To some consumers, a drink is just a drink. To others, it’s a liquid product that delivers innovation, nutrition and a bounty of flavor combinations.

In fact, many of today’s shoppers aren’t settling for run-of-the-mill beverages. They want functionality and quality all at a reasonable price.

That’s why today’s beverage processors – including milk bottlers reaching beyond dairy drinks – are amping up their lines to offer a team of new beverage options that hybrid between each other’s flavor techniques.

Juice marks the spot

It’s no secret that consumer spending is down. According to data from Chicago-based Information Resources Inc. as of June 28, refrigerated juices and drinks are down 2% in dollar sales from a year ago. However, IRI stats also show that the category is up 1.6% in unit sales. That’s because many consumers maintain brand loyalty and continue to take advantage of the many new product offerings.“Consumers continue to seek variety in their food and beverage choices, and juice is no different,” says Layla Baughn, brand manager for Minute Maid, which is owned by the Coca-Cola Co. and co-packed by various bottlers including dairy processors. “In addition, consumers are willing to pay a little more for premium products that go above and beyond.”

In response to consumers’ craving for nutritious juice drinks, the Sugar Land, Texas-based company introduced a team of Minute Maid Enhanced juices, which provide active consumers with flavorful health and wellness solutions, Baughn says.

“More consumers are looking to juice and juice drinks to provide nutrition,” Baughn says, “whether it is naturally occurring (e.g., vitamin C in orange juice) or via nutritional enhancements.”

Meanwhile, companies like Odwalla launched a lineup of premium, all-natural juice options.

“Even with the weak economy, many consumers are still seeking quality products like Odwalla,” says Chris Brandt, vice president of marketing for the Half Moon Bay, Calif.-based company. “Consumers continue to seek variety in juices and juice drinks, and are willing to pay a little more for premium quality.”

For instance, the Mojito Mambo and the Pomegranate Strawberry natural juice quenchers are rich in vitamins C and E, offer one-half the calories and sugar than leading juices and are made with all-natural ingredients.

Another new trend, Brandt says, is the increasing consumer interest in natural products.

In the superpremium juice category, new functional beverages and flavor combinations are a must, says Mikel Durham, general manager for The Naked Juice Co. “Consumers are increasingly aware of how their dietary choices affect overall well being,” he says. “They don’t want synthetic functional beverages; they want all-natural beverages with functional benefits.”

In response, the Azusa, Calif.-based beverage processor introduced its version of a pomegranate juice, which is loaded with antioxidants and – according to the company – the equivalent of 41/3 California pomegranates, as part of the Protein Zone line. The Mango version offers a blend of mango, orange and apple juices, while the Double Berry variety consists of a blueberry and strawberry fusion. Both options bring more than three servings of fruit and 30 grams of protein per 15.2-ounce bottle.

Moreover, other juice products are developed to offer more than just a couple of vitamins and a fruity taste.

Evolve brand kefir, produced by Mountainside Farms in Hackensack, N.J., released Blueberry and Pomegranate flavors that contain 11 live and active cultures, including two probiotic strains, and are enriched with fiber, protein and calcium.

Juiced-up tea

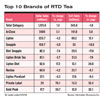

According to IRI stats as of Aug. 9, the ready-to-drink tea market raked in $1.2 million, with a 1.3% increase in sales from a year ago. This segment is a booming business for dairy processors like Turkey Hill and Wawa Beverage Co., both based in Pennsylvania, where RTD tea enjoys wild popularity.That’s because today’s RTD tea makers are tapping into neighboring beverage categories to bring an antioxidant-enriched tea product that’s dripping with a juicy kick.

For instance, Snapple re-introduced its Mint Tea flavor for a three-month timeframe beginning in September, and is its first debut since the Plano, Texas-based parent company Dr Pepper Snapple Group discontinued it in 2007. According to several news releases, Snapple brought back this flavor after consumers voiced demand throughout various social networking sites.

Furthermore, it doesn’t hurt that RTD teas already offer a host of healthy attributes, such as antioxidants, vitamins and other life-enhancement properties that almost no other product on the market delivers.

Through research and development, scientists have found an increasing emphasis on health with regards to tea, says Troy Seeley, president of Sayan Health, Beverly Hills, Calif., such as antioxidants and how they support the immune system, or the inclusion of digestion or detoxifying properties that focus on prolonging one’s life.

Likewise, ZredT produced ZT, which is a line of all-natural rooibos red teas. The Baton Rouge, La.-based manufacturer blends rare rooibos plants, which only grow in the Cederberg Mountains of South Africa, with organic inulin and organic clarified brown rice syrup to create a tea that is low in calories and contains zero caffeine and sugar. The line comes in Unsweetened, Lemon, Vanilla and Ginseng & Honey choices.

Companies like Lake Success, N.Y.-based AriZona Beverage Co. also are getting into the mix thanks to its new line of organic teas, which are certified USDA organic, contain natural antioxidants and are only 50 calories. They come in Pomegranate, Yumberry and Green Tea flavors, and offer a blend of organic green tea, orange juice and organic cane juice.

“The greatest opportunity for growth in the juice and juice drink category is for immediate consumption – single-serve juices and juice drinks – as well as foodservice,” Baughn says. “Consumers are seeking convenience and variety.”

Watered down

On the other hand, according to IRI, the still water category has plunged 7.1% since last year and dropped 4.4% in unit sales, as of Aug. 9, which is a staggering difference from its 5.23% increase in sales and 12.36% rise in unit sales, as of March 30, 2008.Why has this category become so watered down?

“There continues to be more and more water/drink SKU’s competing for the same dollar each year,” says David Morris, director of manufacturing for the water/juice plant at Tyler, Texas-based Brookshire Grocery Co. “The trend for the water plant has been a decrease in gallon water and premium fruit drink demand, no growth in low-end flavor drinks [and] steady growth in refrigerated fresh-brewed tea in gallon and pint.”

