At first glance, the news is hopeful–milk sales are up. In overall dollars, yes, but consumption is a different story.

Higher milk prices mean more revenue but fewer sales for the dairy industry, as current economic conditions pierce processors with a double-edged sword. Each day’s gloomy news of a crisis-stricken economy features vignettes of folks struggling to make ends meet, many forced to choose between paying for milk or their mortgage. And in many households, milk is losing that battle.

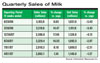

Dollar sales for the total milk category were up more than 10.3% to $13.02 billion for the year ending Sept. 7, according to Chicago-based Information Resources Inc. But that accounts for sales of 4.34 billion units, down 3.6% for the same period.

When Dairy Foods visited the milk segment in 2007, unit sales and consumption figures were a bit more upbeat. The price spikes had only begun, and the milk category was beginning to show some measureable growth, a holy grail that industry groups had been pursuing for years.

The latest data, though, showing a continued downward trend in unit sales suggests cash-strapped consumers are purchasing milk less often as they deal with the rising cost of other food products as well as gasoline and other necessities.

Mintel forecasts total U.S. sales of milk to hit $24.8 billion by 2011, with growth to be driven by innovation in types of milk, packaging and hybrid products, as well as price increases.

Shoring up sales

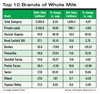

The downward trend in use is being seen at the local and regional level as well. “In our markets, we have seen a decline in consumption of 10% in Kansas City and approximately 6% in the Omaha markets,” says Al Streeter, corporate marketing manager for Omaha, Neb.-based Roberts Dairy Co., co-owned by Prairie Farms and Dairy Farmers of America. “Gallon sales are down a bit and half-gallon sales are up slightly, mostly as a result of price levels and continuing budget pressures on our consumers faced with high fuel prices and escalating food prices across the board.”Dollar sales of whole milk are up 8.35% to $3.4 billion, while units sold are down nearly 5% to 1.08 billion, according to IRI data, which includes sales at food stores, drugstores and mass merchandisers other than Wal-Mart. Sales of skim and lowfat milk are up nearly 12.4% to $8.27 billion, with units down 2.54% to 2.72 billion.

Though processors are no strangers to weak fluid sales, they’re looking at new ways to shore up business. For example, couponing is seeing a renaissance in some markets as cash-strapped consumers seek to economize. “We have responded with increased couponing of the Roberts brand,” Streeter says. “Coupon redemption has increased in our markets after almost a decade of slowly declining redemption rates generally.”

Further, Streeter notes, Roberts went “rBST-free” in February, one of the latest in a wave of processors that have turned their backs on the controversial synthetic bovine growth hormone over the past couple of years.

Organic milk in particular continues to be a light amid the darkness. Horizon Organic, part of Dean Foods’ WhiteWave division, is the top-selling brand of whole milk (right behind private label) and the No. 2 brand of skim/lowfat, according to IRI data. Horizon’s whole milk saw sales approaching $82 million for the year ending Sept. 7, a 46% increase over the previous year; unit sales rose more than 44%. The brand’s skim/lowfat selections saw dollar and unit sales increases nearing 30%.

Such growth would suggest organics have moved from niche to mainstream, as would entry into the segment by traditional dairy companies like Smith Dairy and Shamrock Farms (which introduced a line of organic milk last year). Major retailers also have pumped up their private label organic offerings. In the nearly three years since Wal-Mart jumped into private label organic milk, other major retailers-including Kroger, Costco, Whole Foods and Publix-have joined the pack.

Kemps Plus Healthy Lifestyle Milk and Kemps Plus Healthy Kids Milk both contain 32 mg of MEG-3 brand omega-3 EPA/DHA, from fish oil, per 236 ml serving. Each serving of Kemps Plus Healthy Lifestyle also contains 50% more calcium than regular 1% milk, whereas each serving of Kemps Plus Healthy Kids contains 50% more calcium than regular 2% milks and is an excellent source of vitamin C. Launched in early 2008, these products are available throughout the Midwest.

Looking at the long-term picture, and how this period of high prices fits into the big picture, economic analysts say the emergence of a true global market may be impacting the way the milk market behaves in the United States. It appears that the usually volatile cycle of domestic production and price has changed.

Reaching upward

Moving forward, processors continue to trumpet milk’s nutritional wealth and stress that it’s a good bang for the buck these days. In fact, the “got milk?” campaign recently signed on financial guru Suze Orman for its latest marketing blitz positioning milk as a “nutritional bargain.”“In the face of declining consumption and the threat to brand sales, we are seeking to remind our customers of the reasons that they have chosen the Roberts brand for over 100 years,” Streeter says. “We are the local dairy in our markets, we are farmer-owned and we have been in the forefront on source reduction (reusable plastic cases, etc.) and conservation practices from the beginning.”

She also warns against cutting corners to save money, such as Hershey’s swapping cocoa butter for vegetable oil in some of its products, a move that’s generating discontent among chocolate aficionados.

Fast Facts

- While dollar sales are up for overall milk sales, units sold are down – signs that consumers are being shooed away by high milk prices in a weak economy.

- This trend has been consistent across the past six financial quarters.

- Total dollar sales of milk are expected to approach $25 billion in the next four years.

- Average price per unit for the overall milk category increased nearly 13 cents over the previous year for the 52-week period ending Sept. 7. The biggest single increase among the top 20 brands: 60 cents.

- The highest per-unit price among the top 20 brands for the same period was $4.40.

Links

- State of the Industry 2008: Cheese is Convenient, Naturally

- State of the Industry 2008: Ice Cream--Sweet Success

- State of the Industry 2008: Yogurt Still the Bright Spot

- State of the Industry 2008: Butter--Spreading What's New

- State of the Industry 2008: Changes in the Big Beverage Market

- State of the Industry 2008: Ingredients--Pricey Necessities

- State of the Industry 2008: Introduction

- Curwood