It’s no surprise that yogurt sales are through the roof. Scientific advancements allow processors to develop yogurt with probiotics, fiber, live active cultures and so on.

And to some in the industry, these enhancements aren’t just a trend – they’re a way of life.

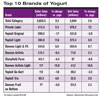

According to Chicago-based Information Resources Inc., yogurt sales lead the pack in terms of the cultured products market as a whole, raking in a 3.3% rise in sales and a 2% increase in unit sales, as of Aug. 9. Although refrigerated dip brand sales are up 3.8%, the category broke even in unit sales.

These stats pale in comparison to their counterparts, such as cottage cheese, which plummeted 5.8% in sales and dropped 4% in unit sales, while sour cream barely eked out a 0.6% rise in sales and ended with a mere 1.4% increase in unit sales, IRI data says.

Yogurt heats up

Refrigerated yogurt continues to dominate the market and market growth, according to a November executive summary published by Chicago-based Mintel Group. The survey says primary gains came from yogurt with pro-health positioning, such as digestive health, which accounted for 10% market share, and organic and natural claims, which contributed to 12% total sales.That’s because several processors are heating up the fridge with healthy and innovative products.

“Beginning in 2006, Dannon’s Activia introduced probiotics to a mainstream consumer audience and began a conversation about how yogurt and other products can deliver clinically proven, functional benefits,” Neuwirth says. “Since then, additional probiotic products, such as DanActive, and the new products we introduced this year, Activia Fiber and Activia Drinks, have helped us extend the benefits of probiotics to a wider consumer audience.”

Dannon also has revamped some of its packaging. “We recently introduced 4-ounce multi-packs for our Light & Fit brand, which are a more economical and convenient choice for consumers and easier to stock for retailers,” Neuwirth says. “The multi-packs also use form-filled-sealed technology, which uses significantly less plastic to produce.”

For its part, Horizon Dairy launched a value-added yogurt option that’s made for toddlers. The Little Blends line combines organic whole milk yogurt with natural fruit and vegetable purees to deliver a daily value of 20% calcium, 25% protein, omega-3 DHA and protein.

Meanwhile, General Mills’ Yoplait line now includes YoPlus Light, which contain a blend of probiotic cultures and a natural dietary fiber with 36% fewer calories. The line comes in Light Key Lime Pie, Light Honey Vanilla and Light Strawberry Banana varieties.

“Early in 2009, the Yoplait Light Thick & Creamy line added Cinnamon Roll and Cherry Cobbler varieties. Yoplait Original yogurt launched three new 99% fat free superfruit-flavored yogurts: Cherry Pomegranate, Blackberry Pomegranate and Blueberry Açai,” says Zoe Schwartz, marketing representative for Minneapolis-based General Mills, owner of the Yoplait brand. “Fiber One Yogurt also debuted in four delicious flavors and just 50 calories per serving. And Yoplait Delights yogurt parfaits launched this fall, a creamy blend of layered yogurt flavors, such as Chocolate Raspberry, Lemon Torte, Triple Berry Crème and Caramel Crème.”

In December, Organic Valley plans to introduce a live, organic, low-fat, pourable yogurt in a 32-ounce bottle that contains Thrive, which is the La Farge, Wis.-based company’s proprietary blend of billions of good probiotic cultures.

“Our ‘Thrive’ concept is unique in its use of certified organic milk, a prebiotic inulin to assist with the growth of the beneficial probiotic bacteria in the gut, as well as an aid in calcium absorption,” says Eric Newman, vice president of sales for Organic Valley and Organic Prairie Brands, “and uses solely Agave syrup, a low glycemic index sweetener.”

The Berry flavor is made with agave nectar and bursts of whole berry puree while the Vanilla variety is made with agave nectar and Fair Trade vanilla. The line also includes a Plain option. In addition, the yogurts contain no added gums or stabilizers, are an excellent source of fiber and calcium and each serving contains 2 grams of organic inulin, per a company press release.

Dipping into goodness

Because more and more consumers are eating in versus going out, dip makers are beefing up their product lines to provide them with some at-home indulgence.Reser’s Fine Foods, for example, introduced Stonemill Kitchens, a line of premium refrigerated dips that are made with real parmesan and mozzarella cheese, artichoke hearts, shrimp and pepperoncinis, in the same family as bell and chili peppers.

“Stonemill Kitchens is available in eight parmesan cheese or sour cream-based recipes that can be used straight as a chip or vegetable dip, or used in appetizer or main course recipes as a topping or ingredient,” says David Lakey, vice president of marketing for the Portland, Ore.-based company.

The line is available in Artichoke & Parmesan, Three Cheese Pepperoncini, Spinach & Artichoke Parmesan, Seafood & Parmesan, Artichoke & Jalapeño, Cajun Seafood and Crab & Roasted Corn varieties.

For its part, Heluva Good created White Cheddar & Bacon and Jalapeño Cheddar sour cream dip flavors, both delivering a clump of spice in a creamy texture.

On the other hand though, dip manufacturers continue to face oncoming challenges, sometimes without warning. Food safety, for instance, is a constant challenge, Lakey says.

Plus, home-office merchandisers continue to make demands about programs, payments and support materials from the vendor, Lakey adds, that there’s often a lack of pristine control. “Many operator cultures give wide latitude to store management to opt out of distribution, promotions or pricing guidelines,” he says. “Either store training and discipline should improve or expectations at the headquarter level should be adjusted.”

Regardless of how the dip community churns out, the overall outlook for this category remains healthy. “New technologies and flavors will add product news to the category,” Lakey says.

Dollop of digestive health

While yogurt and dip processors are churning over thanks to high sales margins, cottage cheese makers are doling out products that offer similar health-enhancing characteristics as its dairy counterparts in hopes of boosting their numbers.For example, Friendship Dairies offered a lineup of all-natural cottage cheese products, containing live probiotic cultures and prebiotic fiber. The Digestive Health option is made with low-fat milk and one-half cup delivers a good source of calcium, prebiotic fiber and protein. Additionally, the enriched prebiotic fiber from chicory root helps stimulate growth and increases calcium absorption and bone health.

The Jericho, N.Y.-based unit of Dean Foods also offers Digestive Health 2%, which is a low-fat, small curd cottage cheese that comes in a 16-ounce container.

Meanwhile, cream cheese producers are experiencing a similarly lumpy outlook.

According to Chicago-based Mintel, cream cheese sales are expected to surpass cottage cheese as the third largest segment due to a 4.4% growth in sales in 2009 and projected year-over-year increases through 2013.

That’s because the increase in at-home and recipe usages help bump growth in this category, says Donald King, vice president of marketing, cheese and dairy, for Kraft Foods, Northfield, Ill.

As a result, Kraft introduced Spinach Artichoke and Tomato Basil varieties, along with Bagel-fuls, which feature Philadelphia Cream Cheese in a hot breakfast-on-the-go format, King says.

In September, Kraft launched a new marketing campaign for Philadelphia Cream Cheese, “Spread a Little Philly,” which strengthened the focus on new usage occasions for the brand, King says. “Our aim is to move consumers beyond the morning bagel from spreading to dipping and baking to cooking,” he says.

On the other hand though, the natural debate may be part of the problem as to why sales are uncharacteristically down because it presents some consumer confusion, says Organic Valley’s Newman.

Regardless of how it’s spread or spooned, these processors don’t let a little decline in numbers get in the way of producing digestive-enhanced items complete with fruity flavors.

Fast Facts

Source: Mintel

Links

- State of the Industry 2009: Beverages -- Fusion of Flavors

- State of the Industry 2009: Butter--Spreading It Thin

- State of the Industry 2009: Cheese -- Spices and Slices

- State of the Industry 2009: Ice Cream--Chilling Effect?

- State of the Industry 2009: Ingredients--Ingredients With Purpose

- State of the Industry 2009: Milk--Flowing Downhill

- State of the Industry 2009: Introduction

- State of the Industry 2009: As the World Turns (Global Report)