That’s why companies like AriZona Beverage introduced still water lines that cross over into other beverage categories and bring a bit of tea and juices to the once-trendy product.

For instance, AriZona’s organic tea water lineup is made with Poland Spring brand natural spring water mixed with organic green tea and sweetened with cane juice. These certified USDA-organic items come in Pomegranate, Green Tea, Yumberry and Mandarin Orange varieties.

Moreover, SOL Elixirs LLC presented solixir, a line of all-natural sparkling botanical beverages, which blend sparkling spring water with pure fruit juice and offer more than 1,700 milligrams of standardized natural botanicals in each 12-ounce bottle to “hydrate the body and soul.” Plus, they come in such flavors as Blackberry Chamomile, Orange Mate and Pomegranate Ginger.

Additionally, Glacéau Vitaminwater, a division of Coca-Cola Co., launched a low-calorie line called Vitaminwater10, which contains 10 calories in each 8-ounce serving compared to the 50 calories that’s in the regular versions.

Even though the water category may be getting a bit dried up, beverage processors still continue to view their economical situation with a glass half full.

“We believe the outlook is bright and we look forward to continued growth in our juice and juice drink business and a growth in the category,” Baughn says.

Whether it’s juice, tea or water, today’s beverages are a fusion of flavors that deliver a bottle of healthy innovation.

Fast Facts: Juice

Source: Mintel

Packaging that's smart

Sustainability is an important attribute to consumers, says Mikel Durham, general manager of The Naked Juice Co., Azusa, Calif., which is why his company is creating a more earth-friendly juice product.“Our efforts include becoming the first nationally distributed brand to transition to 100% post-consumer recycled PET bottles,” he adds, “and becoming the first U.S.-based juice company to team up with the Rainforest Alliance for sustainable fruit procurement.”

As a result, Naked Juice introduced the Naked reNEWabottle, which are translucent, 32-ounce bottles made with 100% recycled product. This transition reduces plastic consumption by 1 million pounds and 8,192 oil barrels per year. Additionally, the bottles are easy to identify because they feature the Rainforest Alliance Certified seal.

“Environmental changes are a major factor influencing our business decisions,” Durham says. “The Naked reNEWabottle is a bottle made from other bottles and truly embodies our commitment to creating a more earth-conscious juice. Our mantra is ‘reduce, reuse, recycle, reincarnate.’”

Fast Facts: tea

Source: Mintel

Get energized, then relax

Toting healthy benefits is just one way beverage processors lure consumers to their share of the shelf. Other beverages do so thanks to its weight loss and energy induced attributes.For example, Funktional Beverages created Red Stuff, which is a line of hybrid sports drinks that combine energy, appetite control, calorie burners and 100% natural GRAS fiber.

Red Stuff hinges its appetite control on LuraLean, which is the only fiber in the world that expands 200 times its original size to induce a full feeling, says Darrell Duchesneau, chief executive officer and co-founder of the Tomball, Texas-based company.

On the other hand, companies like Vitila Brands are taking advantage of the alternative beverage marketplace. Tranquila is a formula that diminishes stress and offers relaxation and comes in a 2-ounce shot. The Original variety helps balance moods and offers an energy boost while the PM option is made with melatonin to enforce habit-forming sleep. According to a press release, both are proprietary blends of immune-enhancing vitamins, minerals and herbal extracts that offer a green tea/lemon flavor.

Fast Facts: water

Source: Mintel

Where's the soy?

According to the Beverage Institute of Health & Wellness, soy-based beverages offer a plethora of nutrients, including protein, carbohydrates, potassium, vitamin B, iron, phosphorus and trace amounts of sodium and magnesium, just to name a few.Despite this apparent bounty, sales of soy-based products are off this year, which may be welcome news to dairy processors, depending on whether they’re also playing in the soy game.

In a study conducted by Chicago-based Mintel, the soy food and beverage market reached $1.4 billion in 2008, but the market for soy-based products dropped 0.4%. Mintel blames the drop on consumers with allergen concerns, as well as those on tight budgets who tend to cut soy products from the grocery list.

Among dairy processors, Dean Foods raised some hackles by backing away from organic status for its Silk line of soy beverages.

WhiteWave Foods Co., the Broomfield, Colo.-based division of Dean Foods, launched a Silk soymilk line nearly two decades ago, but has since expanded its options to include Silk Light, Silk Organic and single serves in Chocolate, Original, Vanilla and Very Vanilla flavors. The dairy giant only uses soybeans from China, thus building a commanding share of the market overseas versus supporting American-based farms.

Meanwhile, Boulder, Colo.-based Hain Celestial Group continues to expand its Soy Dream line of soy-based beverages, launching a “new and improved” version of certified-organic Soy Dream Enriched, fortified with vitamins A, D, B12 and E, and sweetened with organic cane juice. Hain also has rolled out Kidz Dream Smoothies, a fortified blend of fruit juice and soymilk.

Hain’s West Soy brand continues to offer an extensive line of soy beverages, including reduced-fat and nutrient-enhanced soymilks and shakes; the brand’s Longevity product claims to help promote heart and digestive health, energy and calcium absorption.

Links

- State of the Industry 2009: Butter--Spreading It Thin

- State of the Industry 2009: Cheese -- Spices and Slices

- State of the Industry 2009: Ice Cream--Chilling Effect?

- State of the Industry 2009: Ingredients--Ingredients With Purpose

- State of the Industry 2009: Milk--Flowing Downhill

- State of the Industry 2009: Yogurt -- It's Alive

- State of the Industry 2009: Introduction

- State of the Industry 2009: As the World Turns (Global Report)