cheese sticks have anti-aging, brain health and cholesterol benefits based on the natural goodness of the ingredients, plus some additional vitamin fortification.

Of all the recent cheese innovations, this one stands out, as it is frozen. In Japan, Morinaga introduces a frozen novelty that starts with a seemingly ordinary cheesecake ice cream base, but then adds Cheddar and Camembert cheese for a decidedly Japanese touch. Since dairy foods have not traditionally been a part of Japanese cuisine, it is unusual to see such bizarre concepts